You can give me anonymous feedback here: https://forms.gle/q65w9Nauaw5e7t2Z9

Charles He

I don’t really have much to say except pretty much copy and paste my reply, above and point out how wildly hostile this is. No, people are not expected to put up bets for their statements. You are perfectly able to dispute them using arguments.

This is despicable to try to weaponize this practice, partially with the motivation for financial gain, which we both know you are. Your initial comment is absolutely in bad faith.

Separately and additionally, yes, I am exactly willing to take bets once you put up numbers, exactly answering your challenge, which I do not have to do.

Because you so indicated how interested you are, please proceed by operationalizing this and putting up numbers. I will take bets on either side.

Hey, by “sad” are you implying an askance view that I am either being evasive or inadequate?

I think so because you initiated this and won’t provide details of the bets and the tone of other text this: “If you can’t come up with...straightforwardly falsifiable way .”

I would find that derogatory, especially based on my detailed elaboration above, e.g. making me ponder and bet on whether someone I don’t think should be hurt is hurt and forcing me to study the legal details and put up my money to do so.

Separately and additionally, I correctly suspect that asking me to put up the numbers give you a major advantage, and you are attempting to take advantage of perceived emotional errors, by literally taking my money.

The above is plausible, and well, remarkably hostile under the circumstances.

That seems sort of like the perfect example of why someone would object to a prediction market.

I don’t really want to open up the “prediction market” thing, but I will ruthlessly do so, if this is pressed.

Yes, and no, can you operationalize some of the most interesting and relevant questions to you?

These might touch on:

Alameda Research

FTX

Legal acceptability of FTX’s collateralization strategy

The fully and honest true answer is sort of no.

I think legality is poorly posed or not well defined. This is hard to explain and I’m finding the current information environment on the EA forum, and really EA, exceptionally poor and this is disappointing and relevant, if elaborating contributes to the noise.

But basically, whether something is actually found illegal will depend on the administration, style of prosecutor, and political and social environment that could vary wildly, along with many other details. For evidence, see what happened to the 2008 financial crisis, where there was almost no criminal prosecution.

More importantly, the moral meaning of the activity versus what is found illegal can be unintuitive or misleading and this seems more important. I seriously distrust whether people here understand the moral meaning of these actions and I would find the aspects of a prediction to be sort of a predictable and distasteful spectacle.

Also, since I’ve never come close to this kind of activity in any sense, I don’t know much and I don’t care much about the actual relevant laws, especially things like jurisdiction e.g. significance of Bahama, which could be pivotal. (This by the way is one example where the meaning of this question is uninteresting.)

I again reiterate my strong belief in the character and decision making of SBF, which is counter to the would be “mood” right now.

It’s pretty well done now. This is difficult to follow and this must have been a lot of effort, even exhausting. I think your idea to edit posts was a good one and helpful in this situation.

It’s 8 billion now.The ask might be $4 billion.“Crypto exchange Binance reversed course on a rescue offer for FTX Wednesday, leaving the prominent digital firm with an uncertain future as it faces a shortfall of up to $8 billion, according to people familiar with the matter.

Binance chose not to go ahead with the nonbinding offer following a review of the company’s finances, the exchange said. “In the beginning, our hope was to be able to support FTX’s customers to provide liquidity, but the issues are beyond our control or ability to help,” Binance said in a statement.

In a call Wednesday with investors in FTX, founder and Chief Executive Sam Bankman-Fried said he needs emergency funding due to customer withdrawal requests received in recent days, the people familiar with the matter said. Those requests sparked a debilitating liquidity squeeze.FTX told investors that it was hoping to raise up to $4 billion in equity to fill the shortfall, people familiar said.

The implosion of the Binance rescue deal weighed on financial markets already rattled by uncertainty around the outcome of U.S. midterm elections. The Nasdaq dove around 2.5% Wednesday while the Dow Jones Industrial Average and S&P 500 both fell around 2%.

Bitcoin, the biggest and best-known cryptocurrency, fell around 16%, bringing its value below $16,000 for the first time since November 2020. It is now down around 75% from an all-time high reached in November 2021.

Also on Wednesday, Securities and Exchange Commission Chairman Gary Gensler issued a stern warning to crypto platforms, after more than a year of encouraging them publicly to register with his agency. He also likened the broader crypto market to a stack of Jenga blocks that gets weaker with each failure.

Once seen as a shining survivor in a struggling industry, FTX’s fall has sent shockwaves through the cryptocurrency industry. Just months ago, Mr. Bankman-Fried committed nearly a billion dollars to bail out struggling cryptocurrency lenders and was an active lobbyist considered widely to be the face of crypto in Washington.Binance’s retreat now leaves FTX’s fate unclear; the cause and full extent of FTX’s financial problems are unknown. FTX declined to comment.

In an internal FTX slack channel, Mr. Bankman-Fried on Wednesday wrote, “We obviously just saw Binance’s statement; they relayed that to the media first, not to us, and had not previously informed us or expressed those reservations,” according to a copy of the message reviewed by The Wall Street Journal.

Mr. Bankman-Fried wrote that he was working on next steps and doing what he can to protect customers, employees and investors. “I’m deeply sorry that we got into this place, and for my role in it. That’s on me, and me alone, and it sucks, and I’m sorry, not that that makes it any better.”Besides the firm and Mr. Bankman-Fried, well-known institutions that invested in the exchange are on the hook for potentially big losses. Among investors in a $900 million fundraising last year were SoftBank Group Corp., Sequoia Capital, hedge fund Third Point and tech-oriented private-equity firm Thoma Bravo.

Individual traders could also lose funds. FTX has halted withdrawals of both crypto and fiat currencies from the exchange, according to a pinned post in its official Telegram channel.

Michael Turský, a European crypto trader, said he hasn’t been able to withdraw his nearly $11,000 from FTX since midday Wednesday. Those funds represented around 70% of his liquid net worth, he said.

He said he tried to withdraw his cash multiple times, to no avail. “Knowing FTX’s brand and name, I would have never thought it would go under in a few days,” Mr. Turský said. “Even if it did, I would have never expected them to stop all withdrawals”

Losses related to FTX spread beyond the firm itself. Stock investors dumped shares of publicly-traded companies that are tied to cryptocurrencies with holdings of them or that derive fees from trading them.

Shares in Coinbase Global Inc. fell almost 10% despite assurances from its chief executive on Twitter that the company has sufficient assets for customer withdrawals and doesn’t have any material exposure to FTX. Coinbase closed at its lowest level since going public last year when it fetched an $85 billion valuation. Its market value Wednesday was around $10 billion.

Shares of Silvergate Capital Corp., the closest U.S. bank to the crypto world, dropped 12% and have shed some 75% of their value this year. Shares of MicroStrategy Inc., which pivoted from business software into largely a buy-and-hold vehicle for bitcoin, fell nearly 20%.

Brokerage app Robinhood Markets Inc., which offers trading in more than just crypto, was burned by fears that one of its biggest shareholders, Mr. Bankman-Fried, would have to dump his shares. Robinhood shares dropped nearly 14% on Wednesday, bringing losses for the week to more than 30%.

The cause of the FTX liquidity squeeze still isn’t known, but some investors and crypto holders are asking if links between the exchange and a related company, Alameda Research, could have contributed to the crisis. Alameda is majority owned by Mr, Bankman-Fried, and he founded both FTX and Alameda.

Questions about the depth and extent of FTX and Alameda’s financial relationship grew last week after CoinDesk published a report that indicated much of Alameda’s balance sheet was made up of FTT, a cryptocurrency created by FTX.

Cryptocurrency exchanges, like their counterparts in the world of traditional, regulated finance, rely on a mix of partners to provide digital assets for trading, like bitcoin or ether. So-called market makers help traders buy and sell. They get paid by collecting a small difference between the bid and offer price.

Having ties between an exchange and market maker raised governance issues and the potential for conflicts of interest. In theory, such ties could allow a market maker to potentially trade on privileged information or use the exchange to inflate or deflate prices of a given security.

“These related-party relationships are all red flags that any regulator would recognize,” said Larry Harris, a finance professor at the University of Southern California’s Marshall School of Business and a former Securities and Exchange Commission chief economist.

In traditional financial markets for equities and futures, exchanges are required to be neutral platforms. Regulators discourage them from being intertwined with trading firms. In the unregulated world of crypto, though, there aren’t any such constraints.

There were other links between FTX and Alameda, which besides being a market maker traded for its own purposes. The firm used FTX’s FTT tokens as collateral for loans it took out from other crypto lenders, according to people familiar with the matter.

FTT went into freefall in the days after the CoinDesk report and has lost around 90% of its value.

Mr. Bankman-Fried previously rebutted the idea Alameda was intertwined with FTX, saying to the Journal in February that none of FTX’s market makers have access to any nonpublic market data. And while Alameda trades on FTX, he said, “their volume is a very small fraction of overall exchange volume, and their account’s access is the same as others.”″

The site has been taken private. https://www.alameda-research.com/

Sabs — do you think you want to write (negatively) about cryptocurrency in a focused way, as a longer form piece? I think this would be valuable compared to a lot of smaller comments.

Note that Hofmann/Semafor is sort of hostile, but as characterized, it’s very bad for the prospects of a recovery.

It’s more likely that people don’t want to “hold the bags career wise”/work 20 hours a day to fix this for uncertain comp. It’s not evidence of conduct (like embezzlement)—I’m pretty sure Hoffman would go for the throat if it was.

Your comment is valid. This reply is getting into sort of low quality/twitter/reddit style speculation and I might stop writing after this:

Some factors that seem different:

That was Jan 2021, when I think the economy was still in one of the greatest bull runs in human history, money is tighter now for various reasons

At RH, the underlying problem was pretty well defined, and easy to communicate/verify

RH probably had more integration/acceptance in conventional finance. Crypto can be openly hostile, SBF was probably relying on less conventional backstops from his other entities and informal networks

It is possible SBF’s preparations and backstops were formidable, but at the critical moment when withdrawals surged, the separate crisis of defending FTT at >$20 drained all of Alameda and FTX’s resources, that would otherwise almost always be available to satisfy even chaotic customer withdrawals. No one expected both things to happen at the same time

The dual crisis of the withdrawal and FTT issue was spooky, this was two distinct issues. This looked like solvency, and made it a lot harder to get money

It’s not clear the RH FDIC crisis had any visible effects (and it’s not even clear the feds would act in a public way if a violation occurred) while yesterday’s FTX’s withdrawal suspension was blatant, highly damaging and public, by the time FTX was making its phone calls. If they made the calls on Sunday, this may have solved quietly.

RH didn’t give $2M to grantees with a lot cultivated online clout (that the very grant paid to enhance!) who then turn around to unfairly negatively speculate online about deception.

Some other potential factors, are really sort of sad, not SBF’s fault, and I don’t want to write it.

Overall, the negative speculation in this thread seems undue and too negative.

Without trying to make an affirmative statement about what happened at FTX or saying there wasn’t any other factors, the comments in this thread ignore the reality of leverage and risk management in brokerage trading (which is what FTX effectively was).

It can be completely true that no customer funds were invested or speculated, but that the fund as a whole can still collapse due to the mechanics/dependencies of leveraged trading.

For example, Robinhood, which no one believes was speculating with customer funds, had a huge crisis in Jan 2021, that needed billions of dollars of outside money. This was just due to customer leverage and moderately more instability in stock (and probably bad risk management).

Without trying to make an affirmative statement about what happened at FTX or saying there wasn’t any other factors, it seems likely that the idea “that customer funds solely belong to the customer and don’t mix with other funds” is simplistic and effectively impossible in any leveraged trading system. In reality, what happens is governed by risk management/capital controls, that would almost always blow up in a bank run scenario of the magnitude that happened to FTX.

For example, Robinhood, which no one believes was speculating on customer funds, had a huge crisis in Jan 2021, that needed billions of dollars. This was just due to customer leverage (and probably bad risk management, the magnitudes seem much than what FTX faced this week).

Well, besides ignoring Nathan Young’s huge clout, yes, this seems fair.

Yes you’re right. Yesterday morning, the title was less inflammatory and a reasonably factual statement.

The post is less relevant and sliding off the FP, I’ll probably delete the entire post at some point (the comments will remain).

This is surprising, like surreal—we are in the simulation sort of vibe.

I’ve never seen a website indexed like this in Google scholar. Has anyone else?

What you said is valid in general. As a reply/rebuttal, I think your focus/association with “lying” is misdirected or stilted.

Basically, what probably happened to FTX is something like the financial engineering described in this link in this top level post: https://dirtybubblemedia.substack.com/p/is-alameda-research-insolvent. This take, which is quite hostile, doesn’t involve lying per se.

It’s extremely difficult to communicate how normalized something like the above has become, and how much of the “tech” and business success in the 2010s was the result of similar financial engineering and loose capital.

Succeeding in this way, while not lying, is not exactly honest either. But in this moral space, I strongly put all of my support behind SBF and his decisions as a person, based on his choices and goals.

Before ending today’s weird sojourn into corporate finance, I want to point out it’s really disappointing how this has been discussed. I don’t think the modesty and general intuition most people have expressed is very good, the quality of the modal post wasn’t very good (for its first ~10 revisions), and clearly voted up because of who the authors are; clueful, fair comments are shouted down, while EA leaders making making similar appeals to authority/applause lines are voted up.

It’s wild you are at 30⁄23 here.

It’s not just that most people don’t understand, they are wildly brandishing their opinions and producing a weird ignorant cloud—it’s hard to explain, but maybe this person might understand.

Zooming out, I think this is important because basically, it’s possible EA is worse off, A LOT worse off, by having a billionaire come in and flame out like this, than not being there at all.

I guess there’s several issues that need to be dealt with. But the one issue that I think is important and hard to handle well, is the perceptions of competency and spirit of EA.

Throwing off someone because they had a business failure, or pointing out their conduct disproportionately, because they are on the “way down”, is at least as bad as sucking up to them and ignoring it on the way up, and to me, plausibly way worse.

So it’s good to see SBF for who he is, and the work he did and decisions are quite likely entirely valid. That is why I wrote my parent comment and the first paragraphs of this comment.

It’s almost certain that the residual value after FTX.com’s sale will be very low.

There are also major implications for Alameda trading and the remaining FTX entities.

Some of the thoughts in this post and thread seem pretty half baked and very uncertain, I think the pace of writing should be lower.

For example, the withdrawals might be at $6B this morning, that would break systems in a purely ops or make movement of money impractical for very innocent, mundane reasons. This experience adds a lot of confusion and noise when reported and echoed.

The “Satan’s Apple” seems excessively abstract, looking at this from a regular business expansion/portfolio theory seems like more useful and this would benefit from more time.

SBF seems like a very good person. Almost regardless of what happened, I don’t think a reasonable person’s opinion of him should be reduced.

All of the FTX regranters and the FTX grantees, seem to be very virtuous and effective EAs[1]. FTX funding seemed to be building deeper competency in other areas. This seems like a huge loss for EA.

- ^

I have never received or applied for FTX funding and I never took any actions to lead me being funded by the FTX FF. In the past, FTX regranters approached me.

- ^

This comment is speculative/editorial.

Coordination / Bailout

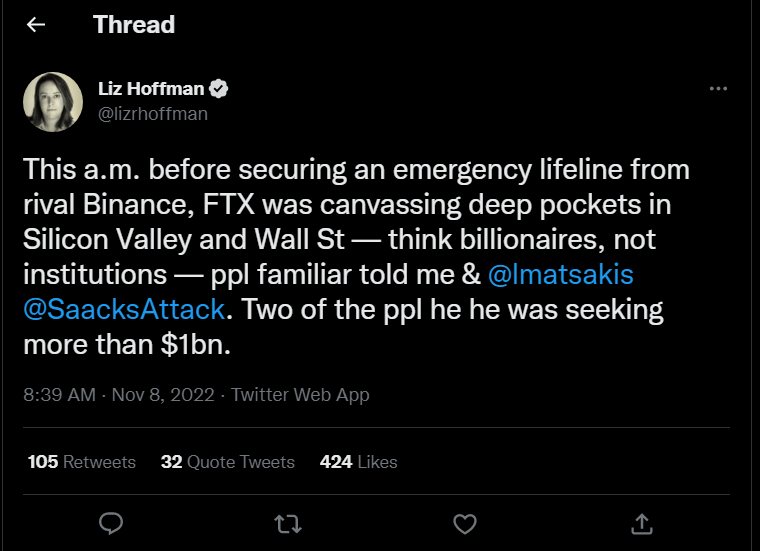

Some sort of coordination or saving of FTX seems desirable. Relevant to this, tweets by Liz Hoffman claims FTX reached out this morning privately for aid. The ask may have started at $1B, but in a few hours the need rose to $5B.

https://twitter.com/lizrhoffman/status/1590021299295768578

If this is true, it seems plausible that the smaller amount could have been secured, but the increasingly larger amounts made it difficult. This seems relevant to ideas about coordination or bailout.

Cause of collapse seems relevant / Bank run seems problematic

Notice that it’s unclear how collapse of its tokens and especially a run of withdrawals would cause solvency or liquidity issues for FTX.

For customer deposits, FTX should be holding assets as cash/tokens, not lending them out or leveraging them. This is what SBF has represented.

It seems possible that FTX had leveraged non-customer assets as part of its business strategy, and the collapse took them by surprise. It could be the suspension of customer withdrawals was simply due to the volume of withdrawals (the amount was rumored to be up to $6B this Tuesday).

It seems good for to EA that this is explained. It seems that SBF, EA competency, and the long term future seems all associated by now.

Hey, no? Because EA forum votes is literally nothing no one cares about, and which I explicitly said in my top thread are bad, and you’re deliberating using this as a ploy to get me to refuse? How about 50⁄50 on an actual real world event?

Also, as mentioned, beginning the “prediction market thing”, can you tell me, like not as a real name thing, but do you have like an an account on a prediction market? Are you associated with the grantees on their prediction market projects?