Basic Income in Australia

EA forum summary

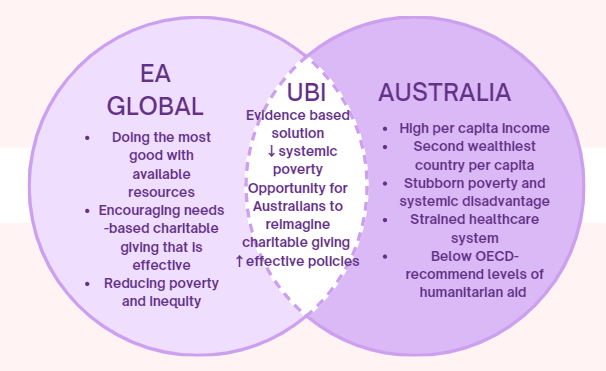

A preliminary intervention evaluation into universal basic income in Australia through the lens of effective altruism. Despite focusing on Australia, we believe this report may be globally relevant.

Abstract

Research question: Is a universal basic income a promising cause for people involved in Effective Altruism to fund?

Aim: This report aims to summarise research into UBI as an intervention option in the cause area of inequality.

Background: Exploratory Altruism: a unique aspect of the EA movement is its openness to new ideas and paths to impact. There is huge potential for more exploratory cause prioritisation research to provide value to the EA community (Hilton and Agarwalla).

Evidence: The evidence base for UBI consists of unconditional cash transfer programs, mostly in low-middle income countries, and ‘natural experiments’. Unconditional cash transfers are well-understood to improve wellbeing in low-middle income countries, and are supported by EA organisations such as GiveDirectly. Forms of basic income provided during the pandemic offered ‘natural experiments’ into UBI. Weak evidence suggests that UBI ‘natural experiments’ improved outcomes across multiple domains compared to existing welfare programs. UBI is yet to be implemented on a large scale in a developed country.

Theory of change: Given the evidence for cash transfers in developing countries, and the present cost of government welfare policies, it is proposed that guaranteed, unconditional payments may be beneficial in both developed and developing nations. We believe the movement for UBI would be best supported through a large-scale, developed-world trial of basic income or funding for a political lobby/activism group. A successful program in a developed nation could be replicated globally, and potentially motivate donors to fund a UBI in a developing nation—a much less costly endeavour.

Cost effectiveness analysis: UBI is a highly scalable policy solution with large potential for impact. It would require a large injection of funding and strong political will.

Tractability, neglectedness and counterfactuals—initial impressions detailed here, but requires more research.

Evidence

“Focusing solely on the most disadvantaged will not reduce health inequalities sufficiently. To reduce the steepness of the social gradient in health, actions must be universal, but with a scale and intensity that is proportionate to the level of disadvantage. We call this proportionate universalism.”

Marmot Review, 2010

Study summary table

| Reference + link | Study type | Findings |

UCTs and Basic Income in LMICs | ||

Cochrane 2022: Unconditional cash transfers for reducing poverty and vulnerabilities: effect on use of health services and health outcomes in low‐ and middle‐income countries | Systematic Review & Meta analysis Objective: assess effects of UCTs on health service use and health outcomes in children and adults in LMICs. Included 34 studies which involving a total of 1,140,385 participants in low-middle income nations (n=1,140,385) | This body of evidence suggests that unconditional cash transfers (UCTs) may not impact a summary measure of health service use in children and adults in LMICs. However, UCTs probably or may improve some health outcomes (i.e. the likelihood of having had any illness, the likelihood of having been food secure, and the level of dietary diversity), two social determinants of health (i.e. the likelihoods of attending school and being extremely poor), and healthcare expenditure. The evidence on the relative effectiveness of UCTs and CCTs remains very uncertain. |

Stanford 2020: What we know about universal basic income: a cross-synthesis of reviews | Systematic Meta review Objective: review all previous UBI interventions across country contexts and their associated effects n= not provided, 16 reviews included | Myriad Discussed in literature review |

Happier Lives Institute. 2020: Cash transfers: systematic review and meta-analysis. | Systematic review & Meta-analysis Objective: To evaluate whether CTs improve the SWB and MH of recipients in LMICs. Thirty-seven studies were included in our meta-analysis, covering 100 outcomes, and a total sample of 112,245 individuals (n=112,245) | Cash transfers significantly increase MH and SWB in LMICs. More research on longitudinal (5+ years) and spillover effects is needed. Future impact evaluations should collect data on MH and SWB to enable comparisons of the relative cost-effectiveness of development interventions at improving people’s wellbeing. |

Zimmermann et al. BMJ Global Health 2021: The impact of cash transfers on mental health in children and young people in low-income and middle-income countries: a systematic review and meta-analysis | Meta-analysis, systematic review 12 116 articles for screening, of which 12 were included in the systematic review (covering 13 interventions) and seven in the meta-analysis assessing impact on depressive symptoms specifically. | Cash transfers may have positive effects on some mental health outcomes for young people, with no negative effects identified. However, there is high heterogeneity across studies, with some interventions showing no effects. Our review highlights how the effect of cash transfers may vary by social and economic context, culture, design, conditionality and mental health outcome. |

Basic Income in developed nations | ||

| Baby’s First Years Study, 2022: RCT investigating a potential causal link between cash transfers and infant cognition | Randomised controlled trial We draw data from a subsample of the Baby’s First Years study, which recruited 1,000 diverse low-income mother–infant dyads. Shortly after giving birth, mothers were randomized to receive either a large or nominal monthly unconditional cash gift. Infant brain activity was assessed at approximately 1 y of age in the child’s home, using resting electroencephalography (EEG; n = 435). | A predictable, monthly unconditional cash transfer given to low-income families may have a causal impact on infant brain activity. In the context of greater economic resources, children’s experiences changed, and their brain activity adapted to those experiences. The resultant brain activity patterns have been shown to be associated with the development of subsequent cognitive skills. |

| United States: GiveDirectly US study: 2020 | Large (n=46077) RCT Outcome: impacts on material hardship and mental health | No effects of the cash transfer on any of the prespecified or other exploratory outcomes. We explore various explanations for these null results and discuss implications for future research on unconditional cash transfer programs. |

| Finland RCT: 2017-2019 | Moderate size (n=2000) Randomized controlled trial (RCT) Two thousand randomly selected registered unemployed people aged between 25 and 58 each received €560 BI per month. This income was unconditional and without means testing and precisely matched that previously received as unemployment benefits. Recipients who found a job continued to receive the payments. | Discontinued following the two year trial “the basic income experiment should be understood as a behavioural intervention designed to enhance the wellbeing of unemployed populations at a time when wellbeing is emerging as a value-producing capacity.” (Meixler) |

| Canada: 1972 | All families in Dauphin, CA (population 10,000) were guaranteed an annual income of 16,000 Canadian dollars ($11,700, £9,400). Population study Duration 4 years Outcome measured include

| Rates of hospitalisations fell by 8.5%, improvements in mental health, and a rise in the number of children completing high school. Discontinued as part of cuts in the budget 4 years later. (Cox) |

Basic Income in Australia | ||

Australian Bureau of Statistics, August 2020. Household Impacts of COVID-19 Survey | Moderate size (n=1,561) Voluntary survey ( online forms or telephone interviews) Self-selected sample from across australia | Coronavirus Supplement and the JobKeeper Payment were most commonly used to pay household bills by those receiving the stimulus payments |

| Klein et al, 2021. Gendered impacts of changing social security payments during COVID-19 lockdowns: an exploratory study | Small (n=173), Retrospective survey (December 2020 looking at May to October 2020), Qualitative (15 minute voluntary survey including multiple choice and open-ended short answer questions) Evaluated effects of a) $550 supplementary payment and b) suspension of mutual obligations (in some cases) Australia, skewed to Victoria | Recipients of Covid cash bonuses and suspension of conditionality in social security payments subjectively reported increased engagement with labour market, increased psychological wellbeing, decreased financial hardship and increased engagement with unpaid work |

Brief literature review

There is strong evidence for the efficacy of UCT’s in improving health and wellbeing, and decreasing extreme poverty in LMICs (Cochrane, Stanford, Happier Lives)

There is strong evidence that basic income improves health and welfare for low-income individuals in developed nations, via assessment of risk factors for disease not disease prevalence directly (Stanford, )

There is weak evidence that basic income programs would improve welfare in Australia compared to existing welfare systems (Klein et al., 2021). There is medium evidence that a UBI in Australia would be spent on household necessities (ABS data)

There is very little evidence of UBI effects compared to traditional welfare systems (Stanford).

There is strong evidence that UBI will have a net zero effect on labour market participation, but will heterogeneously affect labour market composition depending on the sub-group. Individuals may shift from wage labour to more financially risky work such as starting a business, part-time work may increase, time is channelled into other valued activities such as caregiving. (Stanford)

Expert interviews

*Informal phone advice given within the scope of this pilot exploration, quotations not to be used outside of this report*

Dr Leah Hamilton

MSW, PhD

Associate Professor

Department of Social Work

Appalachian State University

Upon interviewing Dr Leah Hamilton early in our research, we posed the question, should we pilot unconditional cash transfers in Australia?

“We don’t need more pilots, we need a real-scale trial” was the essence of the answer. The evidence from pilots is strong, analysing multiple outcomes.

When asked whether such a trial should be targeted towards certain groups or communities, Dr Hamilton stressed a couple of points. Disadvantaged and/or First Nations people have been overstudied, meaning there is a history of being experimented upon, with decisions being made about them rather than by them. We should be cautious in targeting social policies to any particular group.

As such, it is proposed that a payment that is a) universal, so as not to promote separation and stigma and b) unconditional, in order to allow for self-determination, is not only desirable but necessary. This sentiment was echoed by Janell Dymus in the Indigenous Perspectives on Basic Income at BEIN Brisbane, 2022.

Dr Elise Klein OAM

A/Professor Australian National University

Senior Lecturer of Public Policy at the Crawford School, ANU

Member of the Australian Basic Income Lab

To Dr Klein we posed the question, should we pilot unconditional cash transfers in Australia?

Dr Klein agreed that the role of a UCT or BI pilot would be limited, and that it would be more beneficial to attempt to roll this out on a more widespread basis. They pointed to Australia’s experience during the COVID pandemic. The conditionality of unemployment benefits were removed, and supplemental payments increased to above the poverty line.

“The government did something unthinkable, when lockdown number one hit. It implemented a basic income. It was a regular payment, enough to meet basic needs, with no mutual obligations. Free childcare and a basic income. For people on social security, not for everyone.”

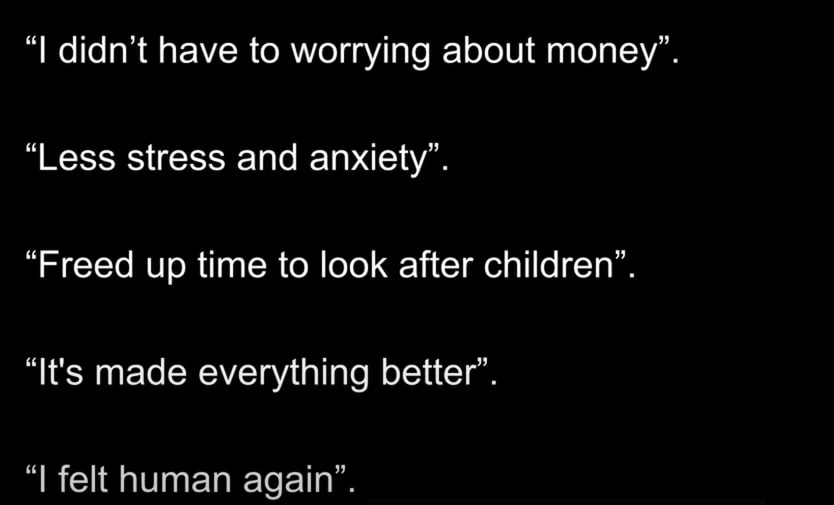

Dr Klein and colleagues conducted a qualitative survey to assess the impact of the supplemental payment on people who received it, some responses of which are included in the appendix.

“Australia’s mutual obligation programs actually make it take longer for people to find employment. When COVID hit, for every one job advertised, there were 13 applicants. Before COVID, for every one job advertised there were 8 applicants.”

If we were to pursue the idea of a pilot, Dr Klein raised the possibility of using the pilot as disaster relief, for example in one of the NSW flood affected regions.

Michael Haines

Basic Income Australia policy researcher,

Former CEO

When we asked, should we pilot unconditional cash transfers in Australia? Michael Haines talked us through a proposed structure and costing of a UBI in Australia.

It is time to be trialling the idea at scale, Mr Haines says. Starting off at a low introductory rate of $10 per week would allow ‘testing by doing’, and any positive or negative effect on inflation and unemployment to be monitored.

Poverty in Australia

Australia is the wealthiest country in the world (correct at 2018), yet we have 3+ million people living in poverty. The percentage of the population living in poverty (12–14%) has hardly changed over 30 years of continuous growth, despite the people in the group constantly changing. This is indicative of a system problem (Haines).

Income poverty

Australia has a high mean income, at $63,882 (pre-tax), however the median income is 25% lower than this.

Mean income is skewed upwards by a small number of very high incomes on the upper tail of the distribution. If all incomes were divided equally, every Australian would receive an income of $63,882 per year. Instead, the median income of $48,400 per year more clearly represents income of the average Australian.

As Gareth Hutchens explains,

“Because of the very high income of a single person (s), the average income for the group is much higher than the typical income of 90 percent of people in the group” (Hutchens)

(Hutchens)

Australia’s income also demonstrates a gap between women and men. In 2019-20, the average taxable income for men was $74,559, and the median was $56,746. But the average taxable income for women was $52,798 while the median was $41,724. (Hutchens)

This is reflective of structural barriers to equality and self determination, particularly in the context of women typically taking on the majority of unpaid caring work.

Income inequality

One measure of income inequality is the GINI coefficient. Values range between 0 and 1. Values closer to 0 represent higher equality and values closer to 1 represent higher inequality (ABS). Australia scored 0.343 in 2018, ranking 103rd in the world in inequality, behind comparable countries such as Canada and France, but ahead of the United States (IndexMundi).

(“Gini Coefficient by Country 2022”)

Income inequality is not a requisite part of development. Different developed countries’ experience over the second half of the 20th century suggest income distribution is heavily shaped by political forces. Notice in the below graph how some developed countries, including Australia, have followed a U shape, while countries such as Japan and mainland Europe have levelled out their inequality.

A universal trend of increasing inequality would be in line with the notion that inequality is determined by global market forces and technological progress. The reality of different inequality trends within countries suggests that the institutional and political frameworks in different countries also play a role in shaping inequality of incomes. This means that rising inequality is most likely not inevitable. (Roser and Ortiz)

(Roser and Ortiz)

Indeed, governments have policies to redistribute income in every country in the world. This is done through progressive taxation and transfer (welfare) payments. The degree to which taxation and welfare are utilised lead to different levels of inequality, as measured by GINI. Without income redistribution, Australia’s GINI would rise from 0.34 to 0.48.

(Roser)

Wealth

According to Credit Suisse’s 2021 report, Australia is the second most wealthy country per capita in the world. Wealth per capita, or the amount of money that each Australian would have if the debt and assets of Australia were distributed equally across the population, rose to a record high of $522,032 in 2021. Australia’s top 10% wealthiest have almost 50% of the country’s total wealth, with an average wealth of $4.75 million. (Horan and Hoehne)

(Horan and Hoehne)

International aid

The globally recognised target for international aid is “official development assistance (ODA) to 0.7% of donors’ national income.”

Australia’s ODA in 2021 was 0.22% of GNI, significantly behind comparable developed countries such as the UK, Canada and northern European states. Of that, approximately 90% went to bilateral programs (i.e. towards a specific partner country). Only 10% went to multilateral (truly international) development programs. (OECD)

Theory of change

“As a health economist, you become aware very quickly that we use the healthcare system to treat the consequences of poverty, and we do it in an inefficient and expensive way. We wait until people live horrible lives for many years, get sick as a consequence, and then we go in all guns blazing to make things better.” (Evelyn Forget, as cited in Cox, 2020)

Theory of change for UBI policy

Model of impact for UBI and health. Credit to (Reed et al )

As Michael Haines explains, UBI has the potential to impact and benefit many of Australia’s people and processes.

“· For the ever-changing group of 3+ million people who lack income, savings & family support, who cannot do paid work, the UBI would meet their basic needs. They would no longer be forced to live in poverty.

· For all income earners, a base level of income insurance if they lose their earned income for any reason: business failure, personal circumstances, or automation, etc. — no need to apply, no delay.

· For low-wage employees, it would represent a wage rise, at no cost to employers.

· For the unemployed, no more second-class citizens. They would be encouraged to take on marginal work, as their earnings would add to their UBI — no more welfare trap.

· For stay-at-home carers (mostly women), it would provide, for the first time, some paid recognition of their valuable contribution to society in caring for children, the aged and disabled, and in supporting the local community. The UBI would also aid in work-life balance.

· For everyone, a UBI would support life-long learning, and new creative and entrepreneurial endeavours when starting out, as well as between gigs.

· For business, it would boost profits & investment as the UBI is spent into the economy.

· For society, it could lower crime & improve wellbeing, and mitigate major upheavals by allowing us to quickly adjust the amount due to changed economic and societal circumstances, such as natural disasters, disease epidemics, and economic crises.

· For the government, a UBI provides an additional tool to help manage the economy to ensure full employment.” (Haines)

Theory of change for EA x Cash Transfers in Australia

(author-developed graphic)

Sample logical framework for UBI public advertising group

Below is a sample logical framework (log frame) for a lobby group advocating for UBI which could be created for UBI. Log frames are an alternative display method for theories of change (see here for basics if unfamiliar).

Please consider reviewing the accuracy of this log frame and suggesting others for a large-scale UBI trial, political lobby group, etc.

| Objectives hierarchy | Indicators | Sources of Verification | Assumptions / Threats | |

| Impact | UBI on the policy agenda | Number of times mentioned in parliament / political ads | Parliamentary records | Political views reflect views of constituents |

| Outcome | Public and politicians care about UBI | Percentage of public who support / are aware of UBI | Household survey | Advertising has the capacity to change opinions |

| Outputs | Public advertising for UBI | Number/scale of UBI ads | Internal records | Advertising group will spend funds on advertising |

| Inputs | Create a public advertising group in Australia | Group is created, staffed and funded | Internal records | EA believes UBI in Australia is a cost-effective funding choice |

A recent YouGov survey asked Australians if they would support a universal basic income, or a guaranteed living wage, and 58% said yes, while 19% opposed it. (Klein)

Cost-effectiveness analysis

A critical question for EA funders is the cost effectiveness of an intervention. As GiveWell explains,

The U.S. poor are wealthy by developing-world standards. All the empirical analysis we’ve come across, as well as the qualitative observations we’ve made on site visits, support the conclusion that “poverty” has very different meanings in the developed world and the U.S., and that even the lowest-income people in the U.S. have (generally speaking) far greater material wealth and living standards than the developing-world poor. More at our 2009 blog post on this topic.

We haven’t found any U.S. poverty-targeting intervention that compares favourably to our international priority programs, in terms of (a) quality, robustness, and generalizability of evidence; (b) cost-effectiveness, i.e., “bang for the buck” in terms of lives saved or improved per dollar spent. (GiveWell)

Hence a funding evaluation would have to either

Accept that these funds would not be directed towards global development through the global poor, at least initially. There is likely a cap on the amount of money that donors are willing to donate overseas “while there are still issues at home”. Treat it prospectively, as an upper-bound intervention with potential to increase global donations in the future

Consider the outcomes to be likely to be very significant in combination, rather than as moderately effective policy changes when evaluating individual metrics

Knock on effects of strengthening global policy towards UBI

Any UBI policy in Australia would require transparency about how the program would be funded and distributed, and this would need to be communicated clearly to the public. Thus, we foresee three possible avenues where funding could be utilised

Economic modelling via consultancy agencies

Public education campaigns facilitated through a new or existing interest group

A pilot of UBI in Australia

Is this quantifiable?

Value for Money is not only about minimising costs; it is about maximising the impact of money spent to improve people’s lives. Low overheads are not necessarily a good thing if it means the agency has compromised on management and oversight functions. It is also important to recognise that VfM is not absolute; costs will vary considerably from program to program depending on the context. For example, the geography and infrastructure of a country, the objectives, design, coverage and duration of a program will influence cost-efficiency enormously. VfM efforts should also be proportionate to the context and level of funding – there is an opportunity cost to complex analyses. (Cash Transfers, DFAT, 2017)

Australia is not the most cost-efficient country to intervene in. Yet, it is exceptionally wealthy and, unfortunately from a global perspective, much of the money in Australia is earmarked towards Australian-based initiatives. Despite this, poverty rates have remained stubborn. UBI has a solid evidence-based in pilot studies.

(Canva)

Enacting the principles of doing the most good with available resources could thus have significant leverage here.

Proposed UBI models

Policy change to allow for a basic income is undeniably costly. There have been a few models proposed regarding to fund a UBI. Basic Income Australia’s proposal includes a phased introduction which allows for monitoring, evaluation and adaptation at short notice. Reed et al details three levels of scheme for the UK, with rates increasing according to public support. Professor Phillips from Australian National University detailed some ideas at the 2022 BEIN Conference, expanded below.

Financing UBI with a Wealth Tax: Concept and Modelling

Associate Professor Ben Phillips, ANU

Direct summary and quotes from the BEIN 2022 presentation

This model increases income tax rate by 13% (it would be 26% if there was no wealth tax)

In this model, a UBI equal to the rate of the age pension ($1026 per fortnight for a single person) would be provided unconditionally to every adult in Australia. This is roughly equal to the half-median poverty line.

Tax-free threshold would be removed

This model increases government cash payments from $130 bil to $459 bil

Enactment of wealth tax includes assets such as family home

17% of households not impacted e.g. age pensioners

Some better off by 60k/year, some worse off by 60k/year

Australia’s top 20% would be worse off by average of 30k/year

Australia’s bottom 20% would be better off by $13k or 20% of income

Affects different demographics differently

This is a politically challenging model. Will homeowners liquidate assets and share wealth with children as a tax dodge? Will people buy less homes, crashing the housing market?

Is this feasible?

Phillips

Scale, Neglectedness, Tractability

Scale

UBI will affect all 25 million Australians

current models suggest It will act as an insurance scheme for all Australians, and will be recouped in taxes where it is not required (ie middle-upper income earners)

Alternative is increasing capital/wealth taxes

Lower bound for affecting wellbeing will be those in poverty in Australia (~3mil) or those currently receiving welfare payments

Is there a way we can estimate the magnitude by which UBI will improve wellbeing? This may require a dive into Klein Covid studies and other subjective wellbeing studies

suggest also the SWB studies used in happier lives institute review

Society wide effects on crime, happiness, liveability etc which tend to follow equality

GINI vs livability scores

Upper bound → effect of this policy on global political landscape (could other developed countries follow Australia’s lead?), more funding for UCT’s in developing nations, ?more scope for philanthropy from Australia to the world

Tractability

Could the political landscape in Australia actually be willing to give UBI a go?

Consider Australia’s past tendency for progressive, evidence-based but largely untested policies

Consider alignment with Labor, LNP, Greens, Independents policies, number and positions of politicians sympathetic to UBI

Dr Klein has helped draft policy on this

Michael Haines has been in discussion with political parties recently

Current government white paper recommends unconditional cash transfers as part of our overseas policy. Could it be used at home too?

Given the wealth of evidence on the feasibility and benefits of using CTP in humanitarian response and the Australian Government’s policy commitments, the first question now considered by DFAT staff in discussions around humanitarian programming is always… if not cash, why not? (Australian Government, 2017)

Neglectedness

Organisations currently working on UBI Australia

Universal Basic income lab

Basic Income australia

Fair GO—Australian Basic Income discussion group

Basic Income Forum

BEIN across the world e.g denmark, netherlands

Estimated funding currently going towards it

From our conversations with experts in the field, funded only by academics out of personal interest

Space to be corrected on this point

The UK has a group, Compass, which publishes papers into UBI, which may serve as a blueprint for a similar organisation in Australia.

″ Compass is the pressure group for a good society, a world that is much more equal, sustainable and democratic. We build alliances of ideas, parties and movements to help make systemic political change happen. One strategic focus is on policy ideas that are rooted in real needs now but which have transformative potential. Introducing a universal basic income is one such policy and speaks to every element of the good society we want to create by providing more freedom, independence, time security and sense of citizenship. This is our third report on basic income and shows how a desirable and feasible scheme could be implemented. The next stage is to build a national coalition in support of a basic income.” (Reed and et al)

Counterfactuals

What would happen without an EA intervention?

Government intervention

Non-government organiastion advocacyGO

Slower uptake domestically

Reduced uptake globally due to having less large scale implementation of UBI

Other models of change, e.g. Denmark’s UBI and social security debate.

For more information about UBI in Australia see

Feedback

Many thanks to Nathan Ashby from the Institute for Effective Policy for some of the initial feedback we have received on the proposal for a UBI in Australia:

“Depending on the model, the answers will range from “completely impossible” to “difficult and unlikely”. I think a wealth tax financed model would never be adopted by a major party and would be political suicide if they did. On the other hand the Michael Haines proposal might be more realistic—though I would like to see a more detailed explanation of his model.

I don’t know of any politicians who support UBI, and I do know that some are adamantly opposed to it (e.g. Chris Bowen). So even the most limited version is a very heavy lift.

Purely as a matter of personal judgement, my instinct would be to eschew any talk of “UBI” and instead work to incrementally reduce the conditionality attached to existing government payments. Ultimately, most of the same people who would be net beneficiaries of a UBI are already receiving payments of some kind—reducing the hoops that they need to jump through to claim those benefits would capture many of the benefits of a UBI. And it’s a much more tractable project—though still by no means easy!”

Conclusion

At this stage, we are unconvinced that Australia is a good candidate to pursue an advocacy or large scale trial of Universal Basic Income.

Perhaps a better target of a UBI might be somewhere such as Denmark (see appendix), where sociopolitical attitudes towards welfare are already more consistent with those requisite for a UBI. Political will for a change of this nature would not seem to be adequate in Australia, with no known politicians or major parties supporting similar policies or goals.

The inequality and inequity of wealth and income distribution in developed countries is a reasonable target for change. As detailed above, inequity has a range of impacts on society and human and animal wellbeing.

In Australia, steady movement towards a less conditional social security policy would attract some of the benefits of a UBI, whereby administrative costs and welfare-associated shame could be reduced, and the liveability and social effects of the payments improved. This would appear to be a more achievable short to medium term goal than implementation of a large-scale social policy change in what appears to be a relatively unwilling environment (we are happy to be corrected on this).

Based on our current understanding, pursuing successful large-scale UBI projects in comparable countries would represent a precedent for Australia to follow suit, and in the meantime reducing conditionality of payments would be an effective policy step.

We welcome and encourage further discussion on this topic below.

References

Works Cited

ABS. “Household Income and Wealth, Australia, 2019-20 financial year.” Australian Bureau of Statistics, 28 April 2022, https://www.abs.gov.au/statistics/economy/finance/household-income-and-wealth-australia/latest-release. Accessed 28 September 2022.

Agarwalla, V., and S. Hilton. “Exploratory Altruism.” EA Meta Reports | CE, July 2021, https://www.charityentrepreneurship.com/ea-meta-reports. Accessed 29 September 2022.

Christensen, Erik. “Basic Income (”Borgerløn”) in Denmark – Status and Challenges in 2017.” basisindkomst.dk, 13 October 2017, https://basisindkomst.dk/basic-income-borgerloen-in-denmark-status-and-challenges-in-2017/. Accessed 28 September 2022.

Cook, Kay, et al. “Gendered impacts of changing social security payments during COVID-19 lockdowns: an exploratory study.” AUSTRALIAN JOURNAL OF LABOUR ECONOMICS, vol. 24, no. 2, 2021, pp. 213-225. https://research.cur Gendered impacts of changing social security payments during COVID-19 lockdowns: an exploratory study tin.edu.au/businesslaw/wp-content/uploads/sites/5/2021/10/AJLE242klein.pdf, https://research.curtin.edu.au/businesslaw/wp-content/uploads/sites/5/2021/10/AJLE242klein.pdf.

Cox, David. “Canada’s forgotten universal basic income experiment.” BBC, 25 June 2020, https://www.bbc.com/worklife/article/20200624-canadas-forgotten-universal-basic-income-experiment. Accessed 29 September 2022.

“Gini Coefficient by Country 2022.” World Population Review, https://worldpopulationreview.com/country-rankings/gini-coefficient-by-country. Accessed 28 September 2022.

GiveWell. “Process for Identifying Top Charities.” GiveWell, https://www.givewell.org/how-we-work/process. Accessed 28 September 2022.

Haagh, L. “The Developmental Social Contract and Basic Income in Denmark.” Social Policy and Society, 2019, 18(2), 301-317. doi:10.1017/S1474746418000301

Haines, Michael. “Why we need a universal basic income and how we can afford it.” Medium, 5 December 2018, https://michael-haines.medium.com/why-we-need-a-universal-basic-income-and-how-we-can-afford-it-29ddd6119b17. Accessed 21 September 2022.

Horan, Rachel, and Joshua Hoehne. “Australian wealth: How we compare on the world stage.” Savings.com.au, 19 November 2021, https://www.savings.com.au/savings-accounts/how-wealthy-are-australians. Accessed 28 September 2022.

“Household Impacts of COVID-19 Survey, 10-15 June 2020.” Australian Bureau of Statistics, 29 June 2020, https://www.abs.gov.au/statistics/people/people-and-communities/household-impacts-covid-19-survey/10-15-june-2020. Accessed 21 September 2022.

Hutchens, Gareth. “What’s the typical income in Australia? This list shows the incomes of hundreds of occupations.” ABC, 27 August 2022, https://www.abc.net.au/news/2022-08-28/whats-the-typical-income-in-australia-list-of-occupations/101330740. Accessed 28 September 2022.

IndexMundi. “Countries ranked by GINI index (World Bank estimate).” IndexMundi, https://www.indexmundi.com/facts/indicators/SI.POV.GINI/rankings. Accessed 29 September 2022.

Klein, Elise. “How COVID-19 turned basic income into a reality | Elise Klein | TEDxCanberra.” YouTube, 20 December 2021, https://www.youtube.com/watch?v=EfyV8YTvG1U. Accessed 21 September 2022.

Troller-Renfree, Sonya, et al. “The impact of a poverty reduction intervention on infant brain activity.” Proceedings of the National Academy of Sciences (PNAS), January 24, 2022. 119 (5) e2115649119. https://doi.org/10.1073/pnas.2115649119

Marmot Review Team . “Fair society, healthy lives: strategic review of health inequalities in England post-2010: the Marmot Review.” Marmot Review, page 15, 2010 .

McGuire, Joel, et al. “Cash transfers: systematic review and meta-analysis.” Happier Lives Institute, https://www.happierlivesinstitute.org/report/cash-transfers-systematic-review-and-meta-analysis/. Accessed 21 September 2022.

Meixler, Eli. “Finland to End Universal Basic Income Trial After Two Years.” Time, 24 April 2018, https://time.com/5252049/finland-to-end-universal-basic-income/. Accessed 29 September 2022.

OECD. “ODA Levels in 2021- Preliminary data—Detailed Summary Note.” OECD, 12 April 2022, https://www.oecd.org/dac/financing-sustainable-development/development-finance-standards/ODA-2021-summary.pdf. Accessed 6 October 2022.

Phillips, Ben. “Financing UBI with a wealth tax: concept and modelling.” BEIN Brisbane Conference presentation, 5 December 2018, https://www.dropbox.com/s/n9hwy11fm9zr3oy/BIENSeptember2022Presentationfinal.pdf?dl=0. Accessed 29 September 2022.

Reed, Howard, and et al. Tackling Poverty: the power of a universal basic income. Basic Income Conversation, 2022. Compass UK, https://can2-prod.s3.amazonaws.com/user_files/user_files/000/076/443/original/Full_Paper_Lansley_Tackling_Poverty.pdf?link_id=4&can_id=638e114940cfcdfb6433919b99db942b&source=email-new-bi-report-record-low-poverty-at-no-net-cost&email_referrer=email_154911.

Roser, Max, and Esteban Ortiz. “our interactive charts on Income Inequality.” Our World in Data, 12 August 2015, https://ourworldindata.org/income-inequality. Accessed 28 September 2022.

Zimmermann, Annie, and et al. “The impact of cash transfers on mental health in children and young people in low-income and middle-income countries: a systematic review and meta-analysis.” BMJ Global Health, vol. 6, no. 4, 2021, p. 1. NIH, https://www-ncbi-nlm-nih-gov.ezproxy.newcastle.edu.au/pmc/articles/PMC8088245/.

Appendix

Australia’s Natural Experiment

Australia’s Natural Experiment

“Basic income is quite a hot topic, many people like to talk about it. But we never, or very rarely, especially in Australia, get to see it in practice.” (Klein)

During the period of payments being increased between 2020-2021, researchers at the ANU found that people on payments poverty levels went from 67 percent to 7 percent (Klein).

Themes from responses regarding increase to social security payment

improved financial security

greater ability to meet basic material needs (including healthcare)

improvement to their psychological wellbeing

resources to better look after children

Themes from responses regarding suspension of mutual obligations

improvement to psychological wellbeing,

freeing up of time,

being able to undertake activities important to them. (Cook et al.)

According to ABS data, “Coronavirus Supplement and the JobKeeper Payment were most commonly used to pay household bills by those receiving the stimulus payments.” (“Household Impacts of COVID-19 Survey, 10-15 June 2020”)

(ABS 2020)

People receiving the supplementary $550 payment reported also spending the money on:

Household bills 67%

Household supplies, groceries 63%

mortgage /rent 39%

Medical needs 26%

Pay down debt 19% (Klein)

The researchers at the ANU found that people on COVID supplementary payments’ poverty levels went from 67 percent to seven percent. (Klein)

On a more qualitative level, recipients reported increased wellbeing as a direct result of the financial aid.

Free text answers from (Cook et al.)

The Denmark example

What is it?

Unemployment benefits are paid as part of an insurance scheme, not dissimilar to Australia’s superannuation scheme. This is separate to the automatic enrollment in social security payments

How is it managed?

A variable rate payment which is automatically paid when a person is out of work that week, via an A-Kasse organisation. A-kasse” is a private association, but the most of the money you pay for membership, the A-kasse transfer to The Danish State. Benefits may not exceed 90% of the person’s previous salary, at a maximum rate DKK 19,351 (AUD 3885) per month, or $971/ week (Haagh).

How to justify an increased tax?

Haagh argues the increased cost is “based on an understanding that a substantial source of modern wealth is due to our shared-owned knowledge.”

What are the outcomes?

More generous unemployment benefits,

Decreased unemployment rate (2.5% at 2022), with the exception of pandemic unemployment (TradingEconomics)

Many thanks to all those who contributed to the ideas and content of this article. Apologies for any referencing errors.

by Elina Christian, Taylor Sweeney

Great post! Thank you for your work!