Cause: biopharma R&D productivity

Epistemic background: I’ve worked in the biotechnology ecosystem for two decades, lately as the founder of a clinical-stage biotechnology company. The occasional Shkreli aside, I tend to think that the industry and related areas of academia and government are mostly filled with well-intentioned people, but that emergent properties of this complex ecosystem—both within and between institutions—often conspire to make rational decision-making impossible. I also tend to believe that, while the noblest rhetoric comes from the academy and public sector, in fact, most of the actual positive impact quietly emerges from more greedy corporate types—basic Adam Smith stuff, nothing clever.

Summary

When it comes to human flourishing, few investments can have a bigger impact than new drugs and vaccines (high confidence).

However, the cost of developing each new drug or vaccine is very high, and has been steadily growing, especially clinical development (high confidence).

High costs reduce the flow of new drugs and biases development efforts in socially suboptimal ways (high confidence).

Despite broad awareness of these trends, few in the drug/vaccine-development ecosystem are making significant investments to reduce clinical development costs (moderate confidence).

This may be due to cultural factors like those identified in other fields by progress studies researchers (moderate confidence).

Directing philanthropic investment into for-profit companies that happen to adopt novel clinical trial designs, platforms, and statistical methods (regardless of disease target) could have a big impact (moderate confidence).

Importance

Most agree new drugs and vaccines are socially valuable

New drugs and vaccines generate the largest consumer surplus of any new product category. Two famous examples are antibiotics and vaccines. Their impact on human health over the past 100 years has been so ubiquitous that tabulating their full value is likely impossible.

Could this intuitive view be wrong? For example, some have criticized the entire field of oncology drugs for being ineffective and overpriced relative to value delivered (not everyone agrees). Occasionally, unexpected side effects cause post-approval recalls, sometimes catastrophically.

On the other hand, it’s also possible that the literature underestimates the societal value created by new drugs and vaccines. Compared with many interventions, it is relatively easy to measure how new biopharmaceuticals generate quality-adjusted live-year (QALY) savings, and this analysis is routine in the field.[i] Government buyers use these calculations to set reimbursement policy, so QALY methodology debates are full of goal-oriented reasoning and ideological debate. Calculating a “true” measure of a new drug’s QALY impact is further complicated by the difficulty of capturing all indirect benefits. For example, routine modern surgery and cancer chemotherapy would be impossibly dangerous without antibiotics technology. The plausible value of Covid-19 vaccines are enormous—estimates commonly reach into the trillions when their impact on lives saved and broader economic activity is factored in.

On balance, though, there is broad agreement that the world would be better off with more drugs and vaccines, particularly for diseases with currently high unmet medical need.

The cost of developing a new drug is high and rising, jeopardizing the flow of new drugs and vaccines

Unfortunately, the cost of developing new drugs and vaccines has been rising for several decades. Annual new drug approvals have been steady or perhaps rising slightly in recent years, but this is supported by a steady increase in funding. Declining productivity, in other words.

This problem is widely known in the drug/vaccine development ecosystem. Many studies—by industry, consultants, independent researchers, and academics—have been published using diverse methodologies. All find the same trend: a steady decline in the industry’s return on investment (ROI) for new-drug R&D. Average ROI dropped below the industry’s average cost of capital 10 years ago; it will soon be negative in absolute terms.[ii]

Lower R&D productivity means fewer new drugs/vaccines generated for any given amount of investment, which means many more lives cut short (relative to the counterfactual). But the situation is even worse than it appears: no industry can indefinitely continue making investments that return less than the cost of capital—eventually, equity investors will divert those dollars to economic activities with better risk-adjusted yields. Bureaucratic inertia, subsidies, charity, and hope may keep things going for a while, but it’s hard to shake the feeling that crisis looms.

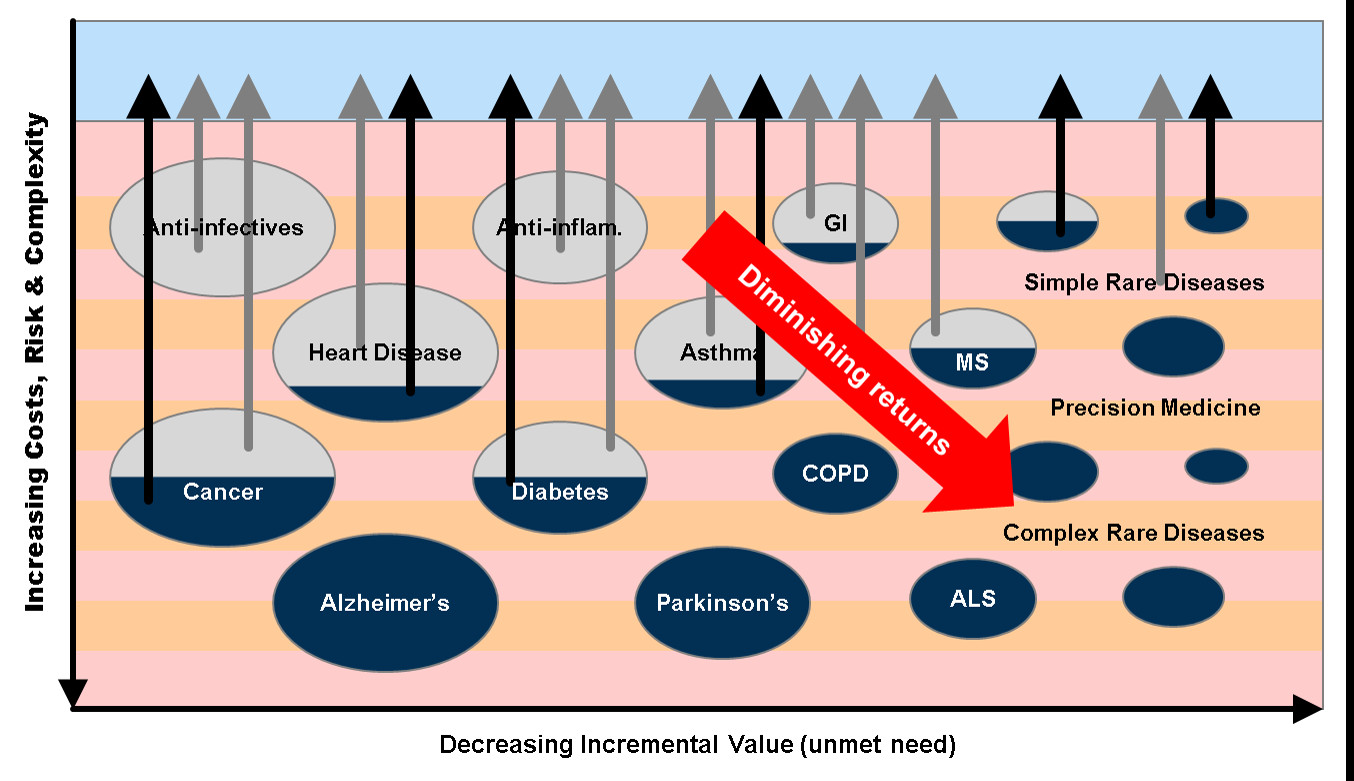

High development costs skew R&D away from socially valuable areas

Declining drug/vaccine R&D productivity may also change the composition of new launches in ways that are socially unappealing: more hair loss and erectile disfunction drugs; fewer new vaccines and antibiotics. This piece does a great job explaining how high development costs affect the funding of research for rare diseases. But the same financial logic applies to certain very common diseases. To appreciate the nuances of this dynamic, consider that the social utility of saving many developing-world children from malaria (measured in QALYs) is greater than saving a handful of elderly Americans from cancer. The costs of drug development for both have risen, but funding for the latter (both R&D subsidies and pricing power) is inelastic for political economy reasons, leaving malaria research largely dependent on handouts. It does not seem to be a coincidence that back when drug/vaccine costs were lower (i.e., when R&D productivity was higher) many of these disease areas were profit drivers (pg. 135) for the industry. Today, vaccines (the ones lacking Covid-era subsidies), antibiotics, and infectious disease interventions of all sorts are considered uninvestable.[iii]

Improving the productivity of drug/vaccine development might therefore not only increase the volume of new drugs coming out each year, but also re-balance the composition of those investment activities back toward socially valuable disease areas.

Conclusions about the importance of this cause area

Basic economic theory and reliable data, from multiple sources using diverse methodologies and data sources, support the conclusion that high and rising development costs are reducing the rate of new drugs/vaccines development (high confidence).

These factors also probably skew R&D investment away from areas of high social value (moderate confidence).

Even small increases in drug/vaccine development productivity could meaningfully increase the number of new drugs and vaccines created, yielding many QALYs (high confidence).

There would probably also be harder-to-measure secondary health benefits, like how antibiotics make surgery possible and vaccines improve long-term health outcomes (high confidence).

These primary and secondary health effects would themselves have valuable secondary economic effects just as Covid-19 vaccines enabled economic re-opening (high confidence).

Neglectedness

Few researchers seem interested in the problem of declining drug/vaccine R&D productivity. It seems impolite even to bring it up—it’s depressing and hopeless, so why talk about it? Following in the footsteps of writers promoting a new science of “progress studies,” this essay proposes that cultural factors best explain both the phenomenon of plummeting R&D productivity and its relative invisibility.

Neglect: why doesn’t industry research solve the problem?

Tremendous advances have been made recently in biology. A good example is genetic sequencing technology, which in recent years has outpaced semiconductor productivity growth (Moore’s Law). There appears to be nothing special about biology that makes it intrinsically resistant to productivity growth.[iv] In recent years, the number of new drugs and vaccines approved each year has been steady or even rising slightly. And both investor funds flows and industry profits have been healthy through 2021. Moreover, biopharma R&D spending has been rising steadily by a variety of measures.

This creates an apparent paradox: for an industry characterized by heavy R&D spending and that aggressively promotes its heavy reliance on innovation, how can it also be characterized by rising R&D costs and plummeting investment returns for new-drug R&D?

Incentives and the emergent properties of complex systems

A few years ago, a Wall Street Journal analysis of biopharma profits revealed a curious correlation: for the period studied, aggregate revenue growth over the examined period was about the same as aggregate price increases on old drugs. In other words, unlike healthier industries, revenues from new products barely keeps pace with the patent expirations.[v]

In the biopharma world, innovation does not drive growth; instead, price-jacking disguises the R&D productivity malaise. It is earnings-per-share (EPS)—not R&D productivity—that drives biopharma stock prices and investment flows, so from outside the industry, things look healthier than they really are. If true, this would align with certain other observable facts:

Drug/vaccine markets are highly regulated and subject to intense government intervention at every level. These interventions create opportunities for rent-seeking. The cat-and-mouse cycles of regulation and evasion that ensue drive further complexity.[vi]

Some well-intentioned regulatory barriers hand undue pricing power to drug makers. The antics of “pharma bro” Martin Skhreli are a good example.

Drug pricing decisions happen in private, but a recent Congressional report offers a case-study for one on-patent cancer drug and, at least in that case, reveals a straightforward link between EPS targets and drug pricing decisions. Not a good look.

The opacity and complexity of drug pricing distorts price signals, resulting in new drugs that are lucrative but may not actually help people much.

Most economically important biopharmaceutical products in the developed world have “composite” customers: doctors order the product, insurance companies pay, and the patient is the consumer. This is abnormal. For most goods and services, these roles are unified in a single mind. The oddity can be exploited to extract rents.

Viewed from this perspective, there’s a case to be made that a significant portion of drug/vaccine R&D is simply wasteful. Sexy new discovery technologies get the lion’s share of R&D funding, the general idea being to pick better drug molecules (safer, more potent, etc.) that will then enjoy higher success rates in the clinic and therefore, finally, nudging R&D productivity higher. Every few years there’s a new trend: lately AI/ML-guided discovery has been hot; 20 years ago it was leveraging the human Genome Project.[vii] It’s a plausible story, but if these efforts have had any impact it is hard to find in the data. At best you might say that the R&D productivity decline would have been even steeper without them. A cynic[viii] might even characterize it as so much elaborate greenwashing, albeit a form of it that also randomly spits out an occasional blockbuster.

Observers have been fretting about these issues for a couple of decades and it’s still here, so the equilibrium seems stable. But still, it’s hard to shake the feeling that the whole set-up is unsustainable. Industry lobbyists have successfully fended off bipartisan political pressure to engage in price fixing for decades, but it’s not obvious that this can go on forever. If a rent-seeking cash cow really is propping up the whole business, things could unwind in a hurry. It may already be happening now.

Caveat: what about all the good scientists?

A tempering note: this pat little story overstates the case. Even more so than individual humans, organizations (and industries) are capable of multiple simultaneous and conflicting motivations. However, the occasional Shkreli aside, people who work in biopharma are decent people who really do want to create new cures that make lives better. And many individual actors (especially startups) certainly have strong economic incentives to create breakthrough therapies. Economic forces and price signals have been attenuated, not abolished.

Nevertheless, it is EPS growth that drives decision-making inside big pharmaceutical companies. Decision-making and priorities within these big companies also dominate thinking within VCs and smaller biopharma companies because big-company M&A and in-licensing activities are the main drivers of investment returns for those smaller actors.

There’s a big gap (years!) between R&D investment and EPS growth, so there’s bound to be some slippage, even in the best of worlds. On this telling, the observed industry behavior is an unfortunate, emergent property of the system, not anyone’s intentional design. The behavior patterns that get reinforced—through a million small mechanisms like promotions, budget allocations, new investments, and public approbation—are ultimately those that yield EPS growth, not R&D productivity. For the industry as a whole, so long as enough new drugs are launched to “keep up appearances,” there seems to be little pressure to fundamentally change things, so those patterns tend to perpetuate themselves.

Neglect: why aren’t government agencies fixing this problem?

The U.S. federal government spends billions subsidizing and regulating biopharmaceuticals. They are not unaware of the R&D productivity problem. To their credit, FDA staff—like their colleagues in industry, mostly motivated, well-intentioned people—have launched several initiatives in response to public criticism of the agency’s perceived role in driving up drug development costs. Some examples are the Model-Informed Drug Development Pilot Program, and CDER’s Emerging Technology Program, and the Accelerated Approval Pathway.

However, these initiatives are small in comparison to the overall incentives and pressures facing agencies like the FDA and NIH. They are also subject to gamesmanship by industry and other political actors, and countervailing pressure to revert to heavier-handed oversight. These efforts sometimes also lapse when the agency encounters staffing and morale issues. They’ve made no discernible impact on new drug/vaccine R&D productivity.

Specifics aside, government agencies are hardly the place to look for insights on productivity.

Neglect: why don’t more academic researchers focus on this problem?

From time to time, academic researchers investigate the drug/vaccine R&D productivity problem. Some good examples include this excellent cost modeling paper from an Eli Lilly team, BIO’s periodic updated reports on clinical trial success rates, and R&D productivity studies by Deloitte, a large accounting firm. These writers have offered various explanations to explain the steady slowdown in biopharma R&D. Here are a few papers advancing various explanations for the decline. This piece by industry insider Kelvin Stott is most approachable for a general audience. Stott’s key conclusion in a subsequent essay is representative of the genre:

“We are rapidly running out of viable new drug targets that could possibly be addressed with existing approaches and technologies.”

A metaphor is offered: drug/vaccine discovery is like drilling for oil, and once the easy wells are tapped out, productivity must decline (no mention of the frackers, though).

This sense of hopeless passivity is widespread. The R&D productivity decline is usually considered an exogenous factor, an unalterable law of nature. Unsurprisingly, for most (though not Stott) the recommended policy is usually to increase subsidies (especially for academics!).

In short, while academic research usefully illuminates the problem, it seems very unlikely to generate the iconoclastic cultural break needed to fix the field’s cultural problem.

Conclusions about neglectedness

Biopharma companies do have incentives to find new drugs, but these are attenuated (high confidence).

Biopharma R&D investment is heavily biased toward one segment of the new drug development process (the high-status, early-stage discovery segment) and does not seem to affect the rate of R&D productivity decline (moderate confidence).

The underlying causes of the R&D productivity malaise may be cultural (moderate confidence).

Government and academic researchers devote relatively little effort to the biopharma R&D productivity problem (high confidence).

Tractability

In thinking about the tractability of the biopharma R&D productivity problem, it is useful to consider the parallels with another market where a massive productivity leap recently occurred: orbital launch services.

Analogy: Boeing vs. SpaceX

The pre-SpaceX orbital launch market was similar in many ways to drug/vaccine development:

Both are highly regulated activities due to obvious safety risks.

Public-sector funding is significant for R&D (NASA for space; NIH for drugs) and for revenues (NASA/military customers for space; Medicare etc. for drugs).

Both are highly politicized (think about space-race politics and the need to spread research across Congressional districts; for drugs, social impact and public-sector healthcare spending dominate the conversation).

Both are highly technical areas where outsiders are discouraged from expressing opinions (compare the cliché “it’s not rocket science” to the reaction when prominent economists began expressing opinions about the public-sector response to Covid-19).

It is probably no coincidence, given these cultural parallels between the two ecosystems, that massive cost overruns and delays have long characterized new product development in both.

Nevertheless, in the orbital launch industry, a new market entrant (SpaceX) has successfully reduced the costs by an order of magnitude (more by some estimates). This has been transformative for old-line industry buyers, and seeded the ground for a renaissance in space exploration. More innovation appears to be on the way.

Critically, no obvious basic science breakthroughs were required. SpaceX uses liquid-fueled rockets like everyone else, not fusion energy or antigravity. In fact, most of the work seems to have been carried out by the same engineers everyone else had access to: SpaceX staffed up by poaching disillusioned engineers from other firms. Like the biopharma industry today, it seems like industry incumbents were staffed with smart idealists frustrated by the constraints imposed by their sickly, subsidy-distorted ecosystem.

Cultural factors are the best explanation for how this unfolded: armed mainly with passion (but yes, also with tons of private capital and public subsidies), SpaceX accomplished what most thought to be impossible.

A similar productivity revolution in drug and/vaccine development should also be possible.

Potential areas for investment

EA should subsidize certain kinds of innovative clinical research at private companies

To spark a similar productivity leap in biopharma R&D productivity, the EA community should focus its resources on the private sector.

SpaceX’s company culture was famously rooted in Silicon Valley’s nimble software industry rather than in the process-driven cultures of Boeing and NASA. The core ideas that enabled this productivity leap—especially re-useable booster rockets—had been around a long time, but these ideas were considered “uninvestable” within the institutional constraints faced by engineers at NASA and its contractor ecosystem. Cultural factors are what finally allowed these ideas to finally be put into practice at. SpaceX. And now that self-landing booster rockets are known to be workable—and lucrative—many other groups are building on the idea. Before that, expert opinion was skeptical.

It will be difficult to predict which innovative ideas could accomplish the same for drug/vaccine development—like re-usable boosters, the best ideas may have been sitting around unused for a long time for reasons of institutional culture. Achieving a similar leap in drug/vaccine R&D productivity will therefore likely require a bold culture change. The seeds of this are most likely to be found within younger, more innovative for-profit companies, so that is where EA should direct its resources.

More specifically, EA investment should be channeled to for-profit companies working with radically new approaches to clinical development, regardless of disease area.[ix]

Why clinical-stage research? There are two reasons. First, the prevailing culture in the biopharma ecosystem focuses on ever cleverer preclinical discovery technologies; clinical research innovation is starved for funding in relative terms. Second, and more importantly, clinical development is the costliest segment of the discovery process.[x]

Targeting investment thematically like this would also give rise to the potential for double-dip charitable ROI: first, most new drugs/vaccines are socially valuable in their own right; second, if the new methods are in fact useful and they catch on, they may accelerate development of many other new drugs in the future. Most companies would be happy to accept charitable grants, but equity investment is probably fine too, and may create a flywheel effect. The Cystic Fibrosis Foundation recently made billions on a mission-oriented investment like this, which they’re now plowing back into more research. But above all, the key goals should be to improve the speed and productivity of clinical trials and to make more advanced statistical approaches culturally acceptable to larger biopharma companies and regulators.

What is the biopharma equivalent to re-usable boosters? I don’t know, but here are some initial ideas:

New therapeutic modalities. Nearly all biopharma industry revenues come from three types of intervention: vaccines, small-molecule drugs, and injected biologics (by volume, mostly insulin and monoclonal antibodies). The last is the newest but has been a mature technology for over 30 years now. It is known that therapeutic classes have different clinical success rates (pg. 16), so adding new therapeutic modalities could open the door to improvements in clinical trial success rates, by most accounts the main driver of development costs.

Another area to look would be clinical-stage companies proposing to use innovative statistical methods and improved clinical trial designs.[xi] Product developers in other industries have long used much more advanced methods, which began to permeate the manufacturing and chemicals industries in the 1950s with the statistical design of experiments revolution. These methods are particularly useful for the development of combination therapies, an area of intense interest right now in oncology. Still, drug developers have yet to carry out a single human clinical trial utilizing this modern experimental approach to statistical design, and the primary reason appears to be a simple cultural blind spot. There are no technical, legal, or regulatory barriers.

Historical precedents to build upon here include the FDA’s embrace of adaptive trial designs and Bayesian statistics, which appear to be on the verge of going mainstream due to some recent high-profile successes. The famous TOGETHER Trial consortium published some of the most important studies from the Covid-19 pandemic using efficient umbrella trial designs at a small fraction of the cost of the NIH’s studies.

Another idea would be to empower the old academic literature on “large, simple” clinical trials with modern internet-enabled decentralized trial technologies now that Covid-19 has made these technologies culturally palatable to regulators and ethics boards.

Expanding the use of human challenge trials is another promising area.

Progress studies

The emerging field of progress studies might well yield useful insights. For example, it would be helpful to have more case studies of disruptive events like the SpaceX example above where a productivity leap followed an institutional cultural change. Even better: are there examples where similar a cultural shift has been intentionally engineered?

Regulatory arbitrage

Regulators heavily influence the culture of new drug/vaccine development ecosystem. And given the dominance of U.S. revenues in most biopharma business plans, the FDA plays a particularly outsized role in setting policies and norms. It would be interesting to explore the potential for accelerating the internationalization of drug development—other regulatory cultures around the world may offer advantages.

There is precedent for this: when monoclonal antibodies were first being developed in the 1980s, it was common for developers to carry out initial human trials in the U.K., precisely because, at the time, it had a more nimble and flexible regulatory approach[xii]. Today, many drug/vaccine development programs initiate their first clinical trials in Australia for similar reasons. The famous TOGETHER Trial consortium has published a string of high-profile papers from a set of clinical sites in Brazil showing that top-quality research can be done in developing countries.

None of these shifts was accompanied by pronounced abuses and trial volunteer fatalities, indicating that the greater regulatory flexibility is possible without sacrificing safety. Here it is important to note that although SpaceX is best known for its “move fast and break things” approach to rocket development, the end product was not only vastly cheaper than others, but also one of the safest ever developed. Research into similar opportunities for regulatory arbitrage might therefore be a fruitful area for investment.

Advocacy work

Advocating for regulatory reform here in the U.S. might seem like the obvious place to start. Likewise, lobbying for public healthcare payment reform and improving the government grant-making processes to reduce rent-seeking could be useful. However, all these areas of public policy are hugely contested, so incremental effort seems unlikely to result in meaningful change. We are inspired by those who are already working in this area; it seems like a Sisyphean task.

Why this won’t work

Here are some counterarguments to the thesis above:

This essay is a critique of biopharma industry culture, but perhaps that conservatism appropriately reflects embedded wisdom not obvious to outsiders. There is a sordid history of unethical human experimentation, after all. Perhaps in this field, there’s a trade-off between morality and economic efficiency, and we shouldn’t push too hard.

On the other hand, rocket ships are hardly safe. And (prior to the 737 debacle) Boeing bureaucracy was lauded for its engineering-first safety culture. And yet, today SpaceX’s way of developing rockets is not only cheaper and faster, but the resulting product is one of the safest ever.

The SpaceX experience shows that a for-profit company led by a charismatic multimillionaire (and subsidies) can shatter productivity malaise in a mature industry. This essay advocates here a more distributed effort, one befitting the EA community. But perhaps this kind of cultural revolution can be effected only by a rare, charismatic multimillionaire.

On the other hand, perhaps the key bottleneck in the past has been the rarity of this personality type: the rare wealthy founder who cashes in but still retains their intensity. Subsidies might alleviate this supply shortage.

Biomedical research and clinical research ethics are no more complicated or risky than rocketry and AI, but cultural taboos block outsiders from participating in the conversation. Donors seem easily more cowed by biomedical domain experts than by experts from other fields. This reduces the likelihood that EA donors will be comfortable supporting this cause area.

On the other hand, we seem to be living in a special time right now due to the Covid-19 pandemic. Many key institutions (CDC, FDA, WHO, etc.) have lost credibility. The pandemic also dissolved the industry’s hopeless passivity in many areas, particularly old accepted truths regarding the speed of drug/vaccine development and the ethics and cultural viability of de-centralized and overseas clinical trials. Now is therefore a particularly auspicious time for this idea.

Some causes of rising R&D costs are structural (e.g., the “better than the Beatles” problem), so perhaps there are some features of drug development that really do make it different than other research fields and uniquely intractable.

This seems unlikely to me; or at least unfalsifiable. It’s the sort of thing that pessimists say about every field, and there are a variety of counterarguments.

Conclusions about tractability

It seems likely that the new drug/vaccine R&D productivity slowdown is caused by cultural factors (high confidence).

The key area where innovation is needed is at the clinical development stage, where regulatory burdens, ethical constraints, and financial pressures are all most severe (high confidence).

The most impactful investments would be subsidizing for-profit clinical development programs, irrespective of disease area, that are working to establish and culturally normalize the most innovative new statistical approaches and clinical trial design concepts (moderate confidence).

More traditional funding for research papers (“progress studies”) and advocacy (lobbying) might also be helpful, but they seem unlikely to accomplish much on their own (moderate confidence).

Notes

[i] The industry typically measures outcomes with quality-adjusted life years (QALYs) rather than disability-adjusted life years (DALYs), which seems to be the favored methodology in the effective altruism community. I am not an expert in the nuanced distinctions between these metrics, but they seem unlikely to affect the general thrust of the argument here.

[ii] The Covid-19 pandemic was accompanied by a relatively small blip in the long-term trend, but it is unclear how much of this is attributable to the massive government subsidies (tab 2, RPP-20-11).

[iii] Covid-19 interventions are not an exception to this. True, some have been wildly profitable, but that’s hardly surprising given the subsidies (see URL in prior footnote).

[iv] This analogy shouldn’t be overextended. There are many additional elements in clinical biology, including ethical considerations with human-subjects research, commercialization considerations around pricing and reimbursement, regulatory bodies, and the myriad fashions and trends that drive decision-making among grant-funding bodies, large corporations, and investors. All of these are human constructs, not laws of nature like gene sequencing chemistry.

[v] As compared with software, semiconductors, and rocketry, the biopharmaceuticals industry is cripplingly dependent upon patent protection, arguably another sign of malaise.

[vi] Some examples here are pharmacy benefit managers, inducements for doctors to prescribe certain drugs or receive kickbacks for diagnostic testing.

[vii] It’s probably not a coincidence that hunting new drugs has the highest social status in these organizations. There is no Nobel or Lasker for clinical trial design achievements, and VCs prefer to fund those startups set-up by molecule-hunters, especially if there’s a Nature paper in the origin story. It’s therefore unsurprising that relatively little R&D investment is directed toward more workaday considerations, such as clinical trial design and GMP manufacturing efficiency. This is all anecdotal, but it lines up with the relative lack of such people in the top leadership of drug companies. It would be interesting to see quantitative analysis of this.

[viii] Not me, for the record.

[ix] If it’s true that EA has an over-funding problem, improving clinical drug development is just the sort of QALY-heavy initiative that could easily absorb the excess funds without waste.

[x] The cost is driven by two factors that amplify each other’s impact. First, the cost of a clinical trial is high and rising. These direct costs are beyond the resources of most charities and governmental funders, so most simply don’t fund late-stage trials, which contributes to the so-called “Valley of Death” phenomenon. Second, these investments happen at the end of development, so failure propagates backward through the development budgeting process in a sense, wiping out all investments and capital costs that came before. For planning purposes, this late-stage attrition means that a rational investor must plan on launching many more early-stage programs, which effectively acts as a significant multiplier on the costs of early segments of the pipeline. These early-stage costs are multiplied through the net-present-value calculation due to the high cost of capital (drug development is risky!) and lengthy development timelines. The math is vicious. Paul et al. propose a simple model to help think through these dynamics. For a more personal take on these dynamics in the rare disease context, see this piece.

[xi] It might seem odd that the most cutting-edge statistical methods are used by the software industry to sell advertising rather than biomedical research, but a bit of cultural conservatism here is understandable given that human lives are often at stake.

[xii] Personal correspondence with the former director of the division of monoclonal antibodies at the FDA’s Center for Biologics Evaluation and Research (CBER).

Interesting post, I’m trying to understand it better. I think the cause area sounds good, but I don’t feel confident about the chance that there’s a huge amount of free-energy lying around (thinking in terms of Inadequate Equilibria). I feel like the heart of the argument is that “cultural” shift akin to what helped Space-X succeed could solve similar problems in Biopharma R&D.

A detailed plan substantiating a trial EA project would help establish the tractability more substantially.

Some specific points I’d like to clarify:

What exactly are the “emergent properties of complex systems” mentioned in the neglectedness section? It sounds like perverse incentives, unexplained lack of translation of technological progress to profitability and maybe backfiring legislation?

“The seeds of this are most likely to be found within younger, more innovative for-profit companies, so that is where EA should direct its resources.”—Can you point to any examples of such companies not succeeding for lack of funding? I think this could be a really strong point if you can point to examples of Space-X equivalents in biopharma that didn’t get off the ground for a lack of “a tonne of private capital and public subsidies”?

“This essay advocates here a more distributed effort, one befitting the EA community.”—this sounds potentially very time-expensive. If money isn’t the limiting resource, EA community member time/focus might be. What is your sense for the number of people/amount of time it would take to test this hypothesis?

I know a space-X engineer who also attributes culture to their success. I’m willing to accept this as a plausible catalyst for radical progress (although exactly what cultural hallmarks you mean might need to be specified).

Great points here. I don’t have great answers for all these, but here’s where I’m coming from:

I couldn’t agree more. It seems obvious to me that the system operates today in an ugly but stable equilibrium. Perhaps the new U.S. Medicare drug pricing bill and/or the current downturn in biopharma equities might cause a shake-up, but it’s been a stable equilibrium for an awfully long time.

You’ve got it. I’ve tried to cite thoroughly, but in this area in particular I’m borrowing very heavily from J. Storrs Hall’s book Where is My Flying Car. In my view the case is even easier to make in this field given how obvious the steady the process of bureaucratization has been in all important institutions touching on drug and vaccine development.

I cannot. I think it’s the nature of things that—like publication bias—the uninteresting outcomes are not reported in the trade press or anywhere else. Unsuccessful startups die quiet, sad, lonely deaths.

Hmm, I suppose I could have made this clearer. I don’t have a great sense of what it takes to shift a culture. What I understand groups like New Science and Roots of Progress are trying to accomplish seems extraordinarily difficult. From what I gather, a lot of it boils down to talking about it a lot, and in various ways. Perhaps talking is just one of the main ways that culture is propagated, and therefore changed? Perhaps also institution building (i.e., end-running existing institutions that are bottlenecking progress). If I’m understanding that correctly, than participating in that conversation, and amplifying things, seems like a really important contribution that the EA community is making to the Progress Studies cause. It’s how I came to these ideas, for one example.

However, in the narrow context of drug/vaccine development, I think the SpaceX example offers an intriguing additional path that’s open to deep-pocketed donors. Biopharma execs may be hopelessly tied up in their own red tape today, but if someone shatters an existing cash-cow drug franchise with a really novel development program, the entire industry would sit up and take note.

To visualize what could be possible, I think a good example of abrupt, industry-wide remodeling might be what happened in the market for cell phone handsets after Apple launched the first iPhone. It looked like science fiction when it came out, and within a few years the former industry goliaths (Nokia, Motorola) were knocked completely out of the market.

SpaceX was a startup and Apple was obviously not, I’m stretching my analogy. But then again, I don’t think any biopharma companies are run with Steve Jobs charisma today. If it’s possible for this to happen in the biopharma field, it will have to come from a startup. And above all what startups are starved for is funding—in particular funding for the wilder long-shot ideas that could really shake things up.

Without a catalyst like that, I suspect the current unhappy equilibrium is probably too stable to be dislodged with dialogue alone.