Climate-contingent Finance, and A Generalized Mechanism for X-Risk Reduction Financing

Summary

Climate adaptation (reducing vulnerability to future climate change) could yield significant benefits. However, the uncertainty of which future climate scenarios will occur decreases the feasibility of proactively adapting. Fortunately, climate adaptation projects could be underwritten by benefits paid for in the climate scenarios that each adaptation project is designed to address because other entities would like to hedge the financial risk of those scenarios.

For instance, many infrastructure projects can be built to withstand extreme climate change through upfront spending. The climate adaptation expenditures generate more climate resilience benefits under more extreme climates. Because the return on investment of many adaptation actions is a function of the level of climate change, it is optimal for the adapting entity to finance adaptation with repayment that is also a function of the climate. It is also optimal for entities with more financial downside under a more extreme climate to serve as an investing counter-party because they can obtain higher than market rates of return when they need it most.

In this way, communities, cities, and states proactively adapting would reduce the risk they over-prepare, while their investors would reduce the risk they under-prepare. This is superior to typical insurance because by investing in climate-contingent mechanisms, investors are not merely financially hedging but also outright preventing physical damage, and therefore creating economic value. Both sides of the positive-sum relationship — physical and financial hedgers — are made better off. This coordinates capital through time and place according to parties’ risk reduction capabilities and financial profiles, while also providing a diversifying investment return to investors.

Governments, asset owners, and companies reduce uncertainty in components of the economy (e.g., commodities prices, credit risks, and interest rates) through trillions of dollars of derivatives positions and insurance contracts – we propose a solution to provide a similar capability in the climate context. Municipalities raise trillions of dollars of debt for infrastructure – we propose a solution to provide that type of investment flow for financing climate-aware real asset projects.

Climate-contingent finance is a fresh approach to addressing catastrophic risk, building a bridge between long-term funding needs and financial risk management. It can be generalized to any situation where multiple entities share exposure to a risk where they lack direct control over whether it occurs (e.g., climate change, or a natural pandemic), and one type of entity can take proactive actions to benefit from addressing the effects of the risk if it occurs (e.g., through innovating on crops that would do well under extreme climate change or vaccination technology that could address particular viruses) with funding from another type of entity that seeks a targeted financial return to ameliorate the downside if the risk unfolds. This approach can finance previously under-funded efforts to address risks to humanity’s long-term flourishing, including extreme climate change, large asteroids hitting the earth, and super-volcanic eruptions.

An article describing this mechanism in detail, including a significant amount of computational simulation to explore different implementations, was just published by Berkeley Business Law Journal. This post is primarily excerpts from that Article.

Problem

“[Climate uncertainty] was marginal during previous centuries and, therefore, was often neglected in decision-making. Now, uncertainty in future climate change is so large that it makes many traditional approaches to designing infrastructure and other long-lived investments inadequate.”[1]

Climate change depends on many political, social, and environmental factors.[2] A sharp reduction in greenhouse gases would be ideal; however, the development of the political, social, and technological solutions necessary remains uncertain.[3] For many scientific problems, uncertainty decreases with time. However, because of the positive feedback effects inherent in climate and sociopolitical systems,[4] uncertainty in the sensitivity of the climate to the level of emissions may increase over time. Uncertainty in the impact of carbon emissions on global temperature change has increased between the last release of the widely trusted global climate model ensemble and the release currently underway.[5] Fully accounting for the uncertainty in climate change significantly increases the costs of climate change and the expected benefits of adaptation.[6]

Figure 1 compares projections from the U.S. National Oceanic and Atmospheric Administration (NOAA) of the number of days per year of significant flooding under low (left) and extreme (right) climate scenarios for 99 coastal U.S. cities.

Figure 1: Yearly projections of days per year that exceed a significant flooding threshold, under low climate scenario (left) and extreme climate scenario (right) for 99 U.S. coastal cities. Each location is a separate line in each chart.[7]

In Figure 2, we focus on one city, New York, to visualize the difference between climate assumptions over varying time periods. The long tail in the changes in the extreme scenario for NYC is even longer when we move from a five-year to a ten-year horizon. Within some ten-year periods, projected increases of the number of days per year of significant flooding range from zero to more than 150, from nothing to catastrophic.[8]

Figure 2: NOAA projections of days per year that exceed a significant flooding threshold for lower Manhattan in NYC from 2020-2100 transformed into change over n-years, where n is 5 or 10, for the low climate scenario (orange bars) and extreme climate scenario (blue bars). The extreme climate scenario has a fat right tail in its distribution. The ten-year forecasts (right chart) have a much more extreme right tail (note the x-axis range) than the five-year forecasts (left chart).[9]

Gavin Schmidt, one of the world’s top climate scientists, said,

“Do we have enough information to know that sea level is rising? Yes. Do we have enough information to tell people whether to build a 1-meter wall or a 2-meter wall? The answer is no.”[10]

Figure 3 supports his assertion, illustrating sea-level rise uncertainty across a wide range of possible climate scenarios.

Figure 3: NOAA projections of sea level change.[11]

Due to human-caused climate change, uncertainty in the future climate is higher than it was when the processes for designing and financing infrastructure were developed. A recent $14 billion upgrade to New Orleans’ flood infrastructure now looks like it could be inadequate in just four years because the designs underestimated sea-level rise.[12] Going forward, is the new design going to be an over- or under-estimate?[13] Extreme but scientifically plausible climate scenarios would be devastating if not proactively addressed. However, the high uncertainty over whether an extreme scenario will materialize — and therefore the potential to undertake an overprotective project — can raise the cost of capital to prohibitive levels, or, more specifically, reduce the willingness to raise capital when the cost of that capital is not tied to the climate outcomes.[14] Louisiana’s Coastal Protection and Restoration Authority developed a $50 billion plan to safeguard coastal populations, and only about $10 billion has been identified to support the plan.[15]

As a report from the Hoover Institution at Stanford University puts it:

“[Climate] uncertainty is new and distinct from risks that engineers routinely consider. It creates challenges for infrastructure planners and engineers unaccustomed to managing such ambiguities. There is a risk of over- or underbuilding, which can, in turn, transfer risks to infrastructure investors.”[16]

Most existing infrastructure is likely under-built, and some may be over-built, given the difficulty of making climate projections and embedding them into design processes.[17]

Goldman Sachs Global Markets Institute believes that:

[A]daptation could drive one of the largest infrastructure build-outs in history . . . Given the scale of the task, urban adaptation will likely need to draw on innovative sources of financing. . . . Cities won’t want to over-commit to specific climate scenarios. . . . Taking an investment approach might suggest that it makes sense instead to “wait and see,” allowing time for new information to emerge before making any major investments. While this approach makes sense in many contexts, the case of climate change appears to be different. The most significant effects of climate change are likely to be the result of “tail events,” which are inherently unpredictable in both their timing and their severity. Waiting won’t necessarily generate more information about these idiosyncratic events. Waiting may instead mean that cities run out of time to prevent severe damages.”[18]

An attractive approach to handling this uncertainty is to take adaptation actions that are designed to have payoffs (by preventing harms) that are as similar as possible across as many plausible climate outcomes as possible, so called “no-regrets” adaptation actions (e.g., building extreme weather early-warning systems). No-regrets actions should be pursued and can likely be financed by traditional mechanisms.[19]

Figure 4: Climate-aware financial analysis of an infrastructure project.

However, truly no-regrets actions that significantly reduce physical risk are becoming rarer as more extreme scenarios are increasingly considered plausible. Some adaptation actions have to be designed and built, conditional on climate change scenarios. Yet it is difficult to design an action that would have similar payoffs across all plausible outcomes. An analysis of adaptation in the United States, the Philippines, and Britain concluded that, for the study areas, none of the flood protection projects had positive expected value for current climate conditions or a low climate change scenario, but all the strategies were economically attractive in the high climate change scenario.[20]

Few adaptation actions will deliver homogeneous benefits across climate scenarios.[21] Therefore, climate uncertainty translates into uncertainty in the benefits delivered by many adaptation actions. This is the core of the financing dilemma.

Furthermore, adapting to future climate scenarios is not just an issue for infrastructure designed explicitly for reducing climate risks. It is a general problem for nearly all existing and future real assets.

According to Morgan Stanley, “climate resilience is fast becoming an investment imperative in real assets.”[22]

Owners of real assets (infrastructure, buildings, and land) have long investment holding periods (often decades)[23] and high exposure to climate change impacts. However, they currently have no means to hedge this long-term climate uncertainty.[24] Hannah Nissan et al. point out the incongruity in how climate uncertainty is treated compared to other complex systems:

Foresight about future exchange rates, oil prices, geopolitical disruptions, or epidemics of new diseases would be invaluable, but there is little expectation that such things can accurately be forecast beyond the short term. Despite high confidence in many aspects of present and future climate change, localized projections are highly unreliable. Where then does the unrealistic expectation come from that the future climate, among the most complex of known systems, should be predictable to the degree of precision often demanded?[25]

Long-term financial entities owning real assets will be forced into one of two groups: Adapters (“A”), proactively adapting; or Backers (“B”), absorbing impacts.[26] Both groups face obstacles that could be addressed by collaborating through a financial mechanism. Some entities are better positioned to move into Group A and reduce their physical risk now; while others will determine that reducing their financial risk without immediately reducing their physical risk is more feasible, and move into Group B for the time being.[27]

Currently, most B entities are unable to effectively hedge the risk of climate outcomes. Municipal bonds have long-term climate risk. Given that there is no way to cleanly hedge municipal bond credit risk (the primary risk to these securities),[28] there is even less opportunity to cleanly hedge municipal bond climate risk. The vast majority of insurance is on a one-year time horizon, which is not helpful for locking in certainty of a hedge on a time scale relevant to climate change, because every year insurance providers can increase rates or stop providing insurance altogether.[29] Furthermore, insurance does not reduce risk in the aggregate. As a “risk transfer” mechanism, it merely shifts risk from one party to another.[30] If we physically reduce risk and prevent damages, we can generate more overall value and, in effect, share that value between parties. Therefore, a standard parametric insurance payout would likely provide a lower expected return than a triggered climate contract and serve as a less effective hedge.[31]

Solution

Party A proactively adapts, making physical changes that explicitly take climate change scenarios into consideration, funded by B[32] hedging financial risk of climate-induced losses (Figure 5).[33] B provides upfront capital to A, who uses the proceeds for adaptation that will substantially reduce losses in more extreme climate scenarios. Under less extreme scenarios, the adaptation may be overprotective. A climate-related financial product of this nature was first proposed by Daniel Bloch and co-authors as a “climate default swap.”[34]

Figure 5: Climate contract lifecycle.

If the effects of climate change are worse than expected, A pays B back with a higher-than-market rate of return on the principal.[35] Reducing risk of property and human health damages is likely to reduce losses (or even increase benefits) in more extreme climate change scenarios.[36] In addition to averting damage, adaptation measures reduce A’s cost of capital for general operations by increasing their creditworthiness: according to BlackRock research, “bonds issued by climate-resilient states and cities are likely to trade at a premium to those of vulnerable ones over time.”[37] A is insuring against risk of ruin by building adaptation projects and only paying for that “insurance” in scenarios where those projects are most needed. The financing allows A to take steps to realize the benefits of adaptation and hedge against overprotecting while doing so.[38]

Benefits of climate adaptation for a municipality include reduced insurance premiums,[39] reduced future uninsured direct damages to property and infrastructure assets, reduced future costs for rebuilding,[40] reduced potential litigation costs,[41] reduced cost of capital for borrowing,[42] maintained attractiveness of the area for outside investment and in-migration, maintained property tax, sales tax, and tourism tax revenues,[43] avoided tail-risk scenarios of collapsing property values and business activity that could lead to a downward spiral and complete abandonment, and increased revenue for natural adaptation solutions from selling carbon credits.[44]

Meanwhile, B is better off because its returns through its hedge are greater than returns from other investments in a more extreme climate outcome state of the world.[45] We explore values of the repayment rates in the simulation experiments in the longer-form paper.[46] The rate of return required by B may be relatively low because the investment pays off specifically in states of the world with high marginal utility; in more extreme climate scenarios, a dollar is worth more than in less extreme climate scenarios.[47] Investing allows B to hedge against physical under-preparedness in a way that’s directly linked to their climate exposures. B parties that are taking a “wait-and-see” approach to climate adaptation through participation in this investment can gain information on adaptation project outcomes — and generate capital in the triggered scenarios — to implement their own (less proactive) adaptation projects in the future.

If the effects of climate change are less severe than expected, A is no worse off than they would have been otherwise, and probably better off. First, they may have over-prepared (at least within the timeline of the repayment, potentially not later), but they paid less for it than a traditional bond repayment. Second, they are more prepared for a future increase in climate change that may still occur over a longer time period beyond the end of the repayment. Third, there are sometimes resilience “co-benefits” that the adaptation projects serve. B was repaid less than they would have been with a traditional debt investment, but their climate risk was hedged enough during the ensuing period that they were able to continue operating and borrowing at lower rates.

A Generalized X-Risk Reduction Financing Mechanism

This post focuses on climate change, but we believe the generalized structure of this risk-contingent financing mechanism applies to any situation where multiple entities share exposure to a risk out of their direct control,[48] R, and one type of entity, A, can take proactive actions to benefit from (either through avoided losses or through absolute gains) addressing R if it occurs with funding from another type of entity, B, that seeks a targeted financial return to ameliorate the downside if R unfolds.

Examples of risks, R, that are appropriate for this type of financing include extreme climate change, natural pandemics, and large asteroids hitting the earth. Examples of proactive actions to benefit from addressing systemic risks include innovating on crops that would do well under extreme climate change, vaccination technologies that would address particular viruses, and mechanisms that deflect large asteroids from earth impact. The actions to mitigate R yield a payoff P if R occurs (through avoided losses or through absolute gains).

Figure 6a: Generalized risk-contingent financing structure.

Insurance does not reduce risk, when measured in the aggregate; insurance shifts risk from one party to another.[49] If, instead, we physically reduce risk and prevent damages, we generate more overall value, which can be shared between parties. Therefore, a parametric insurance payout provides a lower expected return than a triggered contingent contract and serves as a less effective hedge.[50] The key is recognizing the payoffs that proactive risk reduction would have under the negative states of the world, and then, in effect, “securitizing” those payoffs to raise capital to fund the risk reduction.

Another important downside to traditional insurance is that it works by diversifying lowly correlated risks. If a source of risk is systemic, affecting most parties and therefore creating set of highly correlated risks, then it cannot be diversified away. To address systemic risk, it would need to be proactively reduced.

Figure 6b: Comparison of risk-contingent financing to traditional insurance.

A makes changes that explicitly aim to reduce risk, funded by B[51] hedging financial risk. B provides upfront capital to A, who uses the proceeds to reduce their losses in more extreme negative scenarios (Figure 7). In the climate example, A might be building a tall seawall designed for extreme climate change, for instance. Under less extreme scenarios, the actions taken may be overprotective.

Figure 7: The generalized structure of the risk-contingent financing mechanism, which applies to any situation where multiple entities share exposure to an underlying systemic risk, and one type of entity, A, can take proactive actions to benefit from (either through avoided losses or through absolute gains) addressing that negative risk (if it occurs) with funding from another type of entity, B, that seeks a targeted financial return to ameliorate the downside (if it occurs).

The risk-contingent financing mechanism provides capital from B to A at issuance in return for the obligation that A pay back principal and a return if the negative scenario, or one more extreme, is realized before expiration of the contract, i.e., if R occurs in the specified time range. The amount B pays A initially (Principal), the amount that A would pay back B if triggered (Return), the Scenario beyond which triggers the payback, and the length of the Term within which the trigger must be passed to cause payout are all specified when the contract is initially sold.

Contract specifications at the time of initialization:

Principal (e.g., $15 million)

Return (e.g., 150%)

Scenario (e.g., sea-level 1.5 inches above baseline for more than 1 year)

Term (e.g., 15 years)

Contract participants:

A (e.g., an airport building a seawall)

B (e.g., a set of banks and insurance companies)

This general construct of a risk-contingent financial “contract” can be used to create single-trigger swap financial products at one time horizon (what we have described thus far), or debt-like products that have variable periodic interest rates contingent on the Scenario at multiple time horizons. The latter can be created by simply composing a multi-period repayment structure from a series of these contracts at different time horizons.

In the climate context, there is a spectrum spanning the extent to which repayment of principal is tied to a climate change outcome, with traditional debt at 0%, and the structure as described above at 100%. In between the two extremes, repayment could be partially tied to the climate variable; as the climate variable approaches the threshold, the repayment rate increases to a rate similar to traditional debt, and then surpasses that rate as the climate variable passes the threshold.

Figure 8: The cumulative percentage repayment of the principal for a traditional bond is not linked to the climate change that might occur during the life of the bond, rather, the amount repaid is purely a function of the interest rate – this is plotted as the grey dashed line. The extent to which repayment is linked to climate change and the amount of climate change both impact the amount repaid for climate contract bonds. If the climate ends up being more extreme, then the repayment schedule will be shaped like the one of the top two (red) lines. If the climate ends up being moderate, then the repayment schedule will be shaped like the one of the bottom two (blue) lines.

A climate-contingent repayment structure can be applied to any climate-related variable(s)[52] or combinations thereof at any time scale to fund any adaptation projects designed to reduce risk exposure to specific climate thresholds.[53] The potential scope of climate-contingent finance is vast. The longer paper focuses on sea-level rise in cities to illustrate the value that climate-contingent financing can provide.

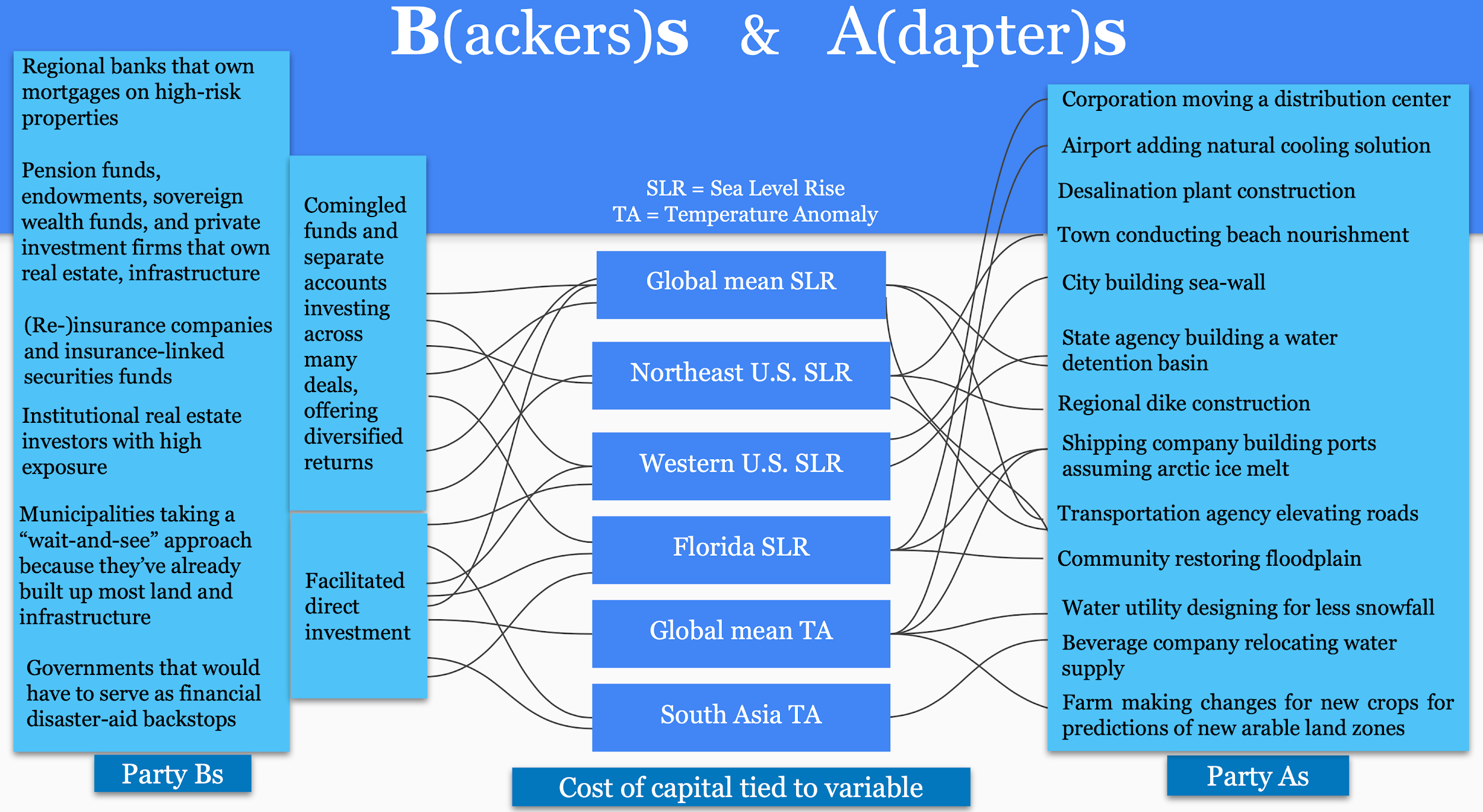

Figure 9 lists types of potential participants to the climate contingent financing mechanisms. Resulting mark-to-market pricing data could guide policy-makers on market expectations of climate outcomes. If there is eventually secondary trading of underlying contracts, prices on specific contracts would reveal up-to-date estimates of specific climate risks, globally guiding public policy and planning.

Figure 9: Conceptual diagram of Climate Contracts linked to thresholds on sea-level rise (SLR) and temperature anomaly (TA) values. Examples of Limited Partners in a set of commingled funds or separately managed accounts that invest in B positions in the climate contracts and examples of parties to the A side of the contracts are listed. In addition to A and B market participants hedging exposures, there will likely also be investors participating in order to achieve returns uncorrelated from traditional asset classes and potentially actors stabilizing markets. Many B participants will view their participation in the fund(s) as both a hedge and an opportunity for an uncorrelated real return. There would be essentially no capacity constraint on the size of the fund(s); they could invest hundreds of billions of dollars without decreasing expected returns.

[1] Stéphane Hallegatte, Strategies to Adapt to an Uncertain Climate Change, 19 Glob. Env’t Change 240, 246 (May 2009), https://www.sciencedirect.com/science/article/pii/S0959378008001192.

[2] For instance, sea-level rise is a function of global emissions, the effect of emissions on temperature, and the effect of temperature on oceanographic changes, according to the New York City Panel on Climate Change, NYC Mayor’s Off. of Climate Resiliency, https://www1.nyc.gov/site/orr/challenges/nyc-panel-on-climate-change.page (last visited Dec. 26, 2021). For more on uncertainty in sea-level rise and its implications, see generally Robert E. Kopp et al., Usable Science for Managing the Risks of Sea-Level Rise, 7 Earth’s Future 1235 (2019), https://agupubs.onlinelibrary.wiley.com/doi/full/10.1029/2018EF001145. See also Marjolijn Haasnoot et al., Generic Adaptation Pathways for Coastal Archetypes Under Uncertain Sea-Level Rise, Env’t Rsch. Commc’ns 1 (2019), https://iopscience.iop.org/article/10.1088/2515-7620/ab1871 (“Adaptation to coastal flood risk is hampered by high uncertainty in the rate and magnitude of sea-level rise. Subsequently, adaptation decisions carry strong risks of under- or over-investment, and could lead to costly retrofitting or unnecessary high margins.”).

[3] See generally Hannah Nissan et al., On the Use and Misuse of Climate Change Projections in International Development, 10 WIREs Climate Change, no. 579, , https://doi.org/10.1002/wcc.579; see generally Tanya Fiedler et al., Business Risk and the Emergence of Climate Analytics, 11 Nature Climate Change87, 91 (2021), https://www.nature.com/articles/s41558-020-00984-6; see generally Peiran R. Liu & Adrian E. Raftery, Country-Based Rate of Emissions Reductions Should Increase by 80% Beyond Nationally Determined Contributions to Meet the 2 ºC Target, 2 Commc’ns Earth & Env’t, no. 29, 1, 6-7, https://www.nature.com/articles/s43247-021-00097-8. Even if we know the level of emissions, “GCMs, although relatively consistent for global average results, exhibit large inter-model variability for regional climate projections.” Lei Zhao et al., Global Multi-Model Projections of Local Urban Climates, 11 Nature Climate Change 152, 152 (2021), https://www.nature.com/articles/s41558-020-00958-8

[4] See, e.g., Zeke Hausfather & Richard Betts, Analysis: How ‘Carbon-Cycle Feedbacks’ Could Make Global Warming Worse, Carbon Brief (Apr. 14, 2020), https://www.carbonbrief.org/analysis-how-carbon-cycle-feedbacks-could-make-global-warming-worse.

[5] See generally WCRP Coupled Model Intercomparison Project, WCRP: World Climate Rsch. Programme (2021), https://www.wcrp-climate.org/wgcm-cmip; and Zeke Hausfather, CMIP6: The Next Generation of Climate Models Explained, Carbon Brief (Dec. 2, 2019), https://www.carbonbrief.org/cmip6-the-next-generation-of-climate-models-explained. Even the uncertainty in simulating historical temperature observations — in hindcasting (not forecasting) — has increased since the last release. For a comparison of the implications for sea-level rise, see generally Stefan Hofer et al., Greater Greenland Ice Sheet Contribution to Global Sea Level Rise in CMIP6, 11 Nature Commc’ns, no. 6289, Dec. 15, 2020, https://www.nature.com/articles/s41467-020-20011-8

[6] See generally Raphael Calel et al., Temperature Variability Implies Greater Economic Damages from Climate Change, 11 Nature Commc’ns, no. 5029, Oct. 6, 2020, at 1, https://www.nature.com/articles/s41467-020-18797-8/.

[7] Data from William V. Sweet et al., NOAA Technical Report NOS CO-OPS 096: Patterns and Projections of High Tide Flooding Along the U.S. Coastline Using a Common Impact Threshold 41-43 (Feb. 2018), https://tidesandcurrents.noaa.gov/publications/techrpt86_PaP_of_HTFlooding.pdf.

[8] The catastrophic outcomes would be due to passing “tipping points” in the climate. The consensus estimates of the temperature at which a tipping point could be reached continues to be moved lower as the science is better understood. Timothy M. Lenton et al., Climate Tipping Points – Too Risky to Bet Against, Nature, Apr. 9, 2020, https://www.nature.com/articles/d41586-019-03595-0.

[9] Data from William V. Sweet et al., NOAA Technical Report NOS CO-OPS 096: Patterns and Projections of High Tide Flooding Along the U.S. Coastline Using a Common Impact Threshold 41-43 (Feb. 2018), https://tidesandcurrents.noaa.gov/publications/techrpt86_PaP_of_HTFlooding.pdf.

[10] Doug Struck, Gavin Schmidt: The Problem with Climate Models? People., Christian Sci. Monitor (Jan. 22, 2021), https://www.csmonitor.com/Environment/2021/0122/Gavin-Schmidt-The-problem-with-climate-models-People.

[11] Data from William V. Sweet et al., NOAA Technical Report NOS CO-OPS 096: Patterns and Projections of High Tide Flooding Along the U.S. Coastline Using a Common Impact Threshold (2018), https://tidesandcurrents.noaa.gov/publications/techrpt86_PaP_of_HTFlooding.pdf.

[12] Thomas Frank, After a $14-Billion Upgrade, New Orleans’ Levees Are Sinking, Sci. Am. (2019), https://www.scientificamerican.com/article/after-a-14-billion-upgrade-new-orleans-levees-are-sinking/.

[13] Projections of sea-level rise estimated on climate model responses fall below simple extrapolation based on recent observational data, i.e., sea-level rise is even worse than the models thought it would be. See generally Aslak Grinsted & Jens Hesselbjerg Christensen, The Transient Sensitivity of Sea Level Rise, 17 Ocean Sci. 181 (2021), https://os.copernicus.org/articles/17/181/2021/#:~:text=We%20define%20a%20new%20transient,temperature%20increases%20on%20this%20timescale.

[14] Regarding the cost of capital for climate risk investments, Pittsburgh Water & Sewer Authority said: “We are constantly evaluating ways to reduce our borrowing costs.” Executive Director of Pittsburgh Water & Sewer Authority: “We need to look ahead and determine whether or not we should be thinking of a much higher degree of prevention or protection and how much can we afford.” J. Dale Shoemaker, How Pittsburgh is Funding the Fight Against Climate Change, PublicSource (Sept. 30, 2019), https://www.publicsource.org/how-pittsburgh-is-funding-the-fight-against-climate-change/.

[15] Financing Resilient Communities and Coastlines: How Environmental Impact Bonds Can Accelerate Wetland Restoration in Louisiana and Beyond, Env’t Def. Fund 16 (Aug. 2018), https://www.edf.org/sites/default/files/documents/EIB_Report_August2018.pdf.

[16] Alice Hill et al., Ready for Tomorrow: Seven Strategies for Climate-Resilient Infrastructure 4 (Hoover Inst., 2019), https://www.hoover.org/research/ready-tomorrow-seven-strategies-climate-resilient-infrastructure.

[17] See generally B. Shane Underwood et al., Past and Present Design Practices and Uncertainty in Climate Projections are Challenges for Designing Infrastructure to Future Conditions, 26 J. Infrastructure Sys. (2020) https://ascelibrary.org/doi/abs/10.1061/%28ASCE%29IS.1943-555X.0000567.

[18] Amanda Hindlian et al., Taking the Heat: Making Cities Resilient to Climate Change, Goldman Sachs Glob. Mkt. Inst., (Sept. 4, 2019), https://www.goldmansachs.com/insights/pages/gs-research/taking-the-heat/report.pdf.

[19] Especially when adaption actions have general economic development co-benefits. See generally John J. Nay et al., A Review of Decision-Support Models for Adaptation to Climate Change in the Context of Development, 6 Climate Change 357 (Feb. 10, 2014), https://www.tandfonline.com/doi/full/10.1080/17565529.2014.912196. See Figure 4 of this post for a visual explanation.

[20] Jeroen Aerts et al., Evaluating Flood Resilience Strategies for Coastal Megacities, 344 Science 473, 473-75 (May 2, 2014), https://www.science.org/doi/full/10.1126/science.1248222.

[21] S. Hallegatte et al., Strengthening New Infrastructure Assets: A Cost-Benefit Analysis 11 (World Bank Pol’y Rsch. Working Paper No. 8896, 2019), https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3430506 (“[C]limate change makes the strengthening of infrastructure assets even more important. Without climate change, the median benefit‐cost ratio would be equal to 2, but it is doubled when climate change is considered. And the fraction of scenarios in which strengthening infrastructure is not profitable is decreased from 14 to 4 percent when climate change is taken into account.”); C.M. Shreve & I. Kelman, Does Mitigation Save? Reviewing Cost-Benefit Analyses of Disaster Risk Reduction, 10 Int’l J. Disaster Risk Reduction 213, 231 (Dec. 2014), https://www.sciencedirect.com/science/article/pii/S2212420914000661 (“For changes in flood regimes, as a result of climate change as well as infrastructure development, understanding the hazard and vulnerability changes is much more challenging with larger uncertainties. DRR [disaster risk reduction] CBAs [cost-benefit analyses] might have different levels of usefulness depending on the hazard and depending on the hazard drivers, such as climate change, which are considered for analyzing CBAs in forward-looking studies”); See generally, Borja G. Reguero et al., Comparing the Cost Effectiveness of Nature-Based and Coastal Adaptation: A Case Study from the Gulf Coast of the United States, 13 PlosOne 1, 8 (Apr. 11, 2018), https://journals.plos.org/plosone/article?id=10.1371/journal.pone.0192132; See generally Audrey Baills et al., Assessment of Selected Climate Change Adaptation Measures for Coastal Areas, 185 Ocean & Coastal Mgmt, Mar. 1, 2020, at1, https://www.sciencedirect.com/science/article/pii/S0964569119309287.

[22] Morgan Stanley, Weathering the Storm: Integrating Climate Resilience into Real Assets Investing 3 (2018), https://www.morganstanley.com/im/publication/insights/investment-insights/ii_weatheringthestorm_us.pdf. Adaptation actions may have been taken during previous climates as well; L. Supriya, Taíno Stilt Houses May Have Been an Adaptation to Climate Change, Eos (Jan. 15, 2021), https://eos.org/articles/taino-stilt-houses-may-have-been-an-adaptation-to-climate-change.

[23] E.g., coal-fired power plants are designed for 40 to 50 years of production, hydro-power infrastructure is designed for up to 100 years, and approximately 66% of U.S. city infrastructure is more than 30 years old today. Jonathan Woetzel et al., Will Infrastructure Bend or Break Under Climate Stress?, McKinsey Glob. Inst. (Aug. 19, 2020), https://www.mckinsey.com/business-functions/sustainability/our-insights/will-infrastructure-bend-or-break-under-climate-stress.

[24] In the longer paper, see Appendix A: Climate Risk Pricing, for a discussion of how climate uncertainty affects asset pricing and why real asset owners are the most vulnerable to physical climate-induced price changes.

[25] Hannah Nissan et al., supra note 6, at 6.

[26] E.g., a city, a homeowner, a mortgage lender, a state government or a transportation group such as the New York City Metropolitan Transportation Authority that runs the public transportation system.

[27] An entity could be an Adapter or a Backer at different time scales and geographies. There will likely be more Backer parties than Adapter parties, i.e., a lot of entities would like to insure at least a small amount of their climate risks but not as many can build large physical adaptation projects.

[28] Ming-Jie Wang, Credit Default Swaps on Municipal Bonds: A Double-Edged Sword?, 35 Yale J. Reg 301, 307 (2018).

[29] See, e.g., Ange Lavoipierre & Stephen Smiley, Could Climate Change Make it Harder to Get Insurance in Australia?, The Signal News (Feb. 5, 2019), https://www.abc.net.au/news/2019-02-06/could-climate-change-make-australia-uninsurable/10783490.

[30] “While current ILS instruments are useful for transferring risks, they are not designed to reduce underlying risks or build resilience to disasters.” Lauren Carter, Can Insurance-Linked Securities Mobilize Investment in Climate Adaptation?, UNDP (Jan. 12, 2021), https://www.undp.org/blog/can-insurance-linked-securities-mobilize-investment-climate-adaptation.

[31] “As [parametric insurance policies have been taken out by municipalities,] those policies have gotten more popular, they’ve started to run into serious questions—like [...] whether the policies’ existence allows governments to punt on harder decisions about where people live and businesses operate in the first place.” Zack Colman, Insurance for When FEMA Fails, POLITICO (Jul. 14, 2020), https://www.politico.com/news/agenda/2020/07/14/climate-change-fema-insurance-341816.

[32] The plan is to have many Backer entities per Adapter, with a fund that has Backers as limited partners and invests in many climate contracts.

[33] See generally Daniel Bloch et al., Applying Climate Derivatives to Flood Risk Management, 56 Wilmott 88 (2012), https://onlinelibrary.wiley.com/doi/abs/10.1002/wilm.10058 (discussing the concept of climate change derivatives to mitigate flood risk); see also Daniel Bloch et al., Cracking the Climate Change Conundrum with Derivatives, 2 Wilmott J. 271 (2010), https://onlinelibrary.wiley.com/doi/abs/10.1002/wilj.41 (original article discussing the concept abstractly); See Figure 5 for a visual representation of climate derivatives.

[34] Bloch et al. (2010), supra note 36, at 271-272.

[35] Daniel Bloch, James Annan, & Justin Bowles, Cracking the Climate Change Conundrum with Derivatives, 2 Wilmott J. 271 (2010), https://onlinelibrary.wiley.com/doi/abs/10.1002/wilj.41

[36] NIBS Finds Investment in Resilient Design Can Pay Off by More than Sixfold, ARCHITECT Magazine. (Jan. 18, 2018), https://www.architectmagazine.com/technology/nibs-finds-investment-in-resilient-design-can-pay-off-by-more-than-sixfold_o. According to Seung Kyum Kim, raising foundations provides 6.6% and 14.3% housing price increases in Miami-Dade and NYC, and adaptation for storm surges provides a 15.8% housing price increase in Miami-Dade. There’s direct loss mitigation value in the event of a climate threshold crossing and, regardless of risk events, there is asset price appreciation due to the recognition of that resilience. Seung Kyum Kim, The Economic Effects of Climate Change Adaptation Measures: Evidence from Miami-Dade County and New York City 2, 24 (May 2019) (Doctor of Design dissertation fellowship working paper) (on file with the Joint Center for Housing Studies of Harvard University), https://www.jchs.harvard.edu/research-areas/working-papers/economic-effects-climate-change-adaptation-measures-evidence-miami. Delavane B. Diaz, Estimating Global Damages from Sea Level Rise with the Coastal Impact and Adaptation Model (CIAM), 137 Climatic Change. 143, 143 (2016) (“[T]here is large potential for coastal adaptation to reduce the expected impacts of SLR compared to the alternative of no adaptation, lowering global net present costs through 2100 by a factor of seven . . . .”). Stéphane Hallegatte, Jun Rentschler, & Julie Rozenberg, The World Bank, Lifelines: The Resilient Infrastructure Opportunity 2 (2019) (“In the median [climate and economic] scenario, the net benefit of investing in more resilient infrastructure in low- and middle-income countries is $4.2 trillion, with $4 in benefit for each $1 invested. Climate change makes action on resilience even more necessary and attractive: on average, it doubles the net benefits from resilience. And because large investments in infrastructure are currently being made in low- and middle-income countries, the median cost of one decade of inaction is $1 trillion.”), https://documents1.worldbank.org/curated/en/775891600098079887/pdf/Lifelines-The-Resilient-Infrastructure-Opportunity.pdf. For an Intermediate-High NOAA climate scenario for Miami-Dade County in Florida, the return on investment for building-level adaptation actions is estimated to be 518%, and the return on investment for community-wide adaptation actions is estimated to be 926%. Urban Land Inst. , Research Report: The Business Case for Resilience in Southeast Florida: Regional Economic Benefits of Climate Adaptation 4, 26 (2020), https://knowledge.uli.org/reports/research-reports/2020/the-business-case-for-resilience-in-southeast-florida?_gl=1*17yztlq*_ga*MjA2MDgwNTAwOC4xNjQwODk1MjE1*_ga_HB94BQ21DS*MTY0MDg5NTIxNC4xLjAuMTY0MDg5NTIxNC4w. A study of Ho Chi Minh City adaptation to sea-level rise finds very large spread in the benefit-cost ratios and net-present values of adaptation measures between medium and high climate change scenarios, Paolo Scussolini et al., Adaptation to Sea Level Rise: A Multidisciplinary Analysis for Ho Chi Minh City, Vietnam, 53 Water Res. Rsch. 10841, 10852 (2017), (“The combination of elevation + dryproofing shows the highest B/C [benefit-cost ratio], ranging from 41 in [the most probable possible future greenhouse gas concentrations (RCP4.5)] to 97 in [extremely severe possible future greenhouse gas concentrations (RCP8.5)] High‐end, and the highest NPV, from 514 B$ in RCP8.5 High‐end to 216 B$ in RCP4.5.”), https://agupubs.onlinelibrary.wiley.com/doi/full/10.1002/2017WR021344. See also Hallegatte et al., supra note 23, at 11 (“[C]limate change makes the strengthening of infrastructure assets even more important. Without climate change, the median benefit‐cost ratio would be equal to 2, but it is doubled when climate change is considered. And the fraction of scenarios in which strengthening infrastructure is not profitable is decreased from 14 to 4 percent when climate change is taken into account.”); Borja G. Reguero et al., supra note 23, at 15. (“As sea level rises, land subsides, storms increase in frequency and intensity, and assets in the coastal zone increase, all adaptation measures become more cost-effective . . . .”); Jeremy Martinich & Allison Crimmins, Climate Damages and Adaptation Potential Across Diverse Sectors of the United States, 9 Nature Climate Change 397, 401 (2019) (“Projected physical and economic damages are larger under [extremely severe possible future greenhouse gas concentrations (RCP8.5)] than under [the most probable possible future greenhouse gas concentrations (RCP4.5)] across all 22 sectors and both time periods, with only 1 exception (urban drainage adaptation costs in 2050. . . ). Damages associated with extreme weather, such as extreme temperature, heavy precipitation, drought and storm surge events, are substantially reduced under RCP4.5. For example, more than twice as many 100-year riverine inland flooding events are projected across the CONUS under RCP8.5 compared to RCP4.5 by the end of the century . . . .”).

[37] Ashley Schulten et al., Getting Physical: Scenario Analysis for Assessing Climate-Related Risks, BlackRock Inv. Inst. 1, 12, (2019), https://www.blackrock.com/ch/individual/en/insights/physical-climate-risks.

[38] Backers, and any financial intermediary facilitating the transaction, has an implicit incentive to help Adapters ensure their adaptation investments are properly implemented because that increases the probability that the Adapters will be able to pay the Backers back.

[39] The U.S. National Flood Insurance Program Community Rating System reduces premiums to reflect the reduced flood risk resulting from a community’s efforts. National Flood Insurance Program Community Rating System, FEMA (last accessed Nov. 16, 2021), https://www.fema.gov/floodplain-management/community-rating-system?web=1&wdLOR=cCB3563C1-9027-8541-BD4B-80EEA92A7C56.

[40] Additionally, while less of a direct monetary benefit than the list in the main text, climate change damages and the reconstruction they require can create greenhouse gas emissions. In this way, by reducing damages and the need to rebuild infrastructure, adaptation can reduce greenhouse gas emissions, which has monetary benefits, especially with a potential price placed on carbon emissions. More broadly, there can be emissions mitigation co-benefits to adaptation actions. See generally, Lobell et al., Climate adaptation as mitigation: the case of agricultural investments, Environmental Research Letters 8 (2013), https://iopscience.iop.org/article/10.1088/1748-9326/8/1/015012/meta.

[41] “[L]itigation could be packaged as breaches of duty, ordinary negligence, and inverse condemnation actions based on a public entity’s failure to adequately plan, prepare, and invest for the inevitable effects of climate change. Any resulting unplanned expenditures due to climate change could potentially cause an inability of the municipality to honor their debt obligations [...] Plaintiffs have alleged that defendants (utilities in some cases) are guilty of wrongful acts or negligence because the defendants gave climate change impacts insufficient consideration, planning, and investment. For example, this occurred in cases related to the 2018 California wildfires, where insurance companies, citing inverse condemnation, are looking to PG&E to pay for wildfire losses.” Insurance, Bond Ratings and Climate Risk: A Primer for Water Utilities, Ass’n Met. Water Agencies 3, 6 (2019), https://www.amwa.net/assets/Insurance-BondRatings-ClimateRisk-Paper.pdf.

And for electric utilities, see Romany M. Webb, Michael Panfil, & Sarah Ladin, Climate Risk in the Electricity Sector: Legal Obligations to Advance Climate Resilience Planning by Electric Utilities, Columbia L. Sch. Sabin Ctr. Climate Change L. (Dec. 3, 2020), https://climate.law.columbia.edu/content/climate-risk-electricity-sector-legal-obligations-advance-climate-resilience-planning.

[42] Debt service costs can account for 50% of a water utility’s total costs. Chapter 2 of Jeff Hughes et al., Defining a Resilient Business Model for Water Utilities, Water Rsch. Found. (2014), https://www.researchgate.net/publication/277477105_Defining_a_Resilient_Business_Model_for_Water_Utilities. Those costs are higher if the credit ratings of the utilities are lower.

Pittsburgh Water & Sewer Authority said: “We are constantly evaluating ways to reduce our borrowing costs.” Executive Director of Pittsburgh Water & Sewer Authority: “We need to look ahead and determine whether or not we should be thinking of a much higher degree of prevention or protection and how much can we afford.” J. Dale Shoemaker, How Pittsburgh is Funding the Fight Against Climate Change, PublicSource (Sept. 30, 2019), https://www.publicsource.org/how-pittsburgh-is-funding-the-fight-against-climate-change/.

[43] Maintaining, or even increasing, the market value of the privately held property could make a material difference to the property tax collected.

[44] For examples of adaptation related activities that could also have emissions reductions benefits, see generally Joseph E. Fargione et al., Natural Climate Solutions for the United States, 4 Science Advances, 1, 1(2018)., https://www.science.org/doi/10.1126/sciadv.aat1869.

[45] If an Adapter is a state or city government, it’s very unlikely, and for some, illegal, to declare bankruptcy and avoid payments. However, the money needs to come from somewhere. The Adapter will need to raise general real estate and sales taxes if they are a city or state, increase fees if they are a water or energy utility, or implement taxes that are closer to directly capturing the benefits provided by the adaptation project. The Virtues of Value Capture, Deloitte (2019), https://www2.deloitte.com/content/dam/Deloitte/global/Documents/Public-Sector/smart-cities-virtues-of-value-capture-19nov.pdf, e.g., taxes on real estate nearest a seawall investment or beach nourishment; see generally Megan Mullin et al., Paying to Save the Beach: Effects of Local Finance Decisions on Coastal Management, Climatic Change, 275, 275 (2018). https://link.springer.com/article/10.1007/s10584-018-2191-5.

Arpit Gupta discusses how infrastructure projects could be funded by more specific property taxes: “Our paper demonstrates that it is technically feasible to determine how much each housing unit benefited from the new transit infrastructure, taking into account its exact location, and its unit and building characteristics. In theory, local government could levy a unit-specific property tax surcharge proportional to the value created. Such micro-targeted property tax surcharges would not only be based on objectively measurable value increases and property characteristics, and hence be fair, they could also become an important financing tool to fund future infrastructure needs.” Arpit Gupta & Stijn Van Nieuwerburg, Take the Q Train: Value Capture of Public Infrastructure Projects 1, 39 (Nat’l Bureau of Econ. Rsch. Working Paper no. 26789, 2020), https://www.nber.org/papers/w26789.

“The value of a property protected by storm surge by a new seawall or natural barrier typically should be higher than the value of a similarly situated property that does not have such protection. Authorities can estimate the value difference between comparable properties with protection and those without it. Some of the difference can then be “captured” through increased taxes on the benefitting properties.” Alice Hill & Leonardo Martinez-Dias, Building a Resilient Tomorrow: How to Prepare for the Coming Climate Disruption 86 (Oxford Univ. Press 2020).

Furthermore, Backers can better make payments if Adapters also issues a catastrophe (cat) bond. We could issue a cat bond linked to the same climate threshold in order to be guaranteed to be able to pay some portion of the outcome to Backers if the threshold is reached, reducing their counterparty risk. We would be issuing a given cat bond that covers many climate contracts, and there would be many Backers parties to a single contract, so we would be able to spread cat bond transaction costs across enough Backer parties that this would be a more attractive option to a Backer than issuing a cat bond themselves. Cat bonds have characteristics that make them well suited for backstopping or complementing a climate contract: they are 100% collateralized and so have essentially no counterparty risk, they provide time scales (multi-year) that lock in rates, and because they have more investor types than most insurance related instruments, they can more buyer demand and thus have reduced rates.

It is also worth noting that if there are acute disasters occurring, the federal government will likely be providing financial disaster aid after acute climate events.

[46] For an alternative pricing approach, see Bloch et al. (2012), supra note 35, at 89 (applying the logic of pricing credit derivative products to pricing climate derivatives by replacing the survival probabilities and default time densities with first-passage (of a climate threshold) distributions and first-passage time density).

[47] Risks that can’t be diversified away (systemic risks) are those that increase the probability that an asset’s value is correlated with most other global asset values, see generally Antti Ilmanen, Expected Returns: An Investor’s Guide to Harvesting Market Rewards (2011); correlated with equity market volatility, see generally Tim Lee et al., The Rise of Carry: The Dangerous Consequences of Volatility Suppression and the New Financial Order of Decaying Growth and Recurring Crisis (2019). This is likely the case for the more extreme global climate risks; therefore, the marginal utility of a dollar is higher for the payoffs for strategies that hedge these risks. Stefano Giglio et al., Climate Change and Long-Run Discount Rates: Evidence from Real Estate (Nat’l. Bureau Econ. Rsch. Working Paper no. 21767, 2015), https://www.nber.org/papers/w21767 at page 6. The Financial Stability Board believes that climate risk “may change – and in places, increase – the degree of co-movement between asset prices, and reduce the degree to which financial market participants were able to diversify exposure to climate-related risks. It might also reduce the efficacy of other channels through which financial market participants seek to insure against climate risks (e.g., via some derivatives markets).” The Implications of Climate Change for Financial Stability 17 (Fin. Stability Bd. Nov. 23, 2020), https://www.fsb.org/2020/11/the-implications-of-climate-change-for-financial-stability/.

[48] The risk-contingent financing mechanism should be applied to situations where the parties involved have negligible direct control over whether the risk occurs. If the investor in the risk-contingent instrument could influence the likelihood or the risk occurring, it could lead to misaligned incentives because they may later on decide that the higher return received from the payout of the contract outweighs the downsides of the risk occurring. With large-scale risks such as extreme climate change, natural pandemics, or asteroids hitting the earth, there are no entities with material direct control over whether the risk is realized.

[49] “While current ILS instruments are useful for transferring risks, they are not designed to reduce underlying risks or build resilience to disasters.” Carter, supra note 32.

[50] See Figure 6b.

[51] Likely many Backer entities per Adapter.

[52] For instance, e.g., temperature, sea-level, precipitation or drought. Data from the U.S. government agencies, such as NOAA (e.g., https://data.noaa.gov/datasetsearch/), can be used as a trusted source for nearly any climate-related variable that would be useful to index to.

In selecting the climate variable, it is a balance between basis risk and broad applicability. Basis risk is the difference between the conditions under which a contract pays out and the conditions that one would like to hedge. For example, global sea-level rise levels may not translate perfectly into the benefits that a seawall provides compared to local relative sea-level rise, i.e., a contract tied to levels of global sea-level rise would have higher basis risk than a contract tied to local relative sea-level rise.

However, there is a trade-off with how widely applicable the climate variable is: the less potential entities that are impacted by the climate variable (e.g., local levels compared to global levels), the fewer opportunities there are to connect counterparties and facilitate hedging activity.

[53] For example: three inches of sea-level rise in 2030.

Strong upvote for an important mechanism for reducing extreme scenarios.