A universal basic income (UBI) is often presented as a public insurance against large-scale and potentially permanent technological unemployment. Many Silicon Valley leaders that believe in and work on the transformative economic potential of artificial general intelligence (AGI) have also voiced their support for UBI:

Sam Altman: “If we cannot find a new kind of work for billions of people, we’ll be faced with a new idle class. The obvious conclusion is that the government will just have to give these people money.”

Elon Musk: “I think ultimately we’ll have to have some kind of universal basic income (...)There will be fewer and fewer jobs that a robot cannot do better. (...) if my assessment is correct (...) then we need to say what are we going to do about it. And I think some kind of universal basic income is going to be necessary.”

We should welcome the public discussion on UBI as well as the various small-scale trials of it, particularly in anticipation of a machine economy. However, in relative terms, there is too much focus on plans to publicly distribute money to everyone. Spending money is the easy part. The hard part is designing income streams that scale in lockstep with the machine economy and can finance a rising demand for social security.

My argument is not that UBI cannot or should not be part of the policy tools to address long-term technological unemployment. My argument is that a UBI to address long-term technological unemployment is more expensive than current UBI proposals and that it is not a sustainable solution to finance an insurance against widespread loss of labor income by taxing labor income:

A post-labor UBI is expensive because it would not merely supplement labor income, but fully replace it. Additionally, the more affordable alternative of a guaranteed minimum income would approach the cost of a regular UBI in a post-labor scenario.

To explore the challenge of financing a UBI in a scenario of large-scale technological unemployment we will examine the case study of Switzerland. In 2016 Swiss voters were offered 2’500 CHF (2’950 USD) every month - no questions asked. Would you take this deal? Well, 77% of Swiss voters rejected it. If you read until the end you will see why this was the right choice—at least based on the argument that it’s an insurance against technological unemployment.

1. UBI for technological unemployment is expensive

1.1 A guaranteed minimum income is cheaper than UBI, but would approach the cost of UBI in a post-labor economy

In the public discourse, the terms UBI and guaranteed minimum income are often used interchangeably. However, they denote different concepts and many famous “UBI proposals” and “UBI trials” are actually guaranteed minimum income proposals and trials. The main reason for this is that guaranteed minimum income is much cheaper to implement than a UBI. However, in a scenario of large-scale unemployment the costs of guaranteed minimum income would rise rapidly and approach the cost of a UBI.

Universal basic income

A UBI is commonly defined as having the following characteristics:

Periodic: a recurrent payment (e.g., every month)

Cash payment: paid in cash, allowing the recipients to convert their benefits into whatever they may like.

Universal: paid to all, independent of income, employment status, children, health status or other factors. Not targeted to the poorest or those who need it most.

Individual: paid on an individual basis (versus household-based).

Unconditional: involves no work requirement

In a UBI everyone actually receives a transfer payment. The idea is that making the payments universal increases buy-in for the program and reduces the stigma of needs-based benefits (“like a school uniform”).

A good example of a UBI proposal is the “Freedom Dividend”, the signature policy proposal of the 2020 Democratic primary candidate Andrew Yang. The proposal would give every US-citizen over the age of 18 1’000 USD per month per person.

Guaranteed minimum income

A guaranteed minimum income or negative income tax is the idea that the state will ensure that everyone reaches a minimum monthly or yearly income. If you don’t reach it, the state will pay the difference, otherwise you will not get anything. So, while the cash payments do not require any active action, payments are withdrawn as labor income rises.[1]

Good examples of guaranteed minimum income proposals are those put forward in the United States in the 1960s and 1970s by Milton Friedman, Richard Nixon, and George McGovern.

In a labor economy, a guaranteed minimum income is a lot cheaper to implement than a universal basic income of the same amount. However, this also means that the costs of a guaranteed minimum income program would rise rapidly in the case of technological mass unemployment as the number of beneficiaries expands. In contrast, the cost of a UBI remains the same regardless of the number of unemployed and underemployed.

1.2 A public spending-neutral UBI is not enough in a post-labor economy

Supporters of UBI like to point out that a remarkably heterogeneous coalition of thinkers including technologists, libertarians, and socialists support the idea of a UBI. However, as always, the devil lies in the details.

Thinkers on the left, such as Philippe Van Parijs & Yannick Vanderborght (2017), generally look at a relatively generous UBI as a foundation to build stronger and much more expansive welfare states. In contrast, libertarian thinkers, such as Charles Murray (2006), are more interested in a public spending-neutral UBI. In other words a UBI that is entirely financed by replacing existing welfare spending.

a) A public spending-neutral UBI would reduce income for some low income households

A spending-neutral UBI reform financed by cutting a large fraction of existing social security programs would increase the amount of beneficiaries that receive a share of social security spending (everyone) at the expense of lower spending per beneficiary. Meaning, it would generate more winners than losers among the population. However, the average loser loses more than the average winners gains. In most countries the current allocation of social assistance programs is more effective in reducing poverty than a spending-neutral UBI reform.[2]

Under spending-neutrality the UBI would have to be set considerably below national poverty lines. According to the OECD, a budget-neutral UBI would amount to €158 per month per adult in Italy, £230 in the United Kingdom, €456 in France, and €527 in Finland.

b) A UBI large enough to maintain or increase transfers to all low-income households would be very expensive

Financing a UBI at 100 per cent of the national poverty line for adults and 50 per cent to children up to 15 years old, would cost between 20 and 30 per cent of GDP in middle income and high income countries and 50 per cent or more in low income countries (graph below).

c) In a post-labor economy we would optimally have a universal high income

A universal basic income should be enough to live on, but just barely. The exact amount differs based on regional income and purchasing power levels. However, most proposals are set below and at best at the local poverty line. The idea is that you have peace of mind if you need to leave an abusive partner, a toxic job, look after a child or try to pursue self-employment. However, you should still be incentivized to seek employment again.

In contrast, if the premise is a persistent problem of technological employment that renders a significant share of the population “unemployable” then a basic income is not exactly utopia. It would ensure that no one starves but it would essentially create a permanent underclass. Hence, some, such as Elon Musk, hope that a growing machine economy will enable a “universal high income”, where humans can comfortably live indefinitely without having to work.

Today, most “UBI” trials use some mechanism to select participants with low income and are closer to a guaranteed minimum income. They are tested as an alternative to other forms of social security or as a supplemental income to low-income households. Hence, they may find that people receiving a UBI have improved well-being. Who wants to run the experiment measuring the well-being effects of replacing the salary of programmers with a 1’000 USD a month UBI?

2. Financing a UBI by taxing labor is not “post-labor proof”

Let’s look at the Swiss popular initiative “For an unconditional basic income”. The initiators have proposed[3] that all permanent resident adults should receive 2’500 CHF (ca. 2950 USD) per month and all children and young people 625 CHF (ca. 730 USD) per month. These numbers were also used in an accompanying volume of essays published by supporters of the initiative and the government has used these numbers as the basis for official calculations presented in the official voting material.

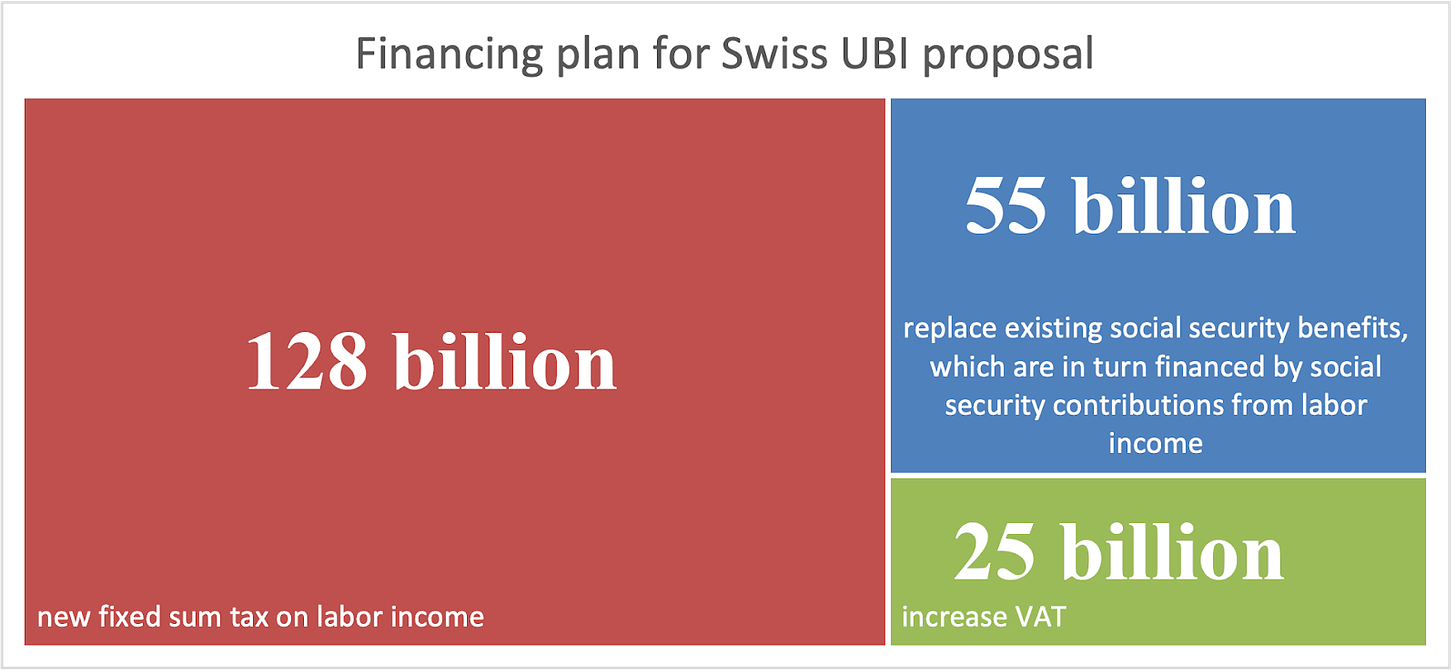

Specifically, the government calculated that the proposed universal basic income would cost about 208 billion CHF annually (ca. 30% of GDP) to cover 6.5 million adults and around 1.5 million children and young people.[4] In discussions with the initiators, the government calculated that the basic income would replace many existing social security benefits, the corresponding savings could finance around 55 billion. Still, social security spending would have to be nearly quadrupled and an additional 153 billion would be required. Around 128 billion CHF of this could be covered by deducting 2’500 CHF from every earned income, or the entire income for incomes below 2’500 CHF.[5] The remaining gap of 25 billion CHF or so would have to be financed by significant savings or tax increases. For example, the VAT could be doubled from 8 to 16 per cent.

So, what’s the issue?

2.1 We don’t know how soon we may run out jobs

A further expansion of the welfare state without significant automation may be premature. Many advanced economies face rapidly ageing societies with worsening dependency ratios and historically high levels of public debt.

We also know that there have been previous waves of automation anxiety that ultimately turned out to be false alarms. Supporters of the initiative held a “robots for UBI” protest and stressed the progress of automation: “Robots are doing more and more work. It is now our task to shape society in such a way that everyone has a dignified life thanks to the digital revolution: More meaningful and self-determined activities are possible.”[6] And yet, here we are another 7 years later: We still haven’t even managed to automate trains and many Western economies have labor and skills shortages. Given this context, we may want to scale a UBI incrementally, in lockstep with the expansion of the AI economy.

2.2 Most financing of the Swiss UBI would fall away in a post-labor scenario

Let’s make an extremized thought experiment and assume that AI will replace all human jobs within the next 10 years. Nearly two-thirds of the foreseen funding for the UBI came from labor income tax. If labor becomes obsolete there is suddenly a 128 billion CHF funding gap. On top of that, labor income taxes also form the backbone of the general government budget of Switzerland and most other developed nations. Across the member states of the Organization for Economic Co-operation and Development (OECD), about 50% of all tax revenues in 2023 came from individual income taxes and social security contributions.

In short, as the Genevan law professor Xavier Oberson argued: “Should mass workplaces for humans disappear in the future, from a tax perspective a double negative effect could occur. On the one hand, significant tax and social security revenues would be lost, while on the other hand, the need would increase for additional state revenue to support the growing number of unemployed human workers.”

Solutions

What is needed to address both the timing uncertainty and the long-term financing issue of UBI with regards to the prospect of technological unemployment is a financing mechanism that scales with the growth of the machine economy. I will explore the strengths and weaknesses of some of the more popular suggestions to address this in future posts.

- ^

This can be based on monthly or annual income checks and with corresponding phaseout provisions. In the extreme case, this can mean that participants have up to 100% marginal tax rate for earning additional income through labor until they reach the minimum income. However, something like 50% phase-out is more common. As Scott Santens has explained, a 100% marginal tax rate reduces willingness to work and hence this is not the best design in the current system.

- ^

Ugo Gentilini, Margaret Grosh, Jamele Rigolini, & Ruslan Yemtsov. (2020). Universal Basic Income: A Guide to Navigating Concepts, Evidence, and Practices. worldbank.org p. 133

- ^

Strictly speaking the text on which the Swiss voted did not specify how high the UBI would be, how it would be financed and who exactly exactly would be entitled to it. In some sense, one can view this as strategic ambiguity to get buy-in from more socialist and more libertarian UBI supporters.

- ^

Swiss Federal Council. (2016). Volksabstimmung vom 5. Juni 2016: Erläuterungen des Bundesrates. pp. 14&15

- ^

This financing mechanism means that even though the Swiss proposal is a UBI in which everyone receives an actual transfer, it would have had the characteristics of a guaranteed minimum income with a 100% marginal tax rate on labor income from 0 to 2’500 CHF.

- ^

Swiss Federal Council. (2016). Volksabstimmung vom 5. Juni 2016: Erläuterungen des Bundesrates. p. 19

Two points:

Firstly, you say “In a labor economy, a guaranteed minimum income is a lot cheaper to implement than a universal basic income of the same amount”. I reject this. The cost of a transfer is the incentives it creates, not the total quantity of money moved around. If the US instituted a million dollar per person UBI, and funded it with a million dollar head tax, the “cost” on paper would be 300 trillion dollars, but the actual cost would be whatever the bureaucrats at the IRS are getting paid to write down all those numbers. No one’s incentives are changed, so society doesn’t actually pay any costs. It’s still producing the same amount of wealth as before, and distributing it in the same way as before.

Imagine two worlds: one in which there is a guaranteed minimum income exactly like the one you described, at a rate of 50,000 dollars. The second, where there is a UBI which gives everyone 50,000 dollars, and there is also a 100% marginal tax rate on all labor income less than 50,000 dollars (which doesn’t apply to the UBI). The first world seems reasonable, and the second crazy, but they are identical for all practical purposes. If you live in either world, and you have no job, and someone offers you to come work for their company to make boxes (or whatever) for 40,000 dollars a year, you’d have to be an idiot to accept! Because you’d be effectively taxed for 100% of that 40,000 dollars no matter what. You’d have exactly the same yearly income either way. A UBI funded by a tax on the poor is not cheaper than a UBI funded by a tax on the rich.

You then say that a guaranteed minimum income would become more expensive as the labor force declined, but the cost of a UBI would remain the same. This is only the case because the effective tax has fewer payers, and is only paid by the tax bracket between 0$ and whatever the guaranteed minimum income is. World 2 would feel the same need to raise taxes elsewhere in the same situation, even though the quantity of money transferred would remain the same. However, if the UBI were paid for by a flat tax on labor income, the quantity available for transfer would stay the same assuming that the total quantity of labor income was the same, and if it were paid for by a progressive tax, the quantity available for transfer would increase! If your worry is that the total amount of labor income will decline, then that brings me to my second point.

My second point concerns financing a UBI. To start, I want to point out that automation increases “society”’s wealth, so if society suddenly has way more stuff in it, but everybody is poorer, something has gone wrong. It should get easier to pay people more if there’s more money to pay them with, not harder.

To simplify, wealth is created by land, labor, and capital. People “earn” money by owning one or more of these things and selling it on the market. I agree that in a post-labor economy, you could not finance transfer payments by taxing the sale of labor, because the value of labor would go way down, and the value of land and capital would increase. But this is actually fortuitous, because land and capital, unlike labor, are alienable. Inequality between wage-earners is a result, at least partially, of nature. You can redistribute some of the income they earn through their skills, but you can’t redistribute their skills. Land and capital are very different. The same bond or share will pay the same return to whoever owns it. A post-labor society’s factor payments would all go to land and capital, which could be owned collectively. Land could be held in common and leased out to those willing to pay society ground rent for it (georgism), and governments could manage large (and/or numerous) social wealth funds on behalf of society, paying out dividends equally to every citizen (some kind of shareholder socialism? Property owning democracy? Really this should be called market socialism but that name is already taken by a different idea). Ideally, everybody would be a landlord who owned an equally valuable slice of land, and a capitalist who owned an equally valuable share of the world’s capital stock. In a world where we don’t need labor to make things, we also don’t need labor income to pay for things.

I talk about all this here

I’m not sure I follow your argument entirely. While your thought experiment is interesting for considering substitution vs. income effects, I believe UBIs are still far more costly than guaranteed incomes.

Yes, guaranteed, means-tested incomes have some costs due to substitution effects that UBIs don’t. People near the income threshold might work less or even quit the labor force to avoid losing benefits, potentially increasing program costs. UBI avoids this by giving everyone the same amount regardless of work.

However, empirically, these effects seem small. Studies on conditional transfer programs like Brazil’s Bolsa Familia and Mexico’s Progresa/Prospera show modest impacts on labor supply. Most find only slight reductions in work hours, if any. These aren’t strictly guaranteed income programs as they have some strings attached, but they seem to be good indicators of how people might respond to similar cash transfer programs. So while the OP overlooked substitution effects, real-world evidence suggests they do not seem nearly significant enough to make guaranteed income programs comparable in cost to full UBI systems.

For reference, I think these papers from an Annual Review UBI symposium are quite good: https://www.annualreviews.org/content/journals/10.1146/annurev-ec-11

Let me explain my first point more clearly.

This is not what I mean. Observe Kevin’s graph describing the guaranteed minimum income in section 1.1. Notice how the first two income brackets have the same total income. An individual’s total income consists of their factor payments (in this case their wage) and their transfer payments. The GMI is structured so that the the wage plus the transfer will always equal at least a particular total income (I’ll continue to use 50,000 as an example). This means that if your wage is 10,000 dollars a year, your total income is 50,000 dollars, and if your wage is 50,000 dollars a year, your total income is still 50,000 dollars. This means in practice that you receive none of the first 50,000 dollars of your wage, making it indistinguishable from a 100% marginal tax rate on those dollars. This is very unintuitive to many people, so let me elaborate:

If you get a raise of one dollar, by how many cents does your total income increase? Your effective marginal tax rate equals 100 minus that number. I pay a tax of 25%, so if I get paid a dollar, I take home 75 cents. In the GMI world, if I got paid a dollar, I would take home 0 cents, because my transfer income would reduce by one dollar. 100 minus 0 is 100, so the effective marginal tax rate equals 100%. You say:

This is an inaccurate description of the problem. There is no income threshold. EVERY wage earner in this scenario is paying that 100% tax on their first 50,000 dollars. And there is no losing benefits. Going from a 40k yearly wage to a 50k yearly wage does not cause the earner to “lose” anything. It just doesn’t cause them to gain anything, so they have no incentive to take on the marginal disutility of the extra work for nothing in return. If they quit the labor force, it’s not to avoid losing benefits, it’s because it’s not worth it to work for no pay.

The same problem remains in the more realistic scenario where the GMI phases out slowly, so that rather than the first two bars in 1.1 being the same size, the second one is slightly larger than the first. This is how most means-tested benefits work in the real world. Let’s say that the GMI now works by paying a transfer of 25,000 for the unemployed, and for every dollar of wages earned, the transfer reduces by 25 cents. Now, if you get a raise of one dollar, your total income increases 75 cents, and pay an effective marginal tax rate of 25% (ignoring all other taxes) on all income between 0$ and 100,000, after which point there is no more transfer money to take away, and you start receiving one dollar for every dollar more you get paid. This is a better tax, but it’s still a tax. It’s not cheaper than a UBI. The cost is the same.

Compare phase-out world to a world with a UBI paid for by a flat tax. In phase-out world, there is a flat tax of 20% (arbitrary number), and the transfer payments phase out at a rate of 25 cents a dollar, meaning that the effective marginal tax rate is 45% between 0 and 100,000 dollars a year (assuming they phase out for each dollar of pre-tax income, not post-tax), and 20% for all income after that. In the second world there is a flat tax of 30%, and the effective marginal tax rate is 30% for all earners. The UBI is not “much more costly” than the GMI, because if you add up all the “labor dollars that someone doesn’t get”, you get the exact same number either way. The only difference is that in UBI-world, the rich receive less total income, and in phase-out world, the poor receive less total income. The same holds if the transfer payments are paid entirely through non-labor income taxes.

Because the “phasing out” of the transfer payments would not appear on the IRS’s balance sheet as being a tax, it’s easy to mistake the GMI as somehow saving money compared to the UBI, even while accomplishing the exact same distribution. This is the mistake of thinking like a tax collector and not like a planning demon. In the same way that it’s easy to produce seemingly valid proofs that 1+1=1 by hiding a division by zero, it’s easy to make money appear out of nowhere by hiding a tax in the transfer system. The 50,000$ GMI world and the UBI+100% tax world have exactly the same distribution, and therefore exactly the same incentives and exactly the same amount of total wealth. There is no dollar that someone has in one world, but not the second. But the second world looks more “expensive” because the government chooses to give money and then take it away rather than withhold it, so it looks like there’s more distribution going on than there actually is. When we look at it from the demon’s perspective, we can see that there’s no difference between giving someone something and then taking it from them, and giving them nothing. This is what I was trying to convey with my example of the one million dollar UBI plus head tax.

> However, empirically, these effects seem small.

The magnitude of the incentive effects is not relevant to the comparison between GMI and UBI. The key thing to understand is that the incentive effects of each are equivalent (if the GMI and UBI arrive at the same distribution). It’s the same effect both times: someone gains fewer cents when their wage is raised by a dollar.

> real-world evidence suggests they do not seem nearly significant enough to make guaranteed income programs comparable in cost to full UBI systems.

They are comparable in cost because they are the same cost. Part of the cost is just hidden with a means-tested system by taxing the transfer payment instead of the wage, giving it the appearance of saving society money, even though everyone’s total income still adds up to the same number.

Thanks for the answer; I think I understood your point better, but I still have a different view. You’re correct that guaranteed income can be described as a UBI with a 100% marginal tax rate on labor income up to a certain threshold. Both these policies are indeed equivalent in terms of incentives and have the same cost. However, this is quite different from the straightforward UBI that the OP was describing!

You also make a good point that most means-tested income programs are incentive-equivalent (or quite similar, though typically with more design details) to a UBI program with a less-than-100% marginal tax rate on labor income up to the threshold. This helps explain why we don’t observe such high substitution effects in practice.

That said, guaranteed income still tends to be much less costly than simple UBI. This becomes evident when comparing a low level of guaranteed income versus a low level of UBI [as defined by OP]. If you offer a guaranteed monthly income of 100 USD [or UBI + 100% marginal tax rate up to 100 USD of labor income] , some people might leave the workforce entirely, but very few would likely do so. This is much less costly than providing 100 USD to every person! The point at which their economic costs [fiscal costs + behavioral costs due to changing incentives] will be similar is largely an empirical question involving labor elasticity, reservation wages, etc.

Your claim here is that a tax on the lowest income tax bracket is “less costly” than a tax elsewhere which raises the same quantity of revenue. I don’t understand how or why this is supposed to be the case. First of all, even with your small transfer example, I’m not sure if I consider the incentives to be that minimal. If a student would have stood to gain 800 dollars a month if they got a part-time job, and now they only stood to gain 700 dollars, I’d expect them to be less likely to get a job. But that’s not even relevant. Compare the two situations which you claim differ in cost:

Both situations, as you describe them, involve a UBI of 100 USD per person per month. In both situations (we will assume), part of the cost is paid by a flat income tax (this isn’t how I think a UBI should be paid for, but it’s easier to understand this way). In America A, there is also a 100% marginal tax rate on the first 100$ of everyone’s monthly paycheck (making it equivalent to a 100$ monthly GMI). In America B, there is only the flat tax, which has to be higher. In both Americas, the tax system must raise roughly 30 billion dollars a month. In America A, every wage earner pays 100$ a month in taxes from the first tax. Let’s say there are 150 million wage earners. That’s 15 billion dollars raised by that tax. The flat tax must be at a rate to raise another 15 billion dollars then. Let’s say the total amount of labor income in the US is a trillion dollars a month. To raise 15 billion dollars from a flat income tax, you’d raise it by 1.5%. America 2 is the same but the flat tax needs to be raised twice as much, to 3%, because wage earners are no longer all paying 100$. I’m oversimplifying here but don’t nitpick me. The point is that it is not at all obvious to me that a 100% tax on the 0-100$ income bracket is “less costly” than a 1.5% raising of the income tax across the board. In monetary terms it’s obviously exactly as costly, just much more regressive, and If there were some reason that it WAS in some way less costly, then I would expect it to be even less costly to raise all 30 billion of the dollars from that same tax bracket, by putting a 200% tax on the first 100 dollars. And this would apply if you wanted to raise a tax for anything, not just a UBI. No one would propose such a taxation scheme to pay for a 15 billion dollar investment in green energy for example. It has no advantage.

Executive summary: Universal Basic Income (UBI) proposals are not well-designed to address technological unemployment, as they are too expensive and rely on unsustainable financing mechanisms in a post-labor economy.

Key points:

UBI to fully replace labor income would be much more expensive than current proposals that only supplement income.

Guaranteed minimum income approaches UBI costs in scenarios of widespread unemployment.

Public spending-neutral UBI proposals are insufficient to maintain living standards in a post-labor economy.

Financing UBI primarily through labor taxes is not sustainable if technological unemployment becomes widespread.

Solutions should involve financing mechanisms that scale with growth of the machine economy, to address timing uncertainty and long-term funding.

This comment was auto-generated by the EA Forum Team. Feel free to point out issues with this summary by replying to the comment, and contact us if you have feedback.