[Cause Exploration Prizes] Fix the Money, Fix the world

This anonymous essay was submitted to Open Philanthropy’s Cause Exploration Prizes contest and published with the author’s permission.

If you’re seeing this in summer 2022, we’ll be posting many submissions in a short period. If you want to stop seeing them so often, apply a filter for the appropriate tag!

There is a growing but small group of people, including influential thinkers like Jack Dorsey (founder of Twitter), with very strong views that the current monetary system is broken; curiously, their prescription to the problem is Bitcoin. At the wake of the recent inflationary spike last summer 2021, I decided to take a deeper look at their arguments to determine if there is some wisdom of the crowds or just a bunch of flat-earther like conspiracy. Surprisingly, I’ve found their case quite plausible and compelling. Even though I still have outstanding uncertainties, I’ve generally found this topic to be highly neglected in EA and the cause exploration prize seems like an excellent opportunity to raise a discussion about this. Because this topic is highly complex, rather than a bullet-proof case, I will attempt to provide an overview and summary of key arguments and provide links for further reading that can probably argue the case much better than I can.

Summary

Money is a technology that facilitates large-scale coordination between its users across space and time. There are qualities that make a Money better at being money. As an individual and society, choosing the wrong Money has drastic negative consequences. The current fractional-reserve debt-based monetary system is unsustainable because it is incongruent with exponential technological deflation, a long time-horizon mindset, and a resource-limited world.

What I see as criticisms towards capitalism and vague calls to overthrow the “system” actually describe “crony capitalism” where bad incentive structures within money creation led to bad outcomes. This can be concretely addressed by replacing the fractional-reserve fiat monetary system with a trust-minimised, censorship-resistant, decentralised, sound “money”.

Such a money could increase freedoms in almost 4 billion people living in authoritarian regimes, incentivise longer time horizon thinking, renewal energy build out, worldwide cooperation and disincentivise conflict. These are very big claims and you should be rightly sceptical.

What is money?

If there was one article you should read it would be this (https://www.lynalden.com/what-is-money/)

Money naturally arises when the number of humans in a group reach the dunbar number or larger. Because of several problems and inefficiencies with bartering, large societies tend to use a medium of exchange to store value instead. Historical forms of moneys such as various stones, beads, feathers, shells, salt, furs, fabrics, sugar, coconuts, livestock, copper, silver, gold, have been organically selected because they have several important monetary properties:

Divisible

Portable

Durable

Fungible

Verifiable

Scarce

It also usually (but not always) has some utility.

Gold is the best among just about every attribute and is the commodity with by far the highest stock-to-flow ratio (Scarcity). In this view, money is a technology, and societies with better technology (money that optimised the above properties) tended to do better than others. However, gold still has some flaws in so far as it is not very divisible. As the speed of commerce became faster than the speed of transferability of gold, economies had to abstract gold into paper notes that are backed by the redeemability to gold. This allowed gold to be centralised in big banks and federal reserves, with currency circulating on top. However, the poor incentives dictate that more bank notes are always printed than can be redeemed for physical gold.

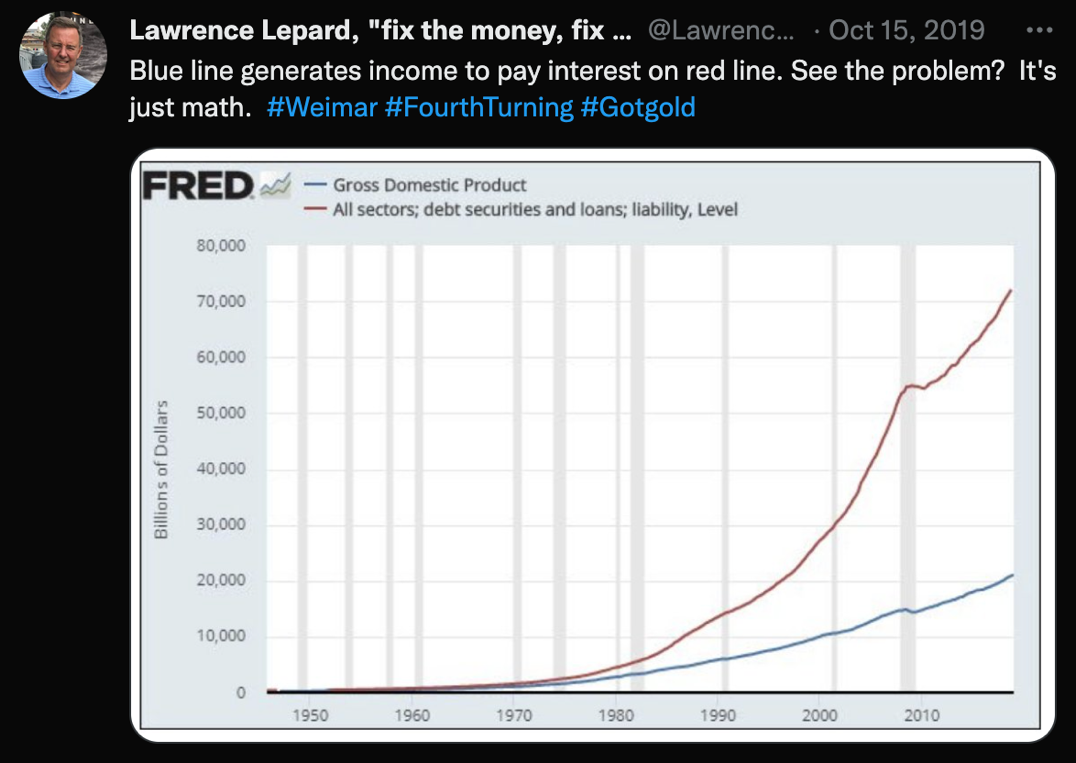

Debasing currency was always a means to empower wars, and in World War 1, many countries had depegged against gold to finance the war. In 1944, the Bretton woods agreement had repegged the US dollar to gold at a highly devalued exchange rate, and the other currencies were pegged to the US dollar in a pseudo gold standard. This didn’t last long as the US deficit continued, and the US government continued to print more paper currency compared to the gold it backed. This culminated in the 1971 Nixon shock, which took the US dollar off the peg to gold and with it all other currencies. Since 1971, all currencies in the world have become unbound to any physical limitations. This is the current petrodollar fiat monetary system that most of us are more familiar with, and money creation is done through lending and borrowing, created out of thin air through a ledger within the banking system. The growth of monetary units in the system is restricted only by the ability to afford more debt in the system.

Banks tend to run on fractional reserve, meaning that when person A deposit 1 dollar into a bank, they can lend it out to others up to 10 times. Person B with their newly borrowed 1 dollar can deposit it in the bank and the process can repeat. In the ideal scenario, this can work well if all the borrowed money is invested towards productive activities that generate a return larger than the interest costs of the borrowing. In reality however, there is always some forms of malinvestment, where the venture doesn’t turn out successful, or the borrowed money goes towards unproductive means such as consumer goods. When there are enough insolvencies in the system due to actors not paying back their debts, then the lenders can fall in a domino effect and cause chain insolvencies. This is exactly what happened in 2008, when the federal reserve decided to step in because certain financial firms were “too big to fail”. Arguably the federal reserve did the right thing by preventing a systemic collapse, however at the cost of their intervention, they had to lower interest rates (allowing easier borrowing) which further exacerbates the malinvestments in the system.

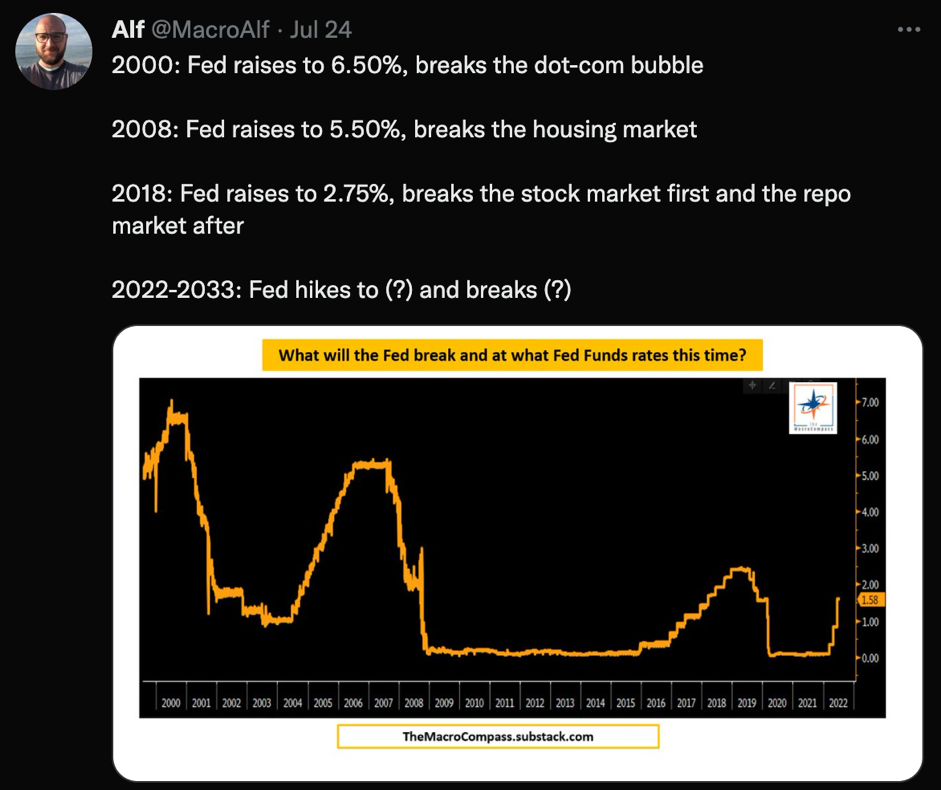

In a healthy free and open market, the malinvestments tend to wipe themselves out in a process of creative destruction. As you can see interest rates have slowly crept lower and lower from as far back as 1980s, allowing the global debt burden to balloon larger and larger. Think about how unsustainable it would be for an individual to continue borrowing to pay back the interest from your previous debts – this is happening across global nations.

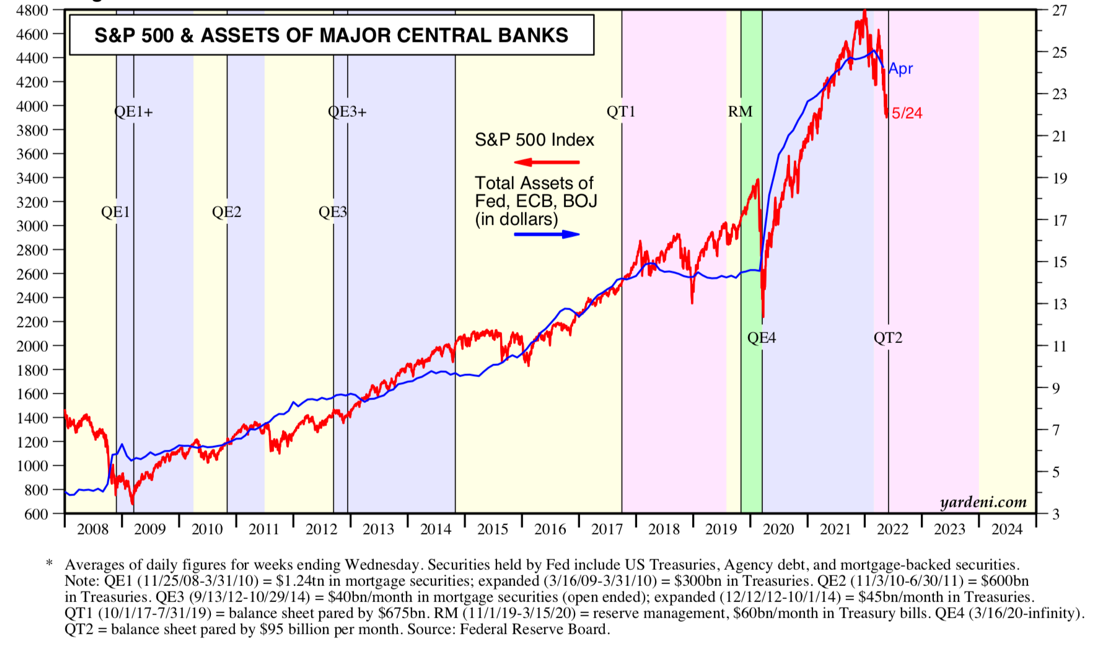

Furthermore, every time there is a crisis, the interventions must get larger and larger because of the increasing debt loads. In 2008, the federal reserve printed around 450 billion dollars, which was considered an astronomical amount at the time. Fast forward to 2020, to deal with the covid crisis, the federal reserve printed a whopping 5 trillion – basically increased money supply by 40% in 2 years.

Meanwhile, central banks keep promising that these are temporary measures and that the balance sheet would normalise are slowly losing credibility. Look at head of European Central Bank answer the question in this video ; ex-federal reserve chair Ben Bernake answer in a senate hearing in 2010 that he would bring the balance sheet under 1 Trillion; or quite comically Neel Kashkari, president of the Federal Reserve Bank of Minneapolis, saying in an interview that there is no end to the Fed’s ability to flood the system with cash.

But why does this all matter anyway?

In short, without a stable monetary base, the ruler for economic calculations is broken. Basic supply and demand, if there is more money chasing after fewer goods, the prices of the goods tend to go up.

This is particularly true for goods that people desire, with low price inelasticity.

Normally price signals serve an important function of disseminating information across a market, brilliantly described here. However, when the opportunity cost of money is manipulated, prices of everything becomes distorted.

This is all fine, if you are directly receiving the newly supplied money and are contributing to pushing prices higher. But there is an unequal distribution of people receiving newly supplied money. This is called the Cantillon effect. The richer have an easier time accessing cheaper credit (think credit scores) and on top of it their lobby efforts can mean money creation disproportionately benefit them, coupled with too big to fail bailout loans that later turned into grants. In fact, there is a website that documents various divergences that occur since 1971 when money creation became unglued from physical commodities.

NOTE: these are merely correlations that could have confounding causes.

As money becomes devalued, everything else that is scarce becomes monetised because people are desperately seeking alternative means to store value. A clear example is the housing prices; where there is a utility value of houses, most current prices are made up of “investment” value of people buying second and third homes not because they need to use it, but so they don’t sit in depreciating cash. This is leading to the homelessness crisis. When money becomes abundant, everything else becomes scarce; and when money becomes scarce; everything else becomes abundant through technological deflation.

What is the historic track record for a broken money causing massive suffering?

When money is broken, the ability for humans to coordinate within the economy collapses. In other words, the tool to measure economic value no longer works. It doesn’t take long to look for consequences of a broken monetary system. History is filled with examples of societies suffering from hyperinflation, from self-inflicted ones:

1920s Weimar Germany (leading to Hitler’s rise)

Or foreign introduced ones such as:

Economies with massively expanded monetary units have not ended well. As of today, 2 billion people live in above 10% CPI inflation. As a fact, since 1800, 50 out of 51 countries that have debt to GDP ratios of at least 130% have defaulted on their debt.

Enter Bitcoin

Bitcoin is many different things to a lot of different people. At the core, it is just open-source software developed by an anonymous person or group by the pseudonym Satoshi Nakamoto. Anyone with a 20-year old computer and an internet connection can run the software and validate a decentralised ledger. The public ledger keeps track of addresses with a native currency bitcoin and crucially, the software ensures that there will only ever be 21 million bitcoins. This improves upon gold in that it’s even more scarce, but it’s infinitely more divisible and transportable. I can zip a tiny fraction of a bitcoin across the world at the speed of light, and there wouldn’t be any credit involved. It’s a bearer asset which means you can hold it like cash in a digital wallet. Unlike deposits in a bank, which are technically loans to the bank custodied by the bank. The network is fully opt-in, and the network sees every participant as the same. Everyone must abide by the same rules.

Before I go on to detail further the “softer” arguments perhaps it’s important to take on the most likely criticisms of this idea.

But isn’t debt good for growth?

The progress movement aims to achieve growth and development, and this is important for reducing suffering worldwide and improving quality of life. However, I believe some nuance is necessary. There is a distinction between technological growth and debt-fuelled short-term growth. I would argue that the latter is unsustainable. From the individual level, if you had accumulated an amount of credit card debt, the solution wouldn’t be to borrow more money to pay it back; ultimately you either have to strap up and cut your spending or increase your productivity to pay back the debt.

Furthermore, there are plenty of problems relating to how we measure growth. Nominal growth in a hyperinflationary economy would be going up, but real growth as measured by purchasing powers would dwindle. GDP as a measure can easily be manipulated as such a large component is government spending.

But isn’t Bitcoin bad for the environment?

For a detailed rebuttal of Bitcoins energy usage issues, this is a great article.

TLDR; There is much misconception relating to Bitcoin’s environmental impact. Bitcoin mining currently uses about 0.7% of world energy usage, which is less than that of clothes dryers and cruise ships. Many doom and gloom articles, such as this one predicting Bitcoin using all worldwide energy by 2020, have made predictions based on false assumptions of how Bitcoin mining works.

On the contrary, there is increasing awareness within the energy sector that Bitcoin mining would be a critical provider of flexible loads to accommodate the inflexible supply of renewable energy. Simple, Bitcoin mining, because of its incredible flexibility in terms of usage and scale, can soak up any sources of stranded and wasted energy (accounting for 60% of world energy production). While there are other methods to do this such as hydrogen electrolysis, Bitcoin mining is the most flexible and scalable method we have currently and so would be a beneficial addition. This provides an incentive structure that de-risks renewable energy production – as currently overbuilt renewables literally have to sell energy at negative premiums when supply is overloaded, creating a disincentive for further build out. Furthermore, Bitcoin mining, can clean up areas of waste methane release that have not previously had profit incentives to do so. See these examples of landfill methane, farming biogas or human waste biogas being used for bitcoin mining, reducing the CO2 equivalent of the methane released. While there are rare examples of such incentive structures reviving non-profitable coal plants, I expect this to become less and less the case as more stranded and waste energy is used meaning their low costs will outcompete in the zero-sum competition for the bitcoin mining block reward.

Furthermore, I believe that the bad incentives in current money creation is at the heart of over-consumption culture. When interest rates are pushed down to zero, we are disincentivised to save, but incentivised to spend and stimulate the economy. This pushes our time preference much shorter. When a natural resource is limited, the price should go up, signalling to us that we should use less of it, but this manipulation of money causes the signals to fail. When prices go up and we print more money/ or add more debt to artificially overcome the price signal, then we are overconsuming the natural resource at the expense of future generations.

Doesn’t inflation cost the rich more than the poor?

This is a contentious point, but I believe inflation affects the poor disproportionately because the rich have most of their wealth tied up into hard assets like houses and stocks, that inflate in price when the money is devalued. This chart shows how directly linked money devaluation and asset valuations are.

Another way to display this is that adjusted for the expansion of money supply, the stock markets around the world has not gone up at all since 2008.

Isn’t Bitcoin wealth distribution very concentrated?

There is a common misconception that “94% of bitcoin is held by the top 2% holders”. As discussed here, this is misleading because this 2% includes exchanges and custodians that hold the coins for millions of customers, as well as publicly traded companies, that in theory are owned by the however many shareholders. It also doesn’t take into account “lost” coins. The truth is, coins are continually being redistributed to smaller and smaller holders, and wealth is becoming less concentrated.

Isn’t Bitcoin just a Libertarian wet dream?

There are a lot of vocal libertarians who are bitcoin supporters. However there is an increasing acknowledgement that Bitcoin also aligns very well with progressive ideals. I personally identify as a progressive and not a libertarian and I see Bitcoin as a tool to counter authoritarianism, and crony capitalism. The chief strategy officer at the Human Rights Foundation is a vocal supporter of Bitcoin and has written extensively (here, here, and here) about how dissidents across the world have been able to use the censorship-resistance property of bitcoin to operate in authoritarian regimes. He estimates that 4 billion people in the world live in authoritarian regimes. Snowden and Assange themselves have used Bitcoin previously to circumvent financial oppression. And if you think this doesn’t affect you, even in western governments, during the trucker protests, Canada not only froze the funds of the protestors, but the people who donated to them. Lyn Alden describes the non-political nature of this issue:

In a world where China is pushing a central bank digital currency, bolstering its ability for massive financial surveillance and repression; Bitcoin is an alternative that offers choice and hope.

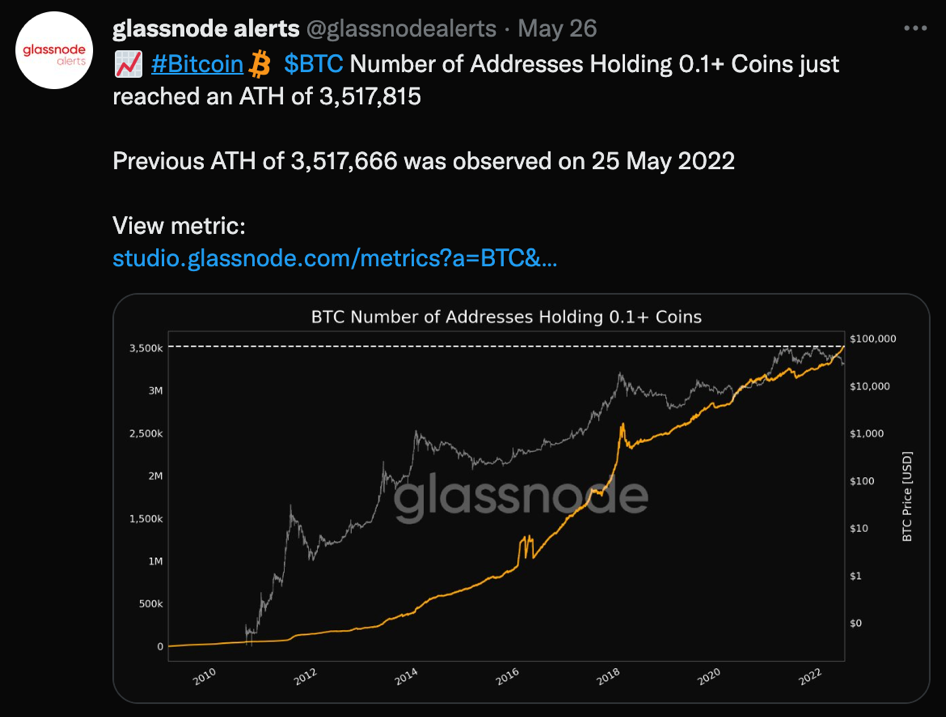

Isn’t it all just a speculative bubble with no use cases?

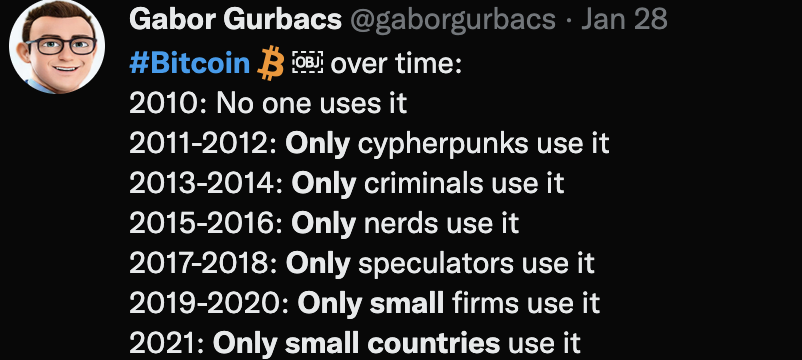

The transition towards a Bitcoin world is still in the very early stages. It is true that the space is still full of speculation, but underneath “real” adoption is steady and continual growth.

Now, several public companies official hold Bitcoin and two countries (El Salvador and Central African Republic) have made it legal tender and official currency – Notably both incredibly poor countries that have not benefited from the legacy monetary system.

El Salvador is predicting an increase in GDP by 7% just from lowering transfer fees from remittance companies like Western Union (accounting for 24% of their GDP). They have also seen a massive tourism spike and gain in foreign investments since adopting Bitcoin as legal tender.

Importantly, small countries now have an alternative to borrowing money from the IMF with unreasonable conditions. El Salvador is tapping into its natural resources by releasing “bitcoin-backed” bonds to build geothermal plants that will generate initial returns by mining bitcoin.

So, what could a Bitcoinised world look like?

The world will be coordinating with one currency, with much less friction (less exchange rate losses). There would still be small amounts of short-term credit; but borrowing bitcoin for the long term is a losing strategy because its purchasing power continually increases because of technological deflation. Things get cheaper and cheaper for everyone, and people no longer need to be debt slaves, people don’t buy useless plastic garbage, instead they save for the long-term future. People will work less, but they can buy more. The wealth inequality will reduce as wages no longer get inflated away, and people who produce real value get compensated.

Disincentivised conflicts

Since the monetary premiums on physical goods and items have decreased in relation to the monetary premium on bitcoin. There is an extremely high barrier to stealing someone’s bitcoin, (the key to the wallet can be stored as a 12-word password in your head), and you can have multiple keys spread across geographies, people are much more incentivised to trade and earn someone else’s bitcoin by producing something of value to sell. As a real-world example of this, immigrants and refugees from Syria and Ukraine can literally flee the country with most of their wealth intact just from memorising their bitcoin key, they can then purchase the things they need when they get to a safer country.

Governments now must raise a war tax if they want to wage war – instead of financing wars with cheap debt and money printer as is the case with the Afghan war. Tension is also reduced because everyone is using a politically neutral currency, instead of a hegemon’s

So what can EA do?

Let’s say you are convinced by these arguments that we should reform the monetary system and adopt a bitcoin standard. What should we do as effective altruists?

The first thing you can do is to buy some bitcoin, as an individual or organisation, you can hold 1-10% of your savings in bitcoin and not suffer to much from the volatility. As much as I’ve laid the moral case for Bitcoin, there is also an economic investing case for Bitcoin (basically an insurance against fiat currency collapse).

The second thing is to fund organisations that encourage bitcoin adoption, especially in developing countries.

The third can be for people to start lobbying groups to influence governments to provide regulatory clarity, so more people can have access to the technology.

The fourth would be for cash transfers to be made using Bitcoin rails. So we can donate more effectively/ bypassing various international bank transfer fees.

Concluding remarks

The title of this post is inflammatory. Of course adopting Bitcoin and removing some of the bad incentives behind the monetary systems wouldn’t solve everything. Is the utopian picture I have painted likely? Probably not… However, I hope this post has given you more food for thought and to engage with this revolutionary technology. I still have a hard time thinking through how Bitcoin can fail. It’s so decentralised with so no single points of failure, that I expect it to be very difficult for governments to enforce a ban.

If you strongly disagree with the statements in this post, please do let me know. I would perhaps offer a bold prediction to allow time to be the adjudicator. As of now in August 2022, western world is facing inflation levels not seen since 1980s, and currently we are in a recession with central banks hiking interest rates to combat inflation. If this continues, the western governments will default under their tremendous debt liabilities. I believe the people in power will continue to kick the can down the road, which means sometime in the next year or two, the central banks will have to reverse rate hikes and run quantitative easing once again. Inflation will get worse, house prices, risk stocks will soar, and Bitcoin will soar more than all of them. Every cycle, Bitcoin establishes trust while central banks lose more and more trust, causing more and more people to opt out of the system.

Further Reading

“Check your financial privilege” by Alex Gladstein

Nice! I was wondering when someone was going to make the full Bitcoin pitch to the EA community. I was on the verge of publishing a very similar essay, but it looks like you beat me to it :)

To the author: please feel free to send me a message! It’s always good to meet others who understand this issue.

In my conversations with EAs, the usual next question is “but what about Ethereum/Dogecoin/NFTs etc.?” I started typing out my thoughts on that here, but it became long enough that I decided to make it into a separate post.

The objections you go through in the post seem a bit weak to me. When I think about whether crypto is good for the world, apart from the speculative bubble objection, the main concern I think of is “Isn’t crypto a scammer’s paradise and isn’t it going to stay that way given that ‘decentralization’ is much uglier in practice than the naive rosy view would have you think?”

We’ve just seen a bunch of crypto entities blow up and hurt people badly who thought (and were promised that) their funds were safe. The highest-volume stablecoin (tether) still looks like a massive fraud and yet many of the biggest crypto exchanges keep dealing with it.

I know that some people in crypto would welcome better regulation, but is that going to work in practice and don’t you lose part of the appeal of it when governments have to get heavily involved after all?

I’d like to see more engagement with these sorts of questions.

(Another point I’m unconvinced about is “Why bitcoin?” as opposed to other coins. Bitcoin has some supremely annoying exponents. Smart contracts seem like an interesting invention with use cases. Wouldn’t the fact that something has a lot of use cases arguably make it safer as a store of value? (I mean, I bought mostly bitcoin at first but by now most of my crypto is ethereum because I can gamble with NFTs and that’s more fun.))

What are the main benefits of fiat that Bitcoin doesn’t have?

Doesn’t fiat allow governments to raise money more easily, by increasing the money supply and possibly easier taxation, to pay for important programs, including health care, education, research (and other public goods) and for emergencies (like COVID)?

Hi Michael, thanks for your comment. I am the original author of this post.

Yes I agree, you can argue that fiat allows governments to monetize their debt much more easily and spend more freely. I have two responses to that:

As Alex Gladstein (CSO of the human rights foundation) argues in this essay, fiat currencies have also allowed governments to finance wars in a much more opaque way. In other words, fiat currencies remove the checks and balances on government spending. This was, in fact, the main reason we removed the gold standard to finance the first world war and even though we re-pegged, we again had to depeg in 1971 in large part due to excessive spending during Vietnam war.

Increasing the money supply can be thought of as a regressive tax, because it ultimately leads to inflation which hurts the poor more than the rich. I’m not advocating for anarchism, and agree that healthcare education research are all important, but if we want to finance those things, we should do it via progressive taxation.

I think the government would still be able to tax bitcoin, via corporate income taxes, VAT etc, but their spending would be much more limited to what the people democratically approve of—think of how unpopular war bonds used to be and how we have replaced them entirely with “credit card wars”.

I think there are some great essays that could be written to make the case for why a transformed monetary policy (like NGDPLT) or transformed financial system (ie, using crypto) might be much better for creating a fairer, more stable and prosperous economy. And this might be important enough that supporting some aspect of the transition to this fairer/better world should be considered an EA cause. But sadly I think this essay does not live up to the potential, and makes the case poorly.

Hi Jackson, thanks for your comments. I agree, that I could definitely have made a better case in this post, however I had to cobble it together in half a day before the submission deadline. I’d be interested to learn more about the NGDPLT you speak of as I’m quite unfamiliar with it.

In terms of crypto, I intend to make a case for why Bitcoin is different from the rest of “crypto”. and I’m in general very skeptical of the promise of wider crypto.

I definitely appreciate the value of getting something out there and not letting ideas languish as unpublished drafts!

Responding about NGDPLT, this is “nominal GDP level targeting”—a proposed framework for the federal reserve to make better decisions about when to raise & lower interest rates, print money, or etc. Its biggest proponents are probably libertarian-leaning economists at George Mason University and the Mercatus Center (I generally like these folks). Here is a three-page summary of the idea, that the fed should stop targeting “inflation” (a rate of increase) and instead target a certain overall nominal GDP each year (a level rather than a rate): https://www.mercatus.org/system/files/Sumner-NGDP-Targeting-sum-v1.pdf

The main upsides here are:

the new system might perform better at avoiding inflation and recession.

the new system would be more objective and algorithmic, basically driven by prediction markets—we’d be putting control of the economy more on autopilot in a way that would be more trustworthy, predictable, and fast-acting in a crisis, compared to the current system of “whatever jay powell feels like, within some reasonable range of debate and political framing”. Although of course NGDP level targeting would not go as far as some crypto ideas of completely algorithmic monetary policy.

My impression is that cryptocurrencies face some major challenges in achieving some of the basic functions of money. For example, check out Bitcoin – The Promise and Limits of Private Innovation in Monetary and Payment Systems by Beer and Weber. They argue (persuasively in my opinion) that traditional currencies have three functions that cryptocurrencies would have significant challenges in achieving, replicating, or challenging:

unit of account

means of payment

store of value

Based on the Beer and Weber paper, here’s my brief expansion of these problems as they relate to Bitcoin:

Having prices in one currency is more efficient than having them in many. Thus, having just one currency (e.g., a national currency) is more efficient than having multiple. Also, having just one currency facilitates trade. Bitcoin in particular struggles to achieve this because a) it introduces a separate unit of account, b) is has no single and identified issuer, and c) its quantity is fixed.

If prices in the cryptocurrency change dramatically and unpredictably compared to standard currencies, then measuring prices in the cryptocurrency don’t make sense. It’s hard to imagine this asymmetry being overcome entirely unless a single cryptocurrency became so widespread and dominant that it achieved more stability than reserve currencies.

Since there is no institution guaranteeing that the currency will be a reliable store of value, the currency is not a reliable store of value. Bitcoin in particular is a speculative asset.

See also the Impossible Trinity in international political economy to get a sense of yet another problem that cryptocurrencies do not yet have a solution for.

I have not yet seen solutions to these problems and there appear to be good reasons to believe that a system similar to Bitcoin cannot solve them. Future cryptocurrencies may put a serious dent in these problems, but I remain skeptical of their near-term (within a few decades) potential to “fix money”.

Hi Ben, thanks so much for your comment! I do appreciate your good faith engagement. Here I’ll respond to a few of your points, and hope that it can be a good starting point for deeper discussion.

I do think that the paper you cite makes good arguments, particularly for the scalability of bitcoin for payments. But I think you would find that the criticisms are outdated now. If you haven’t yet, I would encourage you to learn about the “lighting network” which is a second layer peer to peer payment channel network built on top of bitcoin. You will find that the network can settle hundreds of millions of transactions per second at instant finality settlement with fees of less than a penny. It is also what the El salvador circular economy is building upon. The exciting aspect of this is that you can achieve high amounts of velocity of money, without credit creation.

This is true. Now think about the world adopting a single currency. It would remove so much friction that currently exists due to foreign exchange. This currency would necessarily have to be politically neutral, inclusive, permissionless and censorship resistant ;)

Actually completely agree with this point. Bitcoin is still extremely early in its adoption phase, but the fundamental adoption is growing as fast as the internet, in its early days. Any new emerging monetary asset would necessarily have massive volatility on its path to reaching full adoption. I don’t think this disqualifies bitcoin just yet.

Here I disagree, the value of something is not dictated by whether an institution says it has value. As demonstrated by the gold standard, when we went off the gold peg, many people said that gold only had value because dollars have value and they can be used to redeem gold. This was so wrong that the dollar devalued 10% against gold pretty much directly after the de-pegging. The inverse is also true, no matter how much value the Venezuelan government promises the bolivar to have, they cannot wish value upon the hyperinflating currency. The lesson here is ultimately the value of the currency is based upon trust. And since Bitcoin can verifiably maintain it’s fixed supply, whilst fiat currencies are mathematically guaranteed to debase due to the debt obligations of the government, a lot of people are starting to place their trust in bitcoin more than fiat. Admittedly this is a small but growing number still.

I’ll leave with these thoughts for now. But happy to engage further

I appreciate the genuine engagement!

To preface these comments, I actually do some professional work on crypto economics and I think that almost no one appreciates just how high the bar is for crypto to truly challenge traditional currencies. So my comments below should be taken in the context that I’d love to see a world where crypto can play a role in opening up particular kinds of economic opportunity that currently aren’t really possible, and I’m actively trying to build such a world—but I think there’s a very long way to go!

----

L2 networks and such will certainly improve over prior crypto systems. I do still see a challenge of doing a “trustless” crypto exchange (i.e., massively non-centralized) without it being relatively costly/slow compared to a credible centralized system. But I don’t see this as a major factor either way.

See the impossible trinity for a sense of why this is unlikely to happen. Domestic policy autonomy is reeeeeealy important to countries. And crypto is not going to straight-up beat all the countries. States have too many advantages, so this isn’t even a contest.

This is only for speculative assets. Note that credible centralized institutions issue value-stable things all the time (currencies, bonds, coupons, reward cards, etc.). This is a major problem for the crypto world, but trustworthy centralized institutions can (and do) regularly do this.

I’d add that no credible stablecoin plan exists. National currencies can easily handle an economic downturn, even a prolonged one. All existing stablecoin plans will simply collapse if a sustained downturn is expected. (I’d love to see a plan that doesn’t fail in this way if one exists!)

I think you may be confused about the potential lessons offered by the de-pegging of gold. The de-pegging was caused by a political (and economic) need for an expansionary monetary system, but the supply of gold could not increase. This meant that the relative value of dollars vs gold was decreasing, so it became insane to keep the peg, since those who hold dollars (like foreign governments) could just get all the gold. (And this was happening before the depegging.) So when the peg is released, of course the dollar devalues! That was the point of the de-pegging. That was the direction of the pressure that caused the de-pegging in the first place. This isn’t evidence that gold is somehow more “valuable” because it isn’t being used as much as a currency. It’s a correction that happened because gold wasn’t fit for purpose as a global currency.

The Venezuelan example is a straw man. Instead, I challenge you to convince me of why I should trust the stable true-real-world-value of any crypto token that currently exists anywhere near as much as I trust the USD, Euro, Yen, GBP, or CAD (to name just a few).

The currency’s value is based on trust but also because institutional commitments and designs can be more or less trustworthy. Independent central banks in the West are pretty trustworthy. Their design, political independence, and history of action are pretty impressive. This is an extremely high bar to beat. I think most pro-crypto people don’t realize just how high this bar is.

Bitcoin’s fixed supply doesn’t address the speculation problem I raised. In fact, it is the cause of it. With limited supply and no way to control inflation/deflation, bitcoin will absolutely cycle up and down in value in a purely speculative way. It isn’t even as anchored in value as gold; you can’t use bitcoins to make jewelry or electronics for example. Bitcoin is not a reliable store of value for precisely this reason. If I put X euro into USD and X euro into bitcoin, which one do you think will be closer in value to what I put in when I check back in on it a few years later (or even seconds later)? This is what being a “reliable store of value” means. Traditional currencies are better at this than bitcoin and stablecoins.