The Powerball Lottery Is Now Positive Expected Value for Many Charitable Americans

Disclaimer: I’m not a lawyer or accountant. Check my work and your own situation before spending money on lottery tickets. I think the calculations are correct. Cross-posted from my Substack.

The Powerball is a lottery that exists in almost all American states. On Monday, November 7, the jackpot is worth $1.9 billion dollars. That figure refers to the prize you would receive if you chose to receive an annuity payment from the lottery. The lottery also lets you claim a lesser lump sum amount instead, which you get upfront. Most experts think this is the right move. On November 7, the lump sum is $929 million. (That figure can change if there are more or fewer tickets sold than expected.)

Gambling is rarely a good move. But for people who would like to give a large share of their gambling winnings to charity, playing this Powerball makes sense because of the tax deduction that you can receive by donating to charity.

The Charitable Tax Deduction, the Income Tax, and the Lottery

The federal government and many state governments require Americans to pay a tax based on the income they receive during the year. Some unusual types of income- capital gains, inheritance income- are sometimes taxed at different rates.

Because the lottery does not pay back all of the money it receives in ticket sales and because winners have to pay taxes on lottery winnings, playing the lottery normally has negative expected value, financially.

The federal government and I believe all states allow you to donate a certain share of your income in a year and not pay income taxes on the donated money, provided you donate to tax-deductible charities. For 2022, you can donate up to 60% of your income in cash and receive a tax deduction! If you give more than 60% of your income in cash, you can carry over those deductions for the next five years. This means you can avoid federal income tax on the majority jackpot prize and the entirety of some of the smaller prizes. (Most states have similar rules.)

If you value a dollar given to a charity of your choice, as much as you value a dollar you keep for yourself from lottery winnings, you might want to buy a Powerball ticket for tomorrow. This is especially true for people who:

Are high-income.

Live in states with low or no income tax.

Would buy many tickets, reducing transaction costs per ticket.

Powerball Prizes

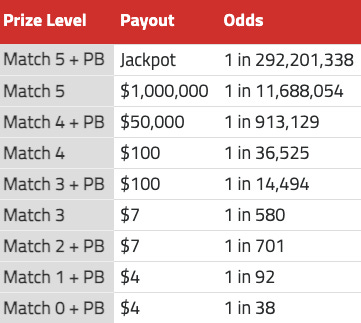

The Powerball offers a variety of prizes. The jackpot is divided between all players with the right numbers on their ticket. When no one wins, the money carries over to the next lottery. The other prizes are awarded to every ticket that has the specified number of matching numbers. Powerball.net helpfully breaks down the odds.

If you have a middle-class income and are not currently exhausting your charitable tax-deduction, you should be able to donate the entire value of all prizes up to $50,000 with no federal income tax implications.

If you multiply these prizes by the probability of receiving them and sum them, you get a figure of approximately $0.0235. The price of a Powerball ticket is $2 so you’re in the hole. Adding in the $1 million prize helps. If you donate $600,000 of the $1 million prize and you’re a high-earner you might have to pay 37% income tax on the remaining $400k. That means the $1 million prize is worth $852K to you. Weighting that prize by its odds and adding it to the other prizes, that lottery ticket is now worth $0.308.

The value of the jackpot prize depends on how many people you expect to share it with.

How Many Other Players and Winners?

If you have a winning ticket, how many other people are you probably splitting the jackpot with? That depends on how many other people played that Powerball draw. Lottoreport.com provides the number of Powerball tickets purchased per draw. Generally, more tickets are sold when the jackpot is higher. Powerball drawings occur on Monday, Wednesday, and Saturday. Monday draws have lower sales- perhaps because there are only two days from the previous draw and people don’t like to gamble on Sunday.

Monday had average sales of 13.3 million tickets.

Wednesday had average sales of 18.2 million tickets.

Saturday had average sales of 25.6 million tickets.

That tomorrow is a Monday is really good for the value of playing the Powerball.

To estimate the number of expected tickets sold for tomorrow’s drawing I ran a linear regression of tickets sold with two independent variables: day of draw and advertised jackpot. The model predicts 220 million tickets to be sold. If you have a winning ticket how many winning tickets should you expect there to be in the other 220 million tickets told? I used an online binomial probability calculator for these probabilities.

There is a 47% chance there will be zero other winning tickets.

There is a 35% chance there will be one other winning ticket.

There is a 13% chance there will be two other winning tickets

There is a 3% chance there will be three other winning tickets

There is a 0.6% chance there will be four other winning tickets.

The other outcomes have negligible probabilities, so I ignore them. Assuming you donate 60% of the jackpot, pay 37% tax on the rest of the jackpot, you get 85.2% of the value of the jackpot. With a lump sum of $929 million and potentially having to share it with others, the expected value that comes from the chance to win a jackpot per lottery ticket is $552 million divided by 292 million or $1.89. Of course there is also the expected value of approximately $0.31 from non jackpot prizes.

The expected value of a ticket for people who live in states without income taxes and max out their charitable contribution deductions is $2.20. The cost of a ticket is $2. it looks like buying a Powerball ticket offers a 10% return if you don’t have to deal with state income tax.

Should You Buy A Ticket?

Whether you individually buy a ticket is up to you. The expected gain per ticket even under fortunate circumstances is only $0.20. You’d have to risk a ton of money to gain enough in expected value terms to offset the costs of time of purchasing tickets, checking tickets, and in states where you can only use cash for lottery tickets, going to the ATM.

You might on principle refuse to gamble or refuse to gamble due to risks of gambling addiction.

If you do gamble and and are charitable, buying a Powerball ticket sounds like a good deal. Before making a decision, check out your own tax situation and the calculations here.

Notes

I am assuming players are not paying extra for “Powerplay” tickets. I haven’t done the math but I’m fairly confident they’re a bad idea.

I used the expected jackpot figure rather than the actual jackpot figure, because I assumed the posted figure was what motivated sales.

The 220 million figure seems reasonable. The model is simple and eyeballing the recent trends, the Monday sales are often lower than the Saturday sales even as the jackpot rises.

I used R for linear regression.

I looked into this briefly too. Two other costs to consider:

1. Sales taxes. Not all states have sales taxes, but most do. Exceptions include: Delaware, Montana, New Hampshire, Oregon. Notably all states have either income taxes or sales taxes, so your best bet is coming from a state (residency) in a state with no income tax and buying your tickets in a state with no sales taxes.[EDIT: This is wrong, see following comments]2. Normal donations are tax deductible (up to 60% of income). When I was first modeling this (and I think you did the same thing), I was including the tax deductibility of lottery winnings, but not the tax deductibility of the counterfactual use of money (which might be direct donations). Obviously this changes the numbers significantly.

So my best guess is that at current jackpot sizes, it only makes sense to do if you can

a) avoid sales tax, b) come from a state with either no income tax or low income tax, and c) already maxxed out your donations deductions (60%).However, if nobody wins the current jackpot, I can imagine at some point very soon things become more +EV even with significant disadvantages outlined above.

Sales tax: Interesting. I live in a state with sales tax but it doesn’t apply to lottery tickets.

Could also make sense for people who don’t itemize so don’t benefit from charitable deduction but would itemize if they won the larger prizes.

Lottery tickets are generally not subject to sales tax, I’m pretty sure.

This seems like a bit of a Pascal’s mugging, unless you are planning on buying a LOT of tickets (and in that case, it would probably be -EV as others would likely be doing the same, so it will be more likely you’ll be sharing the prize).

Interested in arguments as to where I’m going wrong here (re the -ve agreement karma). Why isn’t this basically just throwing away money? What other +EV things should we be doing that have ~million:1 chances of success?

I didn’t downvote you. I think you’re using Pascal’s Mugging idiosyncratically.

Pascal’s Mugging is normally for infinitesimal odds and astronomical payouts, with both odds and payouts often being really uncertain.

Here odds and payout are well-defined. The odds while extreme aren’t infinitesimal.

I think we should be doing lots of things with one in a million chances. Start-ups that could change the world, promising AI research paths, running for president or prime minister. :)

I say “seems like a bit of a”; I get that it’s not literally infinitesimal odds (or an astronomical payout[1]), but it’s small enough that it’s similarly not worth going for imo.

I don’t think any of these are one-in-a-million chances for most people, let alone most EAs, and if anyone goes into them thinking they are, they should be doing something else! Hundred-to-one or even thousand-to-one shots are reasonable for EAs to be making I think, but not million-to-one (or worse). This is especially true given the current size of the community (it would make more sense going for million-to-one opportunities if there were of the order of a million other EAs going for them).

And the odds are certain, and the payout more certain than with most Pascal’s Muggings, but still not certain, as it depends on the number of other potential winners

I think personally preventing extinction for most individuals working to do so, or having an impact on how many animals are farmed through your own diet alone have similar or lower probabilities of success.

Maybe “small” donations to some of the large animal welfare charities, too.

Maybe it’s millions-to-one if you take the end goal (e.g. x-safety or abolition of factory farming), but most people are aiming at accomplishing things in smaller increments, that overall build up to the ultimate success. This action of buying lottery tickets is not cumulative in the same way. It’s 0 or 1 (and overwhelmingly likely to be 0). Donating what would be spent on tickets to EA charities (or otherwise enabling direct work) seems better.

I think buying many lottery tickets is similar to many people working on x-risks, but if you’re passing your donations/grants through a lottery first, you might significantly decrease the probability of making any difference with that money. In some cases, you might not, if you can almost guarantee an impact with the extra money. I could imagine it not changing the probability that the money helps farmed animals too much if the alternative was donating directly to a big animal charity.

OTOH, people should worry about decreasing marginal returns with the money.

The choice is:

a) Donate $2000 to an EA charity of your choice.

b) Spend $2000 on lottery tickets with a 99.9% chance of losing[1], but an expected value of, at best, ~$2200.

Who is choosing b?

This is only factoring in the ≥$50k prizes, but I don’t think it changes the argument that much factoring in the lower prizes.

If EA charities and causes have decreasing marginal returns to additional funding, is this still worth it? This is a 10% increase in funding in expectation, driven by low probability tails of millions of dollars that might be much less cost-effective on the margin, unless you can buy enough tickets, I guess. And if you do buy tons of tickets, does your EV per ticket get worse the more tickets you buy? How much worse?

If this is worth it to do, wouldn’t it be best for a singular large donor to buy, say, $1M+ of tickets, instead of lots of random individuals buying small numbers of tickets?

Transaction costs negate positive expected value

Even at scale, the transaction costs would probably negate the positive expected value. Given tickets have to be bought in cash, you would need to get a load of cash out, give it to a load of people, and pay them not very much to buy tickets for you (thus risking they will run off with the cash). I can’t really see how it would take <1 min of person-time per ticket, given the need to also check them, especially if you are picking the numbers manually rather than taking a random draw (e.g. to maximise the chances of not having to share winnings via avoiding common numbers like dates). At +$0.20 per ticket, that is $12/hr!

It’s instructive to look at the limit of buying all the tickets to guarantee winning the jackpot. This has been attempted a couple of times before in other lotteries, with some success. In the Irish lottery in 1992, a syndicate organised by a previous lottery winner, Stefan Klincewicz, managed to buy 80% of the tickets and made a £310k profit on £1.16M of winnings, before expenses. They had people running all over Ireland buying tickets frantically as the Lottery was closing down machines (because it was aware of their plot). It’s unlikely that they made much money at all after paying all these people for their time, and other logistical expenses. And given they only managed to buy 80% of the tickets, the expected value was likely actually negative!

Even if the jackpot grows further and the EV becomes more positive, I imagine this very fact of higher +EV would lead to more people trying such schemes and actually lower the EV (by increasing the chances of a shared jackpot). Maybe this is already happening given the draw being delayed? I don’t think this is a good idea any way you look at it.

I noticed this before seeing this post and actually bought a ticket. I didn’t win. I bought a MA powerball ticket, but it seems this also counts for the national powerball too (?). In any case, now I can say I’ve experienced buying a lottery ticket. It was very underwhelming!

[I didn’t calculate out the likelihood of multiple winners, but yeah, if you factor that in and the tax involved plus time discounting, its almost striking even.]